This article by Whitney Curry Wimbish was originally published by BoardIQ on October 8, 2024.

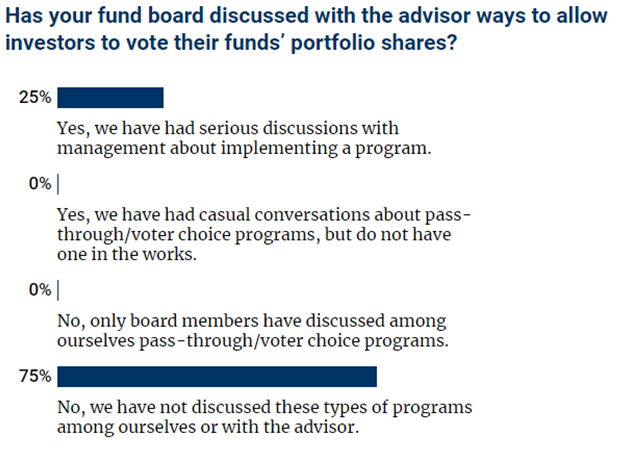

As some fund companies plan to expand their investor proxy voting programs to include more people, independent directors elsewhere said they remain skeptical of the idea.

They said such programs – often referred to as "pass-through voting" or "voter choice" – add unnecessary complication to their oversight of proxy voting without a commensurate benefit, and they expressed doubt that the programs would catch on beyond the large fund groups that have already instituted it.

"I don't find that a very attractive concept, for the most part," said one independent chair, who spoke on condition of anonymity.

"While there will be some shareholders who pay attention to proxy voting and underlying companies, I think for the most part people who invest in mutual funds have passed the baton on investment decision-making as well as proxy voting to the manager."

But some industry observers said that, though large asset managers are the only ones to roll out the programs so far, smaller firms will likely follow suit if they believe giving investors proxy voting rights will set them apart from their peers in a competitive market.

For fund directors, who are responsible for overseeing proxy voting and proxy voting policies, it may be wise to discuss them now, they said.

"While it is the large firms that have created these voter policies so far, it will start flowing down to smaller firms as the infrastructure gets built out," said Steve Messinger, president of fund solutions at Sodali & Co.

"It will soon be offered as a solution to any registered fund company, and I think that will be a good thing for directors because it is yet another way you can allow your shareholders to be involved in their funds, whether they choose to take advantage of that opportunity or not."

Messinger suggested that fund directors ask whether their advisors have explored giving shareholders opportunities to participate in voting fund shares, whether there are technol-ogies that could help facilitate such a vote, and how the voting policies handle controversial corporate actions.

"It is one of those innovations that I think does make sense," he said, "and there's clearly an audience of shareholders who are looking for that kind of direct engagement."

Results of some fund companies' pass-through voting initiatives show that engagement has so far been limited.

At Vanguard, for example, which opened proxy voting for certain investors early last year, 55% of investors eligible to vote their fund shares did so.

The other 45% opted for the default option of leaving it up to the $9.7 trillion asset manager to vote the shares itself.

BlackRock likewise announced a partial uptake in a similar program, which it expanded this year to $2.8 trillion assets, almost half of its index equity assets under management.

As of March 31, clients representing $634 billion in index equity AUM adopted voting choice, a spokesman said last week, almost a quarter of eligible assets. The $9 trillion asset manager does not collect the number of individual investors those figures represent, he said.

Schwab and State Street have also introduced pass-through voting programs for certain investors and sought to expand them since 2022, though spokespeople did not return a request seeking the number of eligible investors and the percentage who participated.

Earlier this year, Northern Trust said it too would offer investors voting rights and would conduct a "phased rollout" of pass-through voting for "select U.S. common and collective funds."

Independent directors are legally responsible for the proxy voting process, including for fund proxy voting policies. Because a pass-through voting program changes how the fund's portfolio shares are voted, directors would need to amend the policy to accommodate it, Bruce Leto, a partner and firm management committee member at Stradley Ronon, wrote in an email.

Directors would also need to be comfortable with the voting policies that the manager sug-gests investors use, he wrote – and with the program's price tag.

"[T]here are costs associated with voter choice, so directors would need to understand those costs and be comfortable with who is paying for them," Leto wrote.

That's where the director who spoke on condition of anonymity said he was skeptical.

"To impose an architecture that passes these votes through, and all the administrative bur-den, timing issues, and the cost of doing that – some funds may step into that breach, but I don't think that's going to be a major trend. That's just an awful lot to bite off, with very little upside," the director said.

"Half the people just don't care and won't do it."

The cost of a pass-through program is also likely to be too high for all but the largest fund companies, he added.

A former independent director who likewise spoke on condition of anonymity said that he too doubted the widespread adoption of pass-through voting.

He said that, even though technology may enable widespread proxy voting, such as via a smartphone, he has noticed an overall decrease in proxy voting engagement of any kind.

"I don't see in the fund business individual investors really trying to vote aggressively. If anything, what we've noticed in recent years is investors are voting less than they were in the past in terms of their interested proxies," he said.

"My experience is that it's gotten harder rather than easier to get quorums to get these votes. I'm not sure exactly why. I just don't think investors really have taken an active interest in that regard."

Messinger said that he has seen firsthand the increased difficulty in engaging shareholders when the fund itself is holding a vote.

He noted that while electronic communication has made the processes less expensive and more rapid in some ways – sending an email is cheaper than mailing a letter – it does not necessarily result in greater engagement, because shareholders tend to ignore emails.

But, he and other observers noted, that is a slightly different process than voting fund shares and is still in a development phase across the industry.

He added that, from the fund director's perspective, facilitating shareholder participation in the proxy voting process is "pretty much an unambiguously good thing."

Related News

Sodali & Co’s Prashilta Naidu Featured in ICGN Future Leaders Committee on Board Effectiveness

12 December 2025

Activist Funds Top €3.34 Billion in Spain

07 December 2025

For-Profit: Treasury extends the entry into force in Verifactu

05 December 2025

Sodali & Co Celebrates Excellence in Financial PR

02 December 2025

Media enquiries

To contact our global experts for comments please get in touch below.

Contact us chevron_right