Subscribe to stay informed, inspired and involved.

This article analyzes the Annual General Meetings (AGMs) of French issuers listed in the CAC 40 and Next 20 index as of June 30st, 2024. It does not include index constituents that are incorporated abroad.

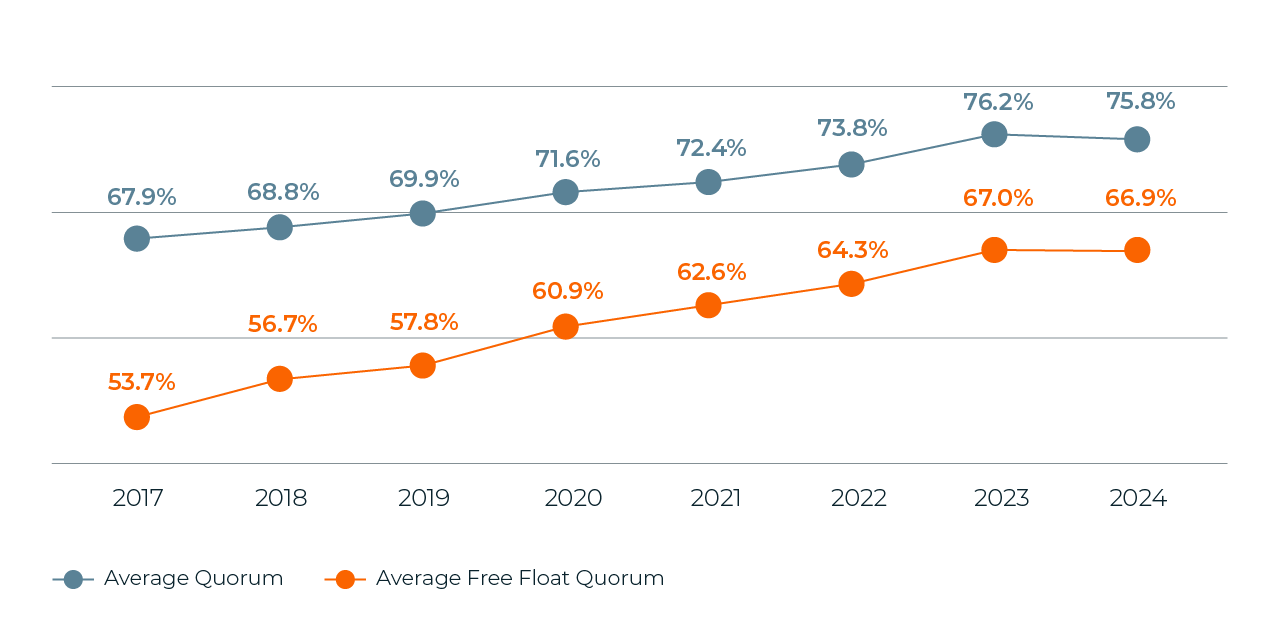

Meeting attendance and quorum

The quorum level has slightly decreased which could indicate a plateau. However, it seems that some investors have experienced issues in the custodian chain and we would not be surprised to see a tiny rebound in 2025.

Quorum

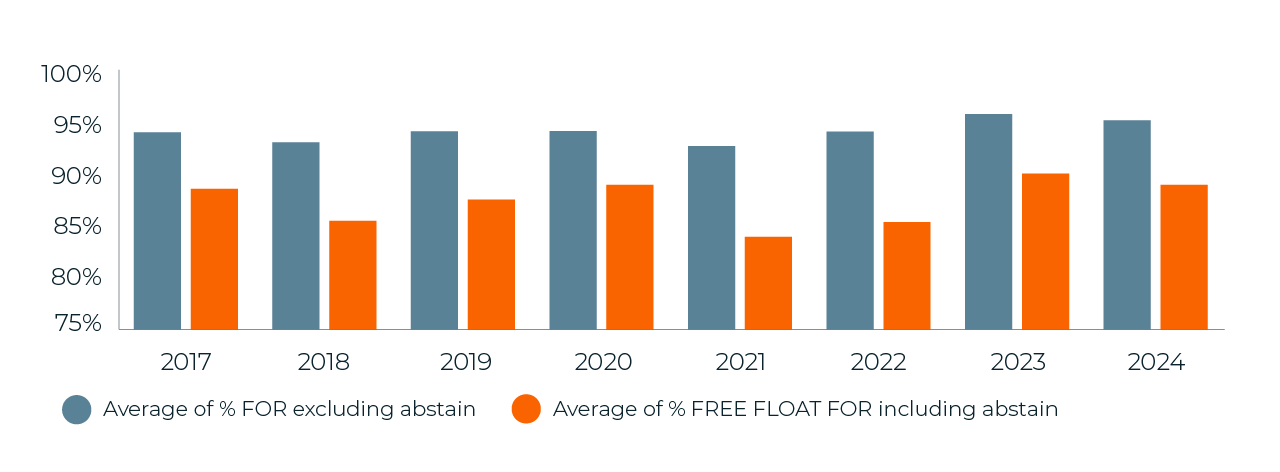

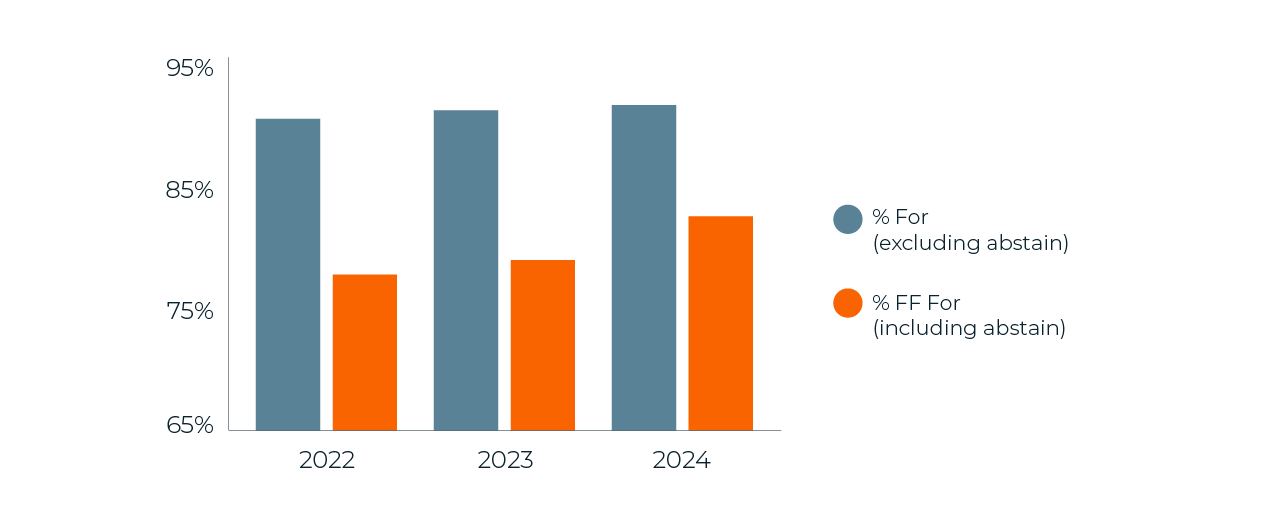

Board elections

There has been a slight regress compared to 2023, the historically highest Free Float support level. This variation is due to the structure of the nominees, with more independent chairman this year. It is interesting to see that the average Free Float level was similar to last year when ISS recommended voting against (59% support) the resolutions (93%). ISS recommended voting against 12% of the resolutions (9% in 2023) and Glass Lewis 8% (6% in 2023). The companies targeted by ‘against’ recommendations are mainly the same – i.e. controlled companies with insufficient independence at board level and Chairman & CEO who are standing for re-elections.

Board Election

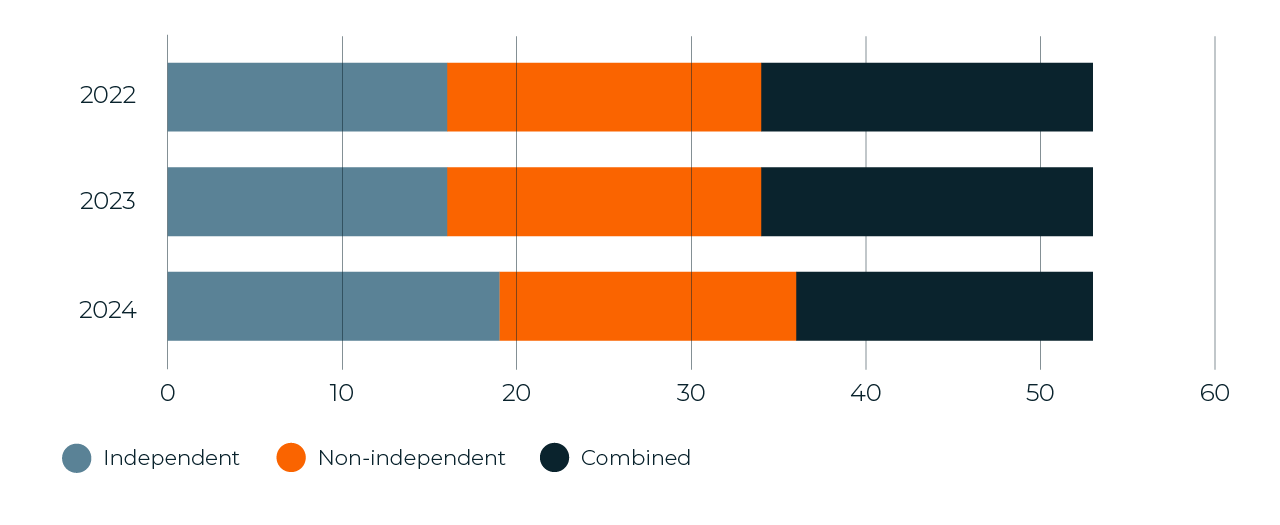

Regarding board structure, for the first time in French history, more than one third of the Chairman are independent (36%). As a result, non-independent Chairman & CEOs (known under the acronym PDG, which stands for Président Directeur Général) dropped to 32% (respectively at 34% and 36% in 2023). However, in some cases, major issuers have combined the two roles into one after the retirement of Chairmen who were former CEOs.

Classification of Board Chair Person (CAC 40 + Next 20)

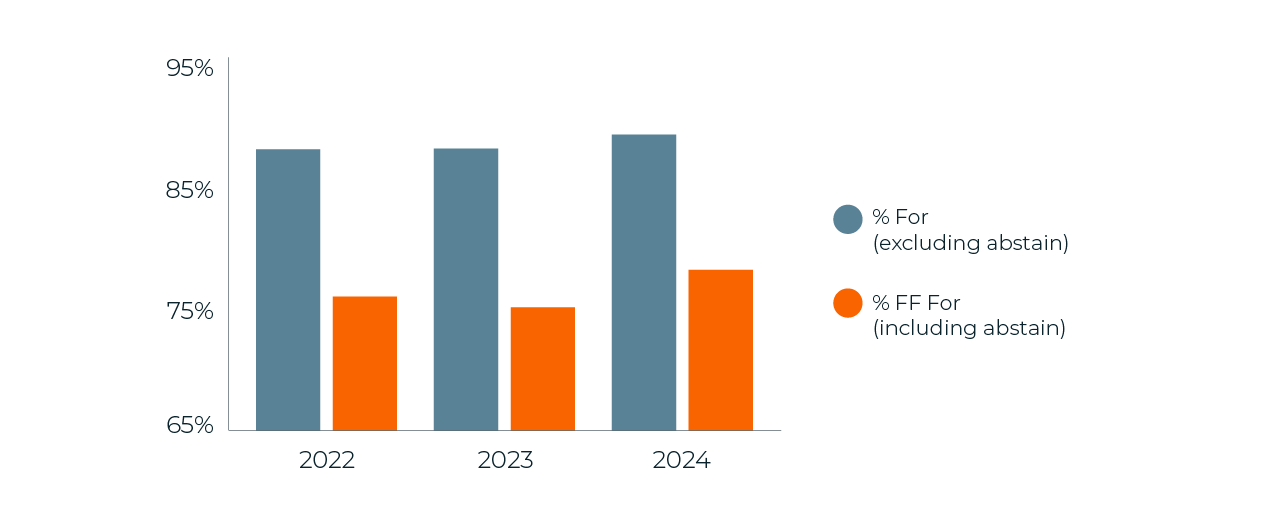

Remuneration

The main reason for opposition among asset managers is the compensation effect, which allows the overperformance of a remuneration target to compensate the underperformance of another target. It is followed by a lack of disclosure of the performance conditions, even though there is a general improvement from the French issuers.

The increase in remuneration packages is a growing topic of conversation. ISS and its followers point out the lack of rationale for these increases, especially in an environment of consecutive increases. Even so, the total amount of remuneration has been acceptable, at least for international investors, due to French asset managers' stricter policies on the maximum package. However, some investors have voted against the CEO's remuneration because of the termination conditions which were not prorated as expected by their voting policies.

The challenging aspect of criteria and the fact that they could be vested below the median caused several against votes within the CAC 40 companies.

Most of the companies that received against votes (and more than 20% of Free Float dissent votes) are controlled companies and were also targeted in previous years.

Remuneration Policy (ex-ante)

Say on Pay (ex-Post)

Activist Campaigns

At TotalEnergies, a coalition led by Francophone investors, (Ethos for Switzerland, Candriam for Belgium, Forum Pour l’Investissement Responsible in France) filed a resolution to split the roles of Chairman and CEO. The board rejected this request and did not include the resolution in the agenda. However, the current Chairman & CEO was standing for re-election and the investors approved this re-election with 75% of the votes in favor of the item.

Two companies, which are not included in our universe, have also been targeted. Both companies are controlled by the funding family.

Two French investors contested the strategy and the governance at Peugeot Invest, which is a controlling shareholder of Stellantis. The investors filed three resolutions, none of which were approved. However the Free Float support is above 50%.

SEB, which makes kitchen and other domestic equipment, is experiencing tension within the family. The minority wing failed to gather the institutional investors for the three shareholder resolutions they filed. However, two board-approved Directors have been reflected with more than 25% dissent votes.

Sustainability

The number of Say on Climate in France has slightly decreased since 2023 (From 9 to 6 companies). Except for the largest corporate greenhouse gas emitters (in 2024 TotalEnergies), these resolutions received high support from the Free Float and were not covered by the French Medias.

For the first time, issuers had to nominate auditors to review and approve the sustainability reporting. This was massively approved, and there were no serious concerns as all the resolutions were approved with a minimum of 92%, and the free float support was 96.5% in favor.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Stanislas de Laporte

Director

Paris

stanislas.delaporte@sodali.com