Subscribe to stay informed, inspired and involved.

The following analysis covers the published results of the companies included in the DAX index (German market index), excluding Sartorius, Porsche AG, and SE vote results due to a lack of free-float investors with voting rights. Support for resolutions includes abstain vote estimates where not disclosed by the company. Free-float support assumes strategic investors support a proposal unless publicly stated otherwise.

Meeting attendance and quorum

For AGMs held in 2024, 30% of DAX companies held physical meetings, with the remaining 70% holding virtual-only meetings. ISS and Glass Lewis have indicated they will pay particular attention to this matter based on their annual survey, the results of which are yet to be published, along with their updated 2025 guidelines. Most DAX Companies sought 2-year authorizations in 2023 and will have to seek new ones in 2025. Despite companies broadly leaning towards virtual meetings, stakeholders such as institutional investors and proxy advisors are expected to closely monitor the rationales for re-authorisations given a rise in shareholder rights concerns across markets regarding virtual-only meetings.

Support at DAX companies will continue to depend on an issuer’s shareholder structure.

Quorum

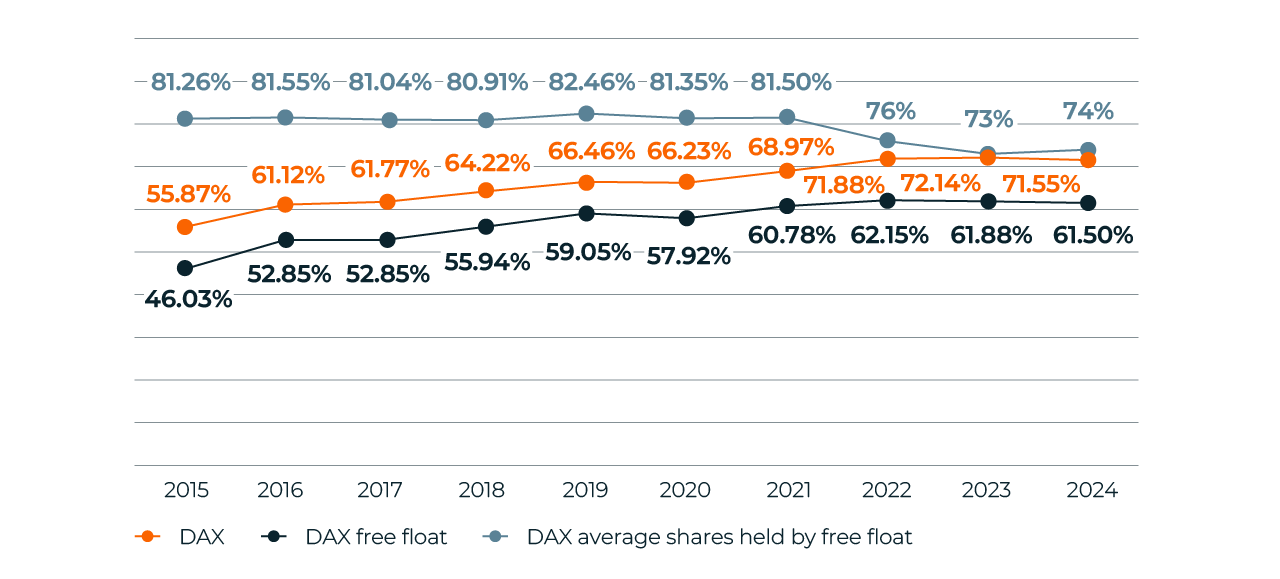

While slightly decreasing from 2023 levels, free float participation remained above 60% in 2024. There was little change to the average shares held by free float, which mainly remained stable after the decrease they registered following the expansion of the main index from 30 to 40 companies in September 2021.

General Meeting Participation

Board elections and discharge resolutions

DAX supervisory board elections in 2024 experienced average free float support of 85% from investors, down from 88% in 2023 and 93% in 2022 respectively. This drop in support results from shareholders holding boards accountable for not meeting their expectations. The key focus areas in 2024 for shareholders included independence (at the supervisory board and committee level), ESG oversight, overboarding, gender diversity in the board, past company performance, ongoing remuneration concerns, and insufficient responses to shareholder concerns.

2024 marked the first year of applying an anticipated ISS guideline, triggering a negative recommendation against directors representing shareholders benefitting from unequal share structures. Where ISS recommended against directors for that reason, the effect on free float support was notable but less pronounced compared to other governance issues, such as independence or overboarding.

Remuneration items

General considerations

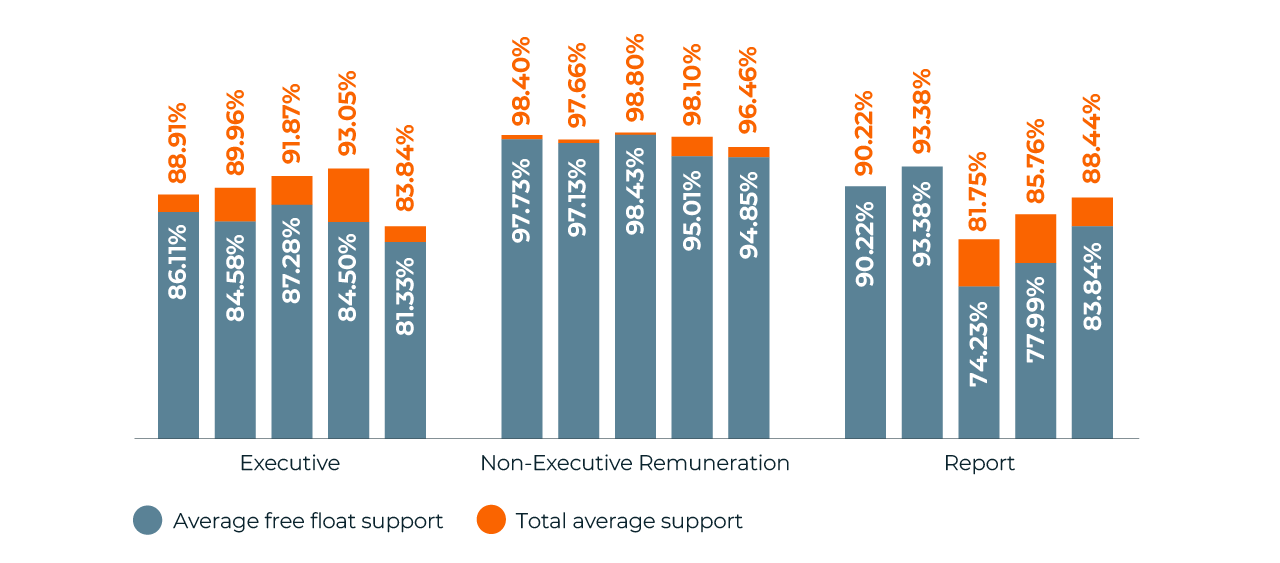

Executive remuneration policies averaged 81% free float support, with three reports unable to reach 80% (1 received less than 50% support). Non-executive remuneration policies registered high levels of approval, which is in line with previous years. Remuneration reports saw another year of improvement in 2024, with an average free float support (84%), which is a slight improvement in 2023 (81%). ISS also recommended against (4) fewer reports than in 2023 (5).

It is clear that year-on-year, the importance of supervisory boards' disclosure on how and why remuneration decisions are made continues to increase. With remuneration policies outlining a go-forward path for how a company will adopt certain remuneration practices, the vague ability to apply discretion and to amend results under these policies have attracted particular criticism. Providing a cogent rationale for decisions provides transparency and allows stakeholders to assess more complete information. Reasons for votes against the remuneration report and remuneration policies in 2024 vary. Still, items that were criticised include: lack of responsiveness to shareholder concerns, inappropriate adjustments/discretion, lack of equity in variable remuneration, high pension payments, insufficiently challenging targets and high severance payments.

Supervisory Boards are encouraged to continue proactively engaging and providing transparent disclosures in annual reporting. These actions will be critical to mitigating the risk of negative vote results at the AGM and are also an important element of good governance.

ESG in Remuneration

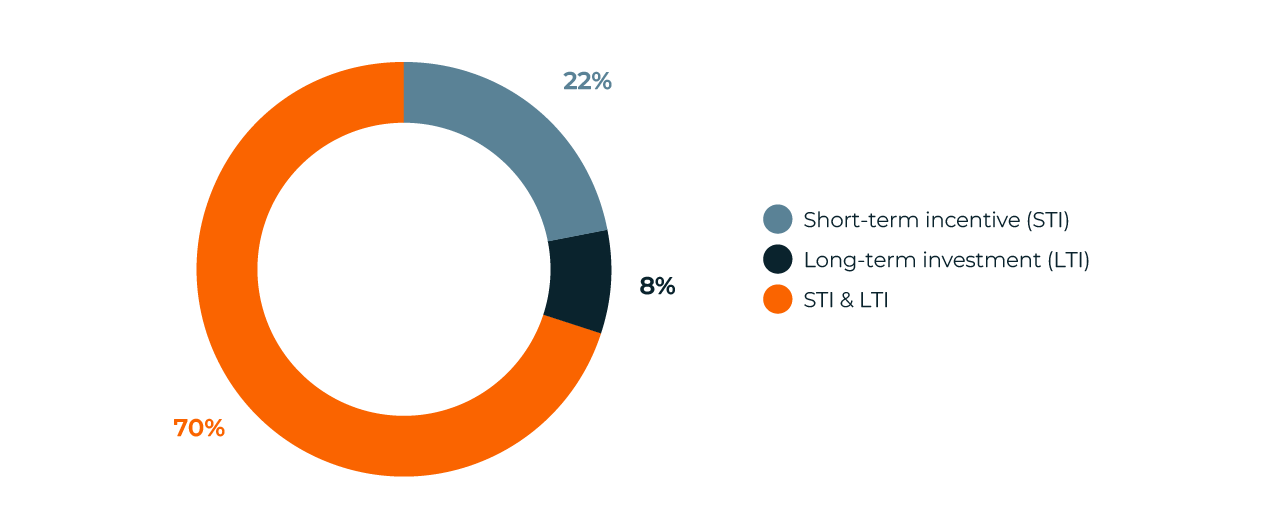

The implementation of ESG criteria—either as a metric or a performance modifier—under incentive schemes represents a consolidated practice among DAX issuers*. ESG metrics are implemented across short—and long-term awards, where a higher portion of modifiers is found under short–term incentive plans—more than three times the number of long-term schemes.

In terms of weight, ESG performance metrics under both types of plans stay predominantly between 20% and 40%. This aligns with market expectations that ESG metrics represent a weighting relative to their materiality to a company’s strategy and operations. Further, quantifiable internal targets are generally preferred because they are measurable and controllable by management.

Despite the implementation of ESG metrics in incentive plans, the topic is expected to remain a key one due to evolving European and international reporting standards (e.g., CSRD, ISSB). Investors will continue to focus on the implementation of ESG metrics and targets and their alignment with company strategy and materiality.

DAX: Implementation of ESG Metrics

*3 Companies were excluded from the analysis due to a lack of disclosure of variable remuneration

Say on Climate

German issuers remain hesitant to allow shareholders to vote on their climate strategy. One company put its climate roadmap up for a vote in 2024 with significant support (97%), following the first, less successful say on climate in 2023. ISS and Glass Lewis both recommended investors support the roadmap, with each focusing on emissions (scopes 1, 2 & 3), looking to see short, medium, and long-term targets, a scenario analysis as well as data being validated by third parties. Adherence to international frameworks such as TCFD continued to be a focus of analysis.

With increasing regulatory pressures and market expectations, companies must continue proactively engaging in their climate transition plans and overall ESG strategies. Board oversight of critical areas will continue to be an area of focus in 2025, with biodiversity expected to continue to increase in focus. Meanwhile, the governance of IT/cybersecurity and AI will remain hot topics for key stakeholders.

Other market considerations

Implementing an “ad hoc” item as a resolution at a company’s AGM can protect from random majorities for proposals submitted at the general meeting. Voting by proxy without a physical presence at the general meeting, preferred by mostly international investors, typically only includes instructions for the published agenda. It does not cover possible motions brought up during the general meeting. Due to the lack of instructions for items not made accessible beforehand, the number of valid votes cast can be drastically reduced. This can lead to random majorities and results not supported by the broad shareholder base.

Boards should be mindful moving forward to mitigate risks regarding the result of such motions tabled at the AGM by allowing investors to vote on ad hoc resolutions before the AGM.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Max Purcell

Director, Corporate Governance