Subscribe to stay informed, inspired and involved.

This article analyzes the Annual General Meetings (AGMs) of Italian issuers listed in the FTSE MIB index as of July 31st, 2024, for a total of 34 meetings. The sample includes Banca Generali and Banca Popolare di Sondrio, respectively listed on FTSE MIB until and from March 19th, 2024. It does not include index constituents that are incorporated abroad and Mediobanca, which holds its Annual General Meeting later in the year.

Meeting attendance and quorum

Attendance format

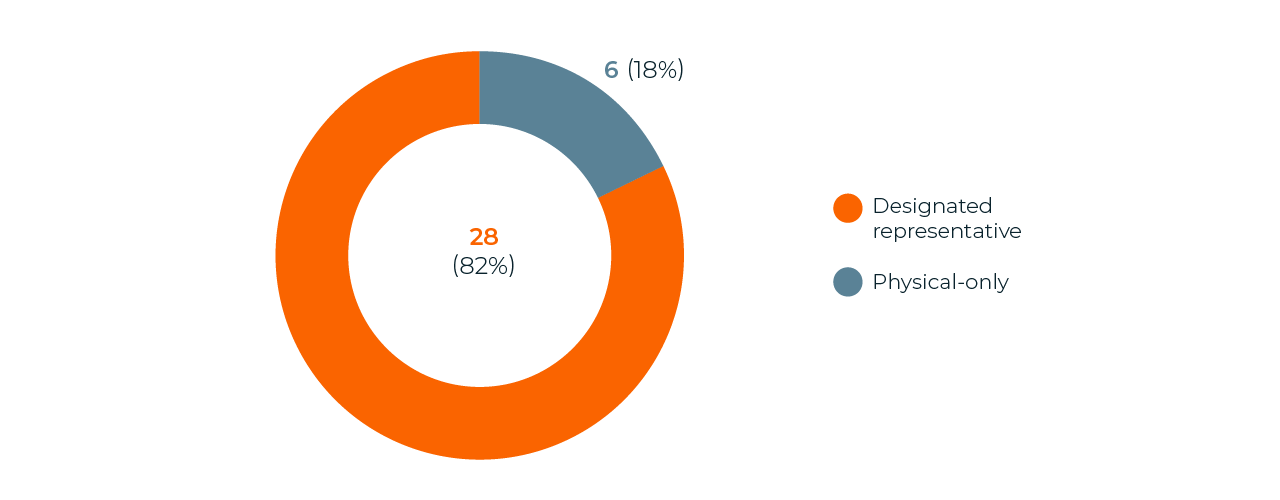

The 2024 shareholder meeting season for Italian companies listed on the FTSE MIB confirmed a noteworthy trend in the format of general meetings. Out of a sample of 34 companies, only six held their meetings with open doors, allowing direct participation from shareholders. The remaining 28 companies opted to conduct their meetings behind closed doors, with shareholder representation exclusively managed by a designated representative. This practice, aligned with the legal provisions that permit such arrangements, has become increasingly common, especially in the wake of the COVID-19 pandemic.

Only six companies decided to hold open-door meetings, indicating a minority preference for traditional, in-person shareholder engagement. Open-door meetings enable shareholders to attend in person, ask questions, and engage directly with the company's management and board of directors. The investor community often lauds this format for promoting transparency and fostering a sense of community and trust among shareholders. The companies that chose this approach in 2024 might have aimed to strengthen these relationships and offer a more tangible form of accountability and communication.

AGM attendance format for FTSE MIB issuers

Most issuers opted to hold the AGM exclusively through designated representatives, requiring shareholders to cast their votes solely by proxy prior to the AGM.

Quorum

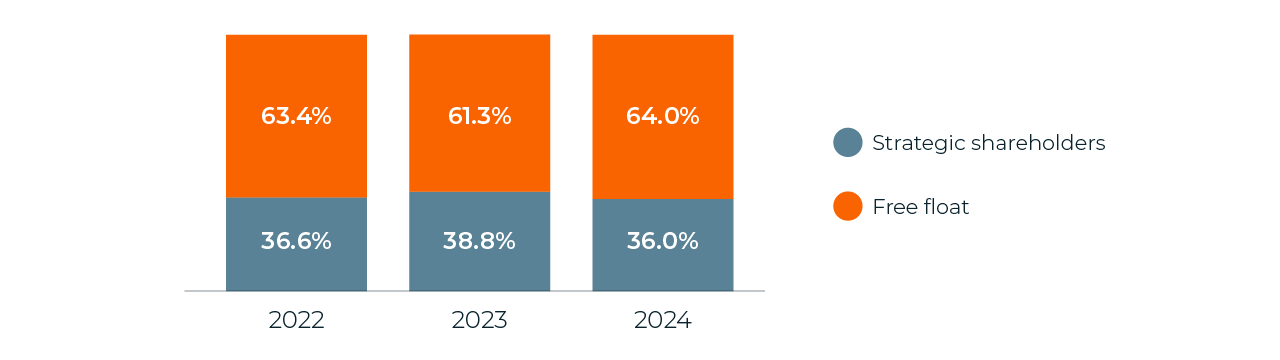

In 2024, we note a decrease in the average stake held by strategic shareholders, compared to the previous two-year period 2022-2023, limited at 36% of the share capital, on average. We consider these strategic shareholders to hold a significant stake in the company due to their active involvement in corporate bodies and their consistent voting at AGMs. Examples of such strategic shareholders include company founders, executives, state-controlled entities, or other shareholders with board representation.

Our study of the ownership structure also reveals an average increase in the free float among FTSE MIB companies. The slight reduction in the influence of strategic shareholders might lead to changes in corporate governance dynamics. With a more distributed ownership structure, there could be an increase in the emphasis on aligning the interests of a broader base of shareholders, potentially leading to more balanced and inclusive decision-making processes.

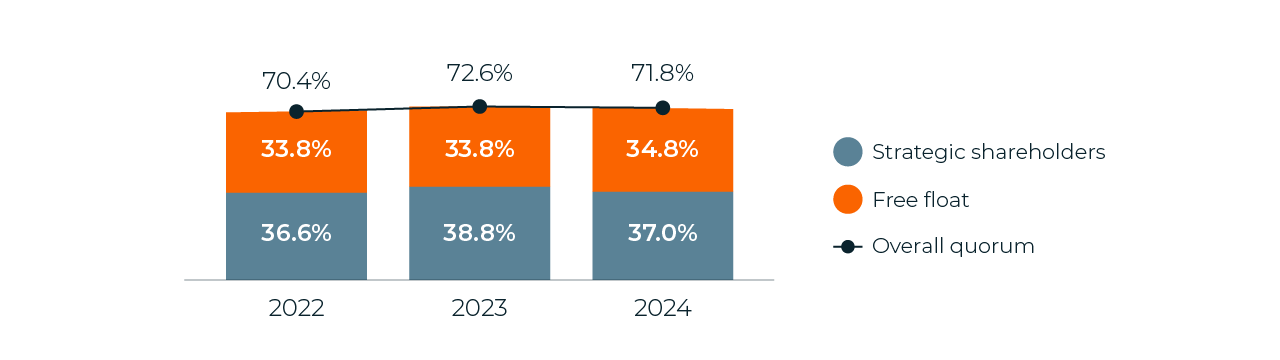

This trend is reflected in the evolution of quorum, considering that the average strategic shareholder participation has decreased by nearly two percentage points, from 38.8% in 2023 to 37.0% in 2024. The free float participation, in terms of share capital, has increased by only one percentage point to 34.8%. This has led to an overall decrease in voter turnout of almost one percentage point over the last year.

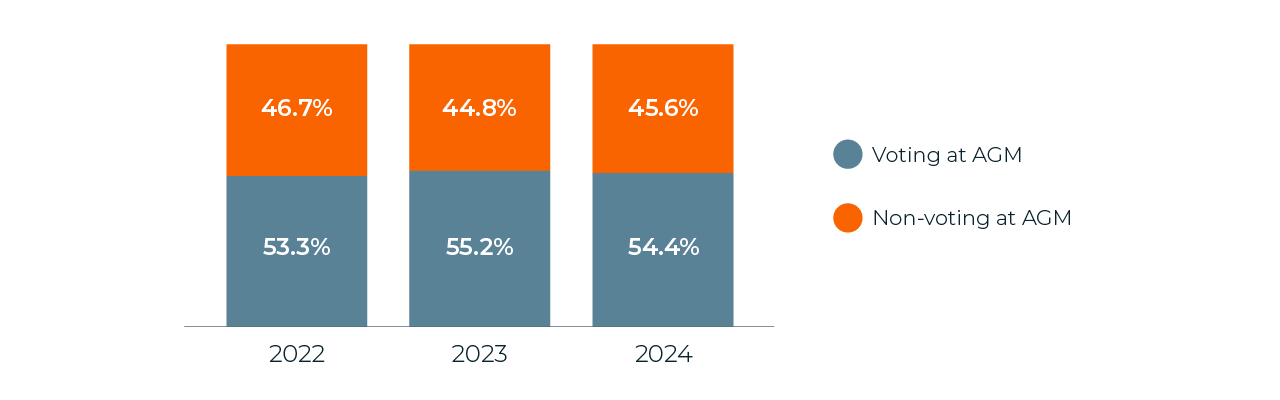

Interestingly, we find that the participation of the free float component in AGM voting, primarily represented by institutional shareholders and retail investors, has decreased. The average percentage of free float voting at the AGMs stood at approximately 54.4%, compared to 55.2% in 2023.

Share capital structure of FTSE MIB issuers' AGMs

The share of strategic shareholders decreased from 38.8% in 2023 to 36% in 2024, with a corresponding increase in the free float from 61% to 63%. This shift indicates a broader distribution of ownership and potentially greater influence of institutional investors and retail in AGM outcomes.

Quorum evolution and breakdown in FTSE MIB issuers' AGMs

The slight decrease in strategic shareholders' participation from 38.8% in 2023 to 37% in 2024, with the free float increasing marginally from 33.8% to 34.8% in the same period, suggests a slight redistribution of voting power, with more involvement from the free float.

Free float AGM participation in FTSE MIB issuers

Despite an increase in terms of share capital, the free float has, on average, decreased its participation through votes at the Italian FTSE MIB issuers from 55.2% to 54.4%.

Board elections

In Italian corporate governance, particularly within FTSE MIB listed companies, the list voting system plays a crucial role in shaping the composition of the board of directors. This system allows shareholders to present and vote for different lists of board candidates, ensuring a more representative and democratic election process at the end of the three-year term. Shareholders, including minority groups (above a certain ownership threshold), can submit their own lists of candidates, promoting diverse and balanced board membership.

Typically, these slates are put forth by the main shareholder(s) and Assogestioni, the Italian association of institutional investors. In a few cases, the board of directors itself also has the opportunity to present its own list of candidates. This bylaw provision allows the existing board to propose a slate of individuals whom they believe are best suited to steer the company strategically, particularly in cases where there are no controlling shareholders and the share capital is dispersed. The ability of the board to present a list ensures that the board can advocate for continuity and stability in leadership while still adhering to the principles of transparency and shareholder democracy inherent in the list voting system.

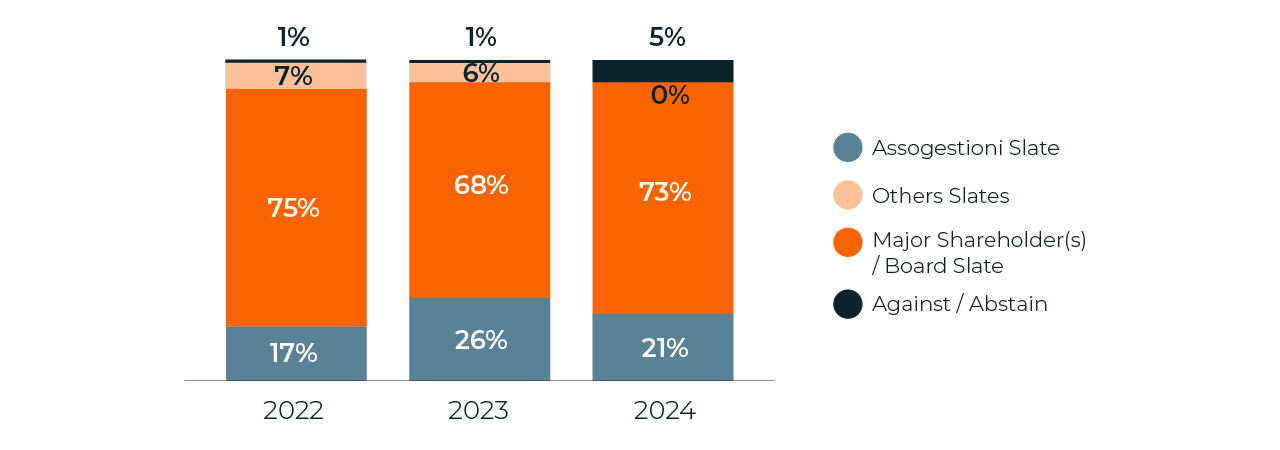

In 2024, nine companies conducted board renewals through the voto di lista system. This year, slates presented by institutional investors through Assogestioni received less support compared to 2023, decreasing from 26% to 21% of the votes cast at the AGM, on average. In four out of nine renewals, the board of directors presented its own slate of candidates, receiving, in all cases, support from the main proxy advisors and the majority of institutional investors.

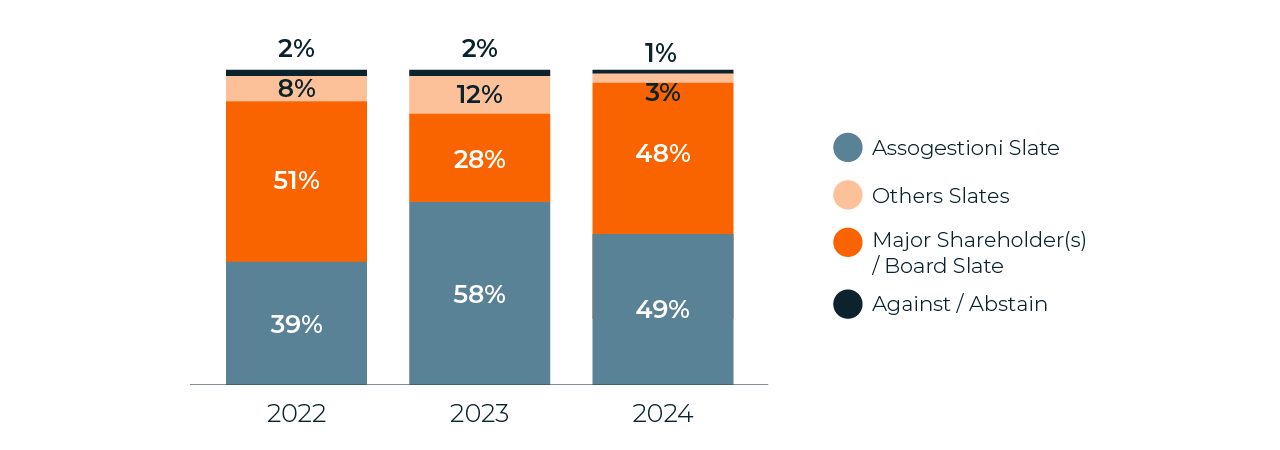

This can be further observed when examining the second graph, which illustrates the voting preferences of the free float. The significant shift in free float support (48%) is most likely determined by such circumstances, compared to 2023 when only two out of 12 companies had slates submitted by the outgoing board.

Lastly, the average lack of support equal to 5% registered in 2024 is worth mentioning, related to the abstention of a significant shareholder in Telecom Italia's AGM. This contrasts with what was registered in the past, when abstention was close to zero and an average of 6% and 7% of overall votes, respectively in 2023 and 2022, were cast in favor of a third (sometimes activist) slate.

Slates' average overall support

In 2024, the slates presented by the major shareholder or the outgoing board remained the most voted ones, with a year-on-year increase in the average support, from 68% to 73%. Assogestioni slates experienced a decrease in support, decreasing by 5 percentage points.

Slates average free float support

In 2024, we saw a change of perspective in the average free float support, favoring the major shareholder/board slates (71%) rather than Assogestioni. This is likely to be attributed to the four out of nine renewals where the outgoing board submitted its own list of candidates.

Post-AGM boards

Board composition

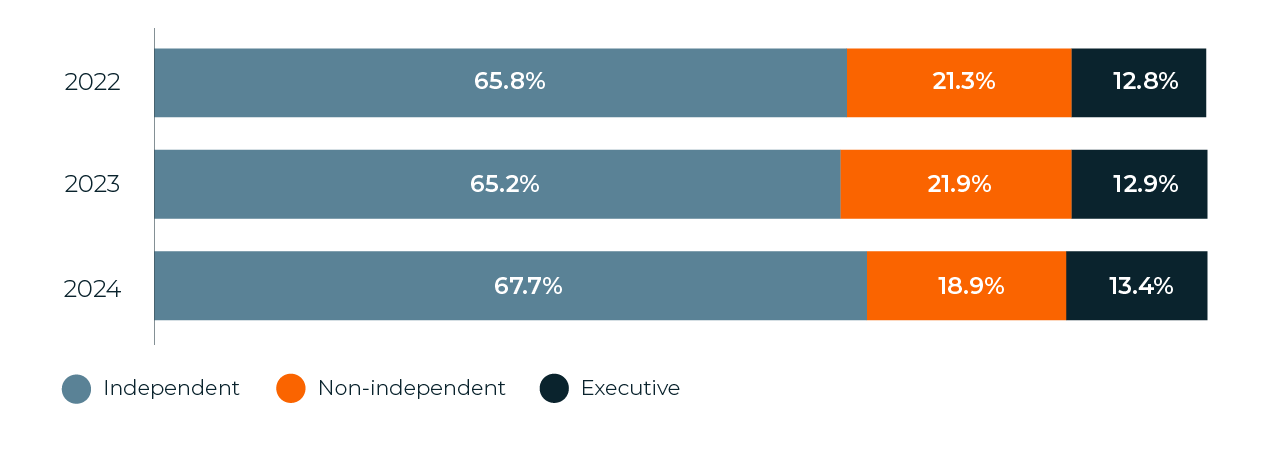

Following the 2024 board renewals, the composition of the boards of directors for Italian blue-chip companies at the close of the 2024 voting season showed minimal change compared to 2023. However, the data from 2024 indicates a modest improvement in board independence. External independent directors now make up nearly 68% of the total, a slight increase from 65% in 2023. Meanwhile, the proportion of non-independent directors has decreased slightly, reflecting a positive trend toward greater board independence.

Only four of the 34 issuers included in the panel have boards where independent directors are in the minority, all of which have a controlling shareholder. Additionally, nearly 31% of the issuers in the sample have appointed lead independent directors, a figure that shows a decrease vis-à-vis 2023 (38%) possibly due to the change in composition of the panel.

Post-AGM board composition for FTSE MIB issuers

Overall, the average level of board independence remains strong, consistent with local Corporate Governance Code guidelines, which recommends a minimum independence threshold of 50% for non-controlled companies.

Board Chairperson

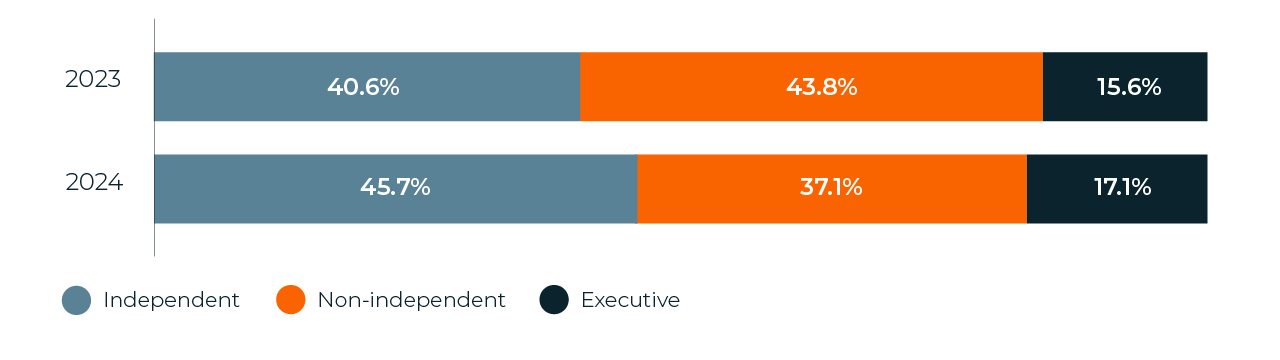

An analysis of board chairs at Italian FTSE MIB companies reveals a trend towards more independent leadership. In 2024, almost 45.7% of boards are chaired by independent directors, up from 40.6% in 2023. The proportion of boards with chairs who are externally affiliated directors has decreased to 37% from nearly 44% the previous year, while the percentage of chairs who are also insider executives has slightly risen to 17% from 15.6% in 2023.

Classification of Board Chairperson in FTSE MIB issuers

These figures suggest that while most board chairs in Italian FTSE MIB companies are still non-independent, there is a gradual shift towards greater independence in these roles. Notably, only one company continues to have a combined chairperson and CEO role, with most companies maintaining a separation between these executive and oversight functions.

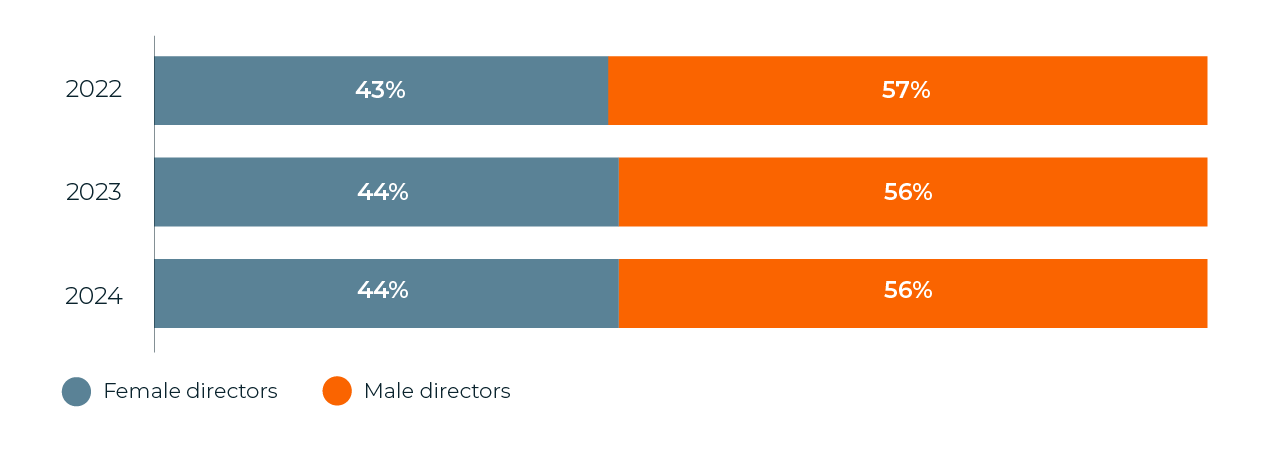

Board gender diversity

Gender diversity within Italian main index companies has remained stable and compliant with regulatory requirements. In 2024, female directors account for 44% of board positions, a figure that remains consistent with 2023 and shows a slight increase from 43% in 2022.

Additionally, the number of boards chaired by women has remained stable, with seven boards (20% of the sample) having a female chairperson in 2024. Only one company has a female CEO.

Board gender diversity in FTSE MIB issuers

Stability in gender diversity indicates ongoing compliance with the regulation requiring at least 40% representation of the less represented gender on corporate boards. While the average gender diversity across FTSE MIB boards exceeds the mandatory threshold, there is still one company that does not meet the required level.

Remuneration

Approval of the Remuneration Policy and the Remuneration Report

The "say-on-pay" mechanism for Italian issuers, similar to other European markets, involves shareholders voting on Sections 1 and 2 of the Remuneration Report. This report outlines the compensation for top management and key governing bodies, including the board of directors and internal statutory auditors. Section 1, detailing the remuneration policy, requires shareholder approval via a binding vote at least once every three years. Section 2, covering the remuneration paid in the previous fiscal year, is subject to an annual advisory vote.

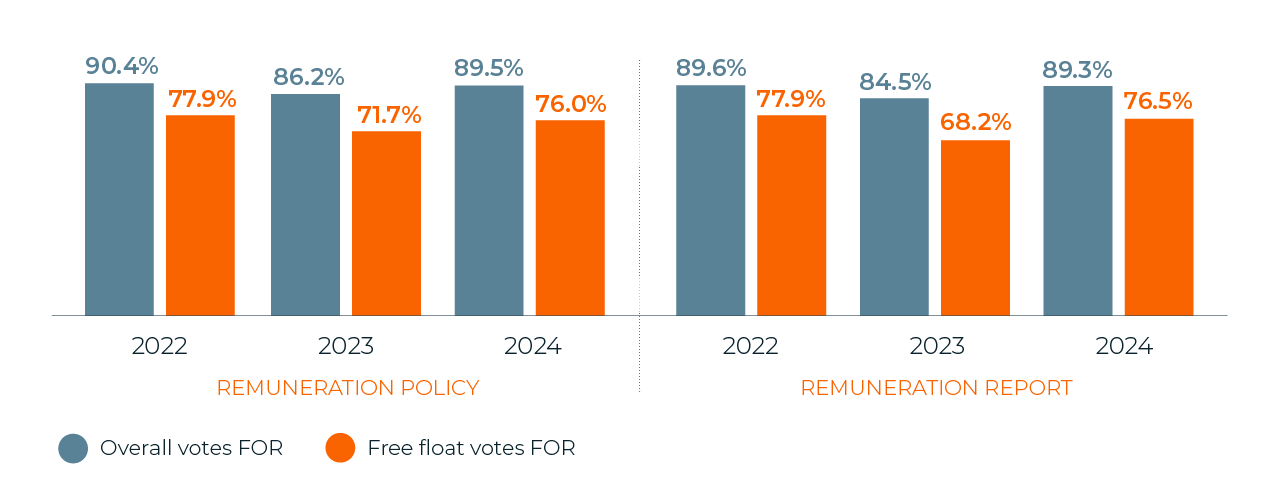

In 2024, executive remuneration continued to be a contentious issue. Shareholder dissent averaged circa 11% for both the remuneration policy and the remuneration report, indicating a decrease from 2023, where dissent was circa 14% for the policy and 16% for the report.

The overall approval for the Remuneration Policy increased from 86.2% in 2023 to 89.5% in 2024, and for the Remuneration Report from 84.5% to 89.3%. However, opposition from the free float remained notable, with support levels at circa 76% for both the Remuneration Policy and Report.

The voting results indicate that shareholders, especially institutional investors, took a slightly more lenient approach in 2024 compared to 2023.

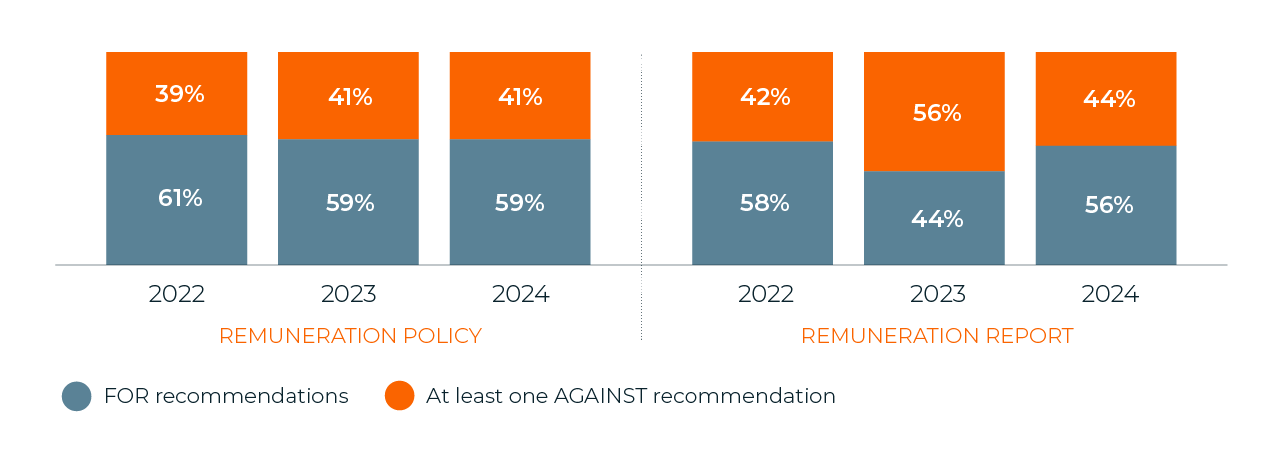

ISS and GL voting recommendations in FTSE MIB remuneration items

Among the primary concerns raised by proxy advisors during the 2024 season, we highlight excessive severance agreements, insufficient responsiveness, misalignment of CEO pay versus peers or performance and the lack of disclosure on performance targets under variable incentives.

This can be partly associated with the reduction in the number of negative recommendations cast by the two most influential proxy advisors, ISS and Glass Lewis, for the remuneration report. These proxy advisors continued to exert significant influence, issuing negative recommendations for 41% of the remuneration policies and 44% of the remuneration reports, maintaining a critical stance. Overall, proxy advisors supported 59% of the Remuneration Policies and 55% of the Remuneration Reports in 2024.

Approval of the remuneration policy and the remuneration report

Both the Remuneration Policy and the Remuneration Report garnered the lowest levels of support at the FTSE MIB annual general meetings. In particular, the opposition from the free float nearly reached 25%, on average.

Despite these challenges, some companies provided positive examples of remuneration practices. However, international investors continue to view Italian companies as overly discretionary in their pay practices. To address these concerns, issuers need to enhance transparency and establish more effective engagement with shareholders to better align expectations and outcomes.

DDL Capitali

As of 2024, Italy has introduced a significant shift in corporate governance with the enactment of the DDL Capitali, formally known as the "Decreto Legislativo sulle Capitali".

The DDL Capitali is part of Italy's broader strategy to enhance its financial market's attractiveness and competitiveness. By modernizing corporate governance practices, the regulation aims to:

- Attract foreign investment: the streamlined decision-making process and enhanced voting rights for long-term investors are likely to make Italian companies more attractive to foreign investors seeking stable and efficient markets.

- Promote market stability: encouraging long-term investment through increased voting rights can contribute to market stability, reducing volatility caused by short-term trading activities.

- Support corporate growth: with a more stable shareholder base and efficient governance mechanisms, companies can focus on strategic growth initiatives, innovation, and long-term value creation.

This new regulation, brings forth two pivotal changes in the way listed companies operate:

Closed-Door Shareholder Meetings

Traditionally, shareholder meetings in Italy have been open to all shareholders, allowing direct participation in decision-making processes. However, the DDL Capitali permits companies to hold these meetings with exclusive participation through a designated representative. This means that instead of shareholders attending and voting in person or by proxy, a single representative will attend on behalf of all shareholders, consolidating the voting process and potentially streamlining decision-making.

The decision to hold closed-door meetings can be attributed to several factors, such as:

- Legal flexibility: Italian law allows companies to hold shareholder meetings without physical attendance, streamlining the process and reducing logistical complexities.

- Cost efficiency: representative-led meetings can be more cost-effective, eliminating the need for large venues and extensive security measures.

- Operational efficiency: closed-door meetings often result in more streamlined proceedings, as the designated representative consolidates and presents shareholder votes and questions in an organized manner.

- Reduced disruptions: these meetings can minimize disruptions caused by large, diverse groups of shareholders with varying agendas, allowing for a more coherent and cohesive deliberation process.

While the closed-door approach offers several advantages, it also raises questions about shareholder engagement and transparency. Some investors, as well as the most prominent proxy advisors argue that this format may limit direct interaction between shareholders and the company's leadership, potentially reducing the sense of accountability and immediacy in addressing shareholder concerns. First, it limits shareholders' ability to cast their votes only before the meeting, potentially restricting their ability to respond to developments during the meeting. Second, it curtails access to shareholder rights beyond voting which are typically exercisable at the shareholders' meeting, such as the presentation of new resolution proposals.

Nonetheless, in light of the recommendations formulated in the past by the supervisory authority on shareholder rights, companies have adopted measures to ensure shareholders make an informed vote, particularly through timely disclosure of the resolutions on the agenda and anticipation of Q&A deadlines.

As of July 31st, only four FTSE MIB companies have presented the resolution to amend their bylaws to introduce the closed-door meetings format. In all cases, proxy advisors have recommended against said introduction, ultimately leading to a strong free float dissent (average support from non-strategic shareholders accounted on average for 14.5% of the total). In one case, the resolution failed to pass the shareholder scrutiny, given the lack of presence of a majority shareholder.

Increased Voting Rights

The regulation also introduces measures that enable companies to increase voting rights. In particular, the new art. 127-quinquies of the Consolidated Law on Finance (TUF) establishes that companies that adopt the increased voting mechanism may also provide in the articles of association that - in addition to the ordinary increase of a maximum of two votes per share which can be achieved after an uninterrupted period of ownership of the share equal to at least 24 months - the voting rights can be further increased to the extent of one vote per share for each 12-month period of continuous ownership of the shares, up to a maximum of 10 votes per share, according to a progressive step-up mechanism.

By increasing voting rights for long-term shareholders, the regulation seeks to further align the interests of the company with those of its most committed investors. This can lead to more stable and strategic governance, as long-term shareholders typically prioritize sustainable growth over short-term gains. On the other side, the stretching of the deviation from the “one-share one-vote” principle, by further consolidation of voting power could lead to greater control by a small group of investors, potentially marginalizing others.

Looking Ahead

The DDL Capitali represents a landmark change in Italian corporate governance, reflecting the country's commitment to modernizing its financial markets. While the regulation offers several advantages, including enhanced efficiency and stability, it also necessitates careful consideration of potential drawbacks related to transparency and minority shareholder rights.

The 2024 season's data suggests a continued preference for closed-door meetings among FTSE MIB companies, reflecting a broader trend towards virtual and proxy-based shareholder engagement. However, the minority of companies maintaining open-door policies highlights an ongoing commitment to traditional, in-person interaction.

As companies navigate the evolving landscape of shareholder meetings, balancing efficiency, safety, and engagement will remain crucial. Future regulatory changes and shareholder preferences will likely influence how these meetings are conducted, potentially leading to new hybrid models that combine the best elements of both open and closed formats.

In conclusion, the 2024 shareholder season for Italian FTSE MIB companies underscores a significant shift towards closed-door meetings, with legal provisions and practical considerations driving this trend. However, the ongoing debate about the best way to engage shareholders ensures that this area will continue to evolve in response to changing circumstances and stakeholder expectations.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Cesare Schiavon

Manager, Corporate Governance