Subscribe to stay informed, inspired and involved.

The data below shows the evolution of the 16 PSI issuers' 2024 proxy season by analyzing their 2024 AGMs compared to those held in the preceding years. It is worth noting that PSI issuer Greenvolt had two AGMs in 2024. Surprisingly, PSI issuers Corticeira Amorim, REN, and EDP Renovaveis, stopped releasing the data on the quorum and the numerical voting outcomes of their AGM as they did not publish the AGM minutes in 2024 for the first time.

Attendance formats, Participation and Quorum

Attendance formats

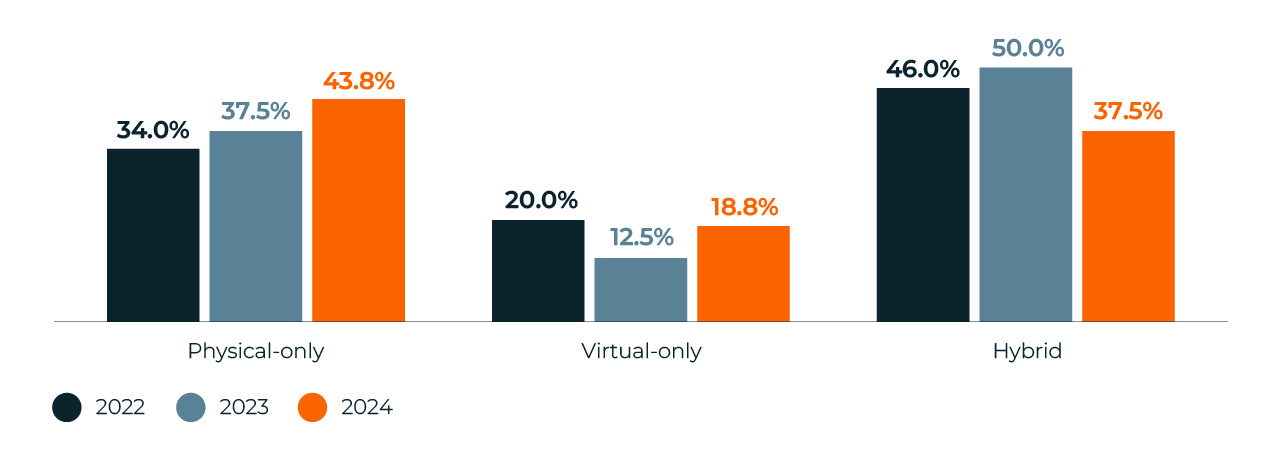

Since the game-changing arrival of virtual attendance possibilities at AGMs during the pandemic, PSI practice remains relatively stable regarding AGM formats. In 2024 PSI members have continued to opt for three different choices. However, there have been some changes in their preferences.

For example:

- hybrid meetings, which allow shareholders to attend the AGM both physically and virtually (decreasing to 37.5% of the AGMs)

- physical-only meetings, which only permit shareholders to participate in person or by post (an upturn to 43.8% of the AGMs, becoming the preferred format for 2024)

- virtual-only meetings (increasing to 18.5% of the issuers and remaining the least preferable option in 2024).

Therefore, hybrid meetings, which are generally considered the most inclusive shareholder meeting format, are no longer the most frequent option (as they were in 2023 and 2024) as PSI issuers are returning to the conventional physical-only format.

PSI: Attendance formats

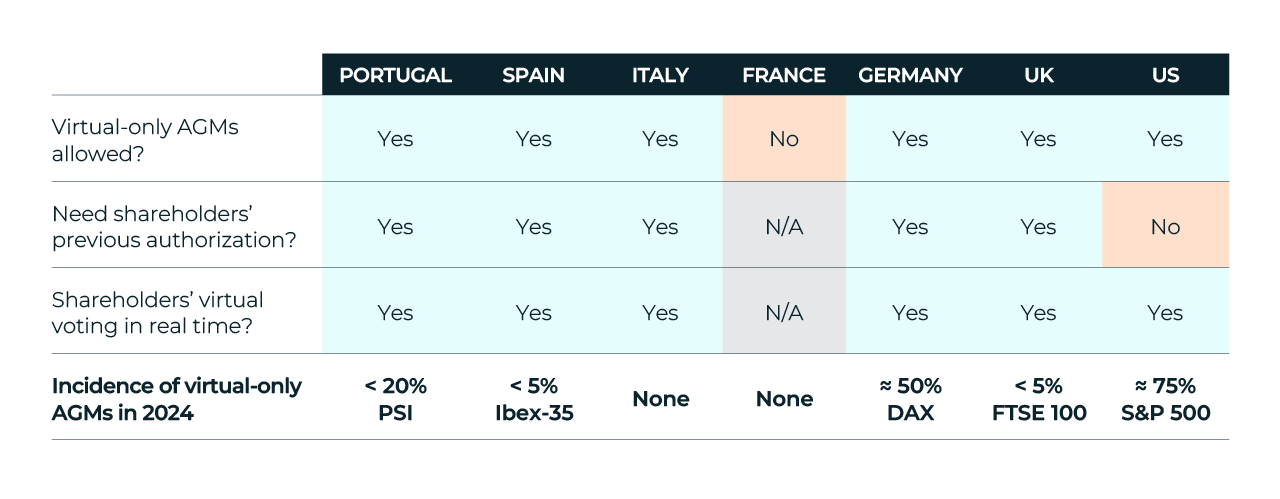

International incidence of virtual AGMs

The virtual element of post-pandemic AGMs has unevenly developed in the main international markets. While some of them do not allow AGMs to have any virtual component (mainly regarding the in-real-time online voting), others allow shareholders' meetings to be held under a virtual-only format, as long as shareholders had previously authorized it -which is the case of Portugal. Other markets give full powers to the board to convey AGMs in the most convenient format without asking for shareholders' permission at any moment. This is how the virtual components of AGMs have evolved in some international markets:

It is worth noting that the authorizations approved by shareholders (in the form of bylaw amendments or specific one-off grants) to enable virtual-only AGMs were passed in the context of the pandemic and under extraordinary circumstances. Some stakeholders have flagged that despite these exceptional circumstances no longer being relevant, some issuers still organized virtual-only AGMs.

Overall, the hybrid format is still perceived as the most inclusive form for shareholders to participate at the AGM, as it equally allows physical and virtual participation.

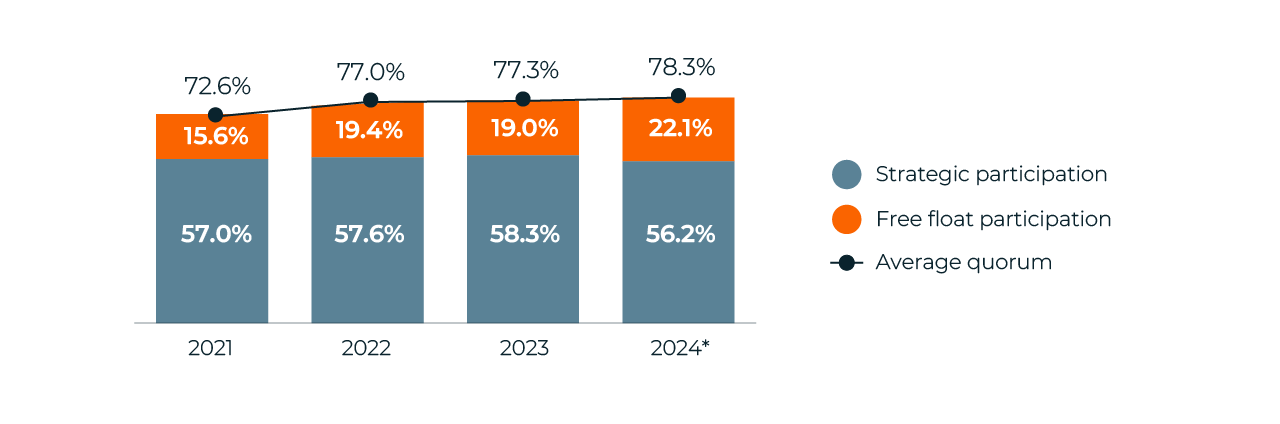

Participation and Quorum

The evolution of quorum levels at AGMs was significantly impacted by issuers' share capital structure. In the PSI 2024 proxy season, the average quorum remained broadly unchanged regarding the previous attendance percentages, slightly above a healthy 78%.

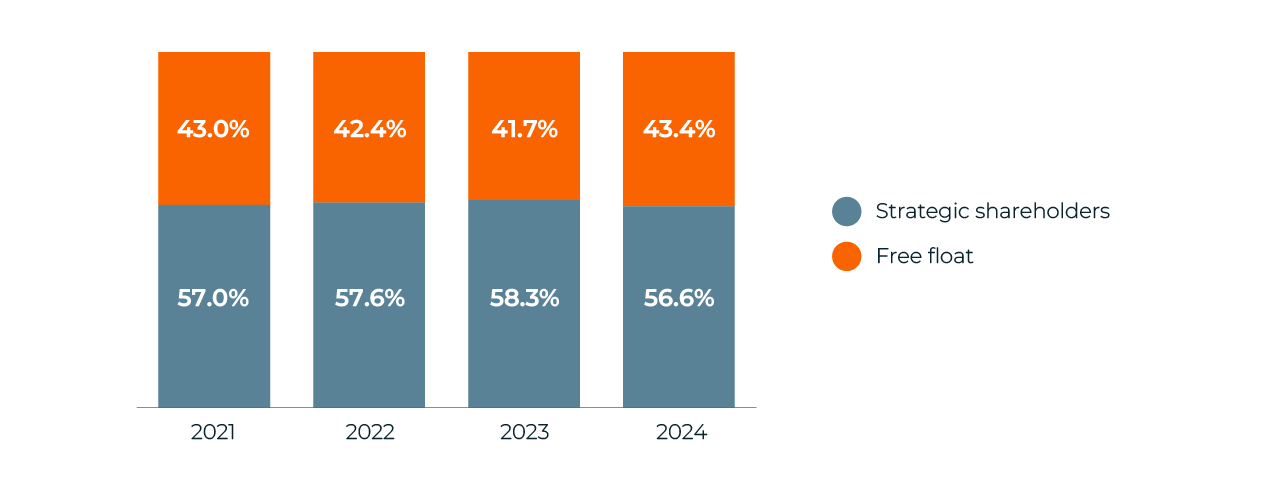

This level highly correlates with the outstanding presence of strategic shareholders in PSI issuers' share capital, which once again remain dominant in the PSI share capital basis (holding 56.6% of total voting rights on average). It is not a coincidence that c. 68% of the PSI issuers are controlled companies. Strategic shareholders, such as company founders and shareholders with board representation, state-controlled entities, executives, and employee funds, are primarily involved in issuers' governing bodies and day-to-day management, being also core participants and always-FOR voters at AGMs – hence their direct impact both in high quorum levels and high approval ratios. Interestingly, the weak presence of free-float shareholders in companies' share capital does not contribute to adopting best practices in corporate governance.

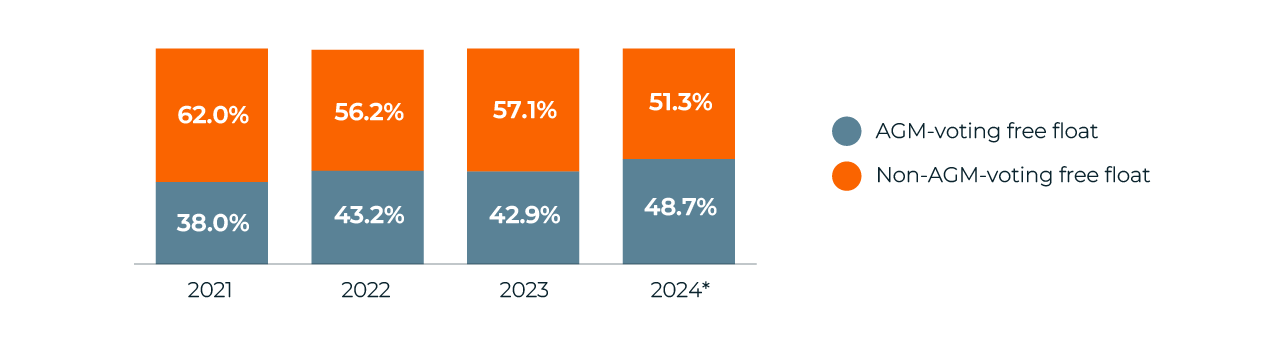

PSI: Average share capital structure

PSI is a minority-free-float index. On average, in proxy season 2024, the majority of the voting rights were in the hands of strategic shareholders – c. 57%. Indeed, only five PSI issuers' share capital was predominantly in the hands of the free float.

PSI: Average quorum and participation breakdown

In line with the PSI share capital structure, this estimation reveals that in proxy season 2024, on average, approximately 72% of the participants at PSI AGMs were strategic shareholders, while only the remaining 28% were free-float shareholders.

**These average figures lack the data of the three PSI issuers that stopped releasing any information regarding AGM quorum in 2024.

PSI: Free float's average AGM participation

Even though the free-float is, on average, a minority in PSI issuers' share capital, an enthusiastic c. 49% participate at AGMs. Once again, as per this estimation, in two PSI issuers, the majority of their AGM quorum votes were made up of free float shareholders—EDP and Galp Energia.

**These average figures lack the data of the three PSI issuers that stopped releasing any information regarding AGM quorum in 2024.

Board Elections

The Portuguese market operates one-tiered boards. Insider executives, external independents, and external affiliated directors may coexist on the board. Directors are appointed through the single vote of a slate that comprises all nominees for a defined period, usually three years (classified board). The later substitution of any members during the appointment period is carried out through the individual election of the replacing nominee.

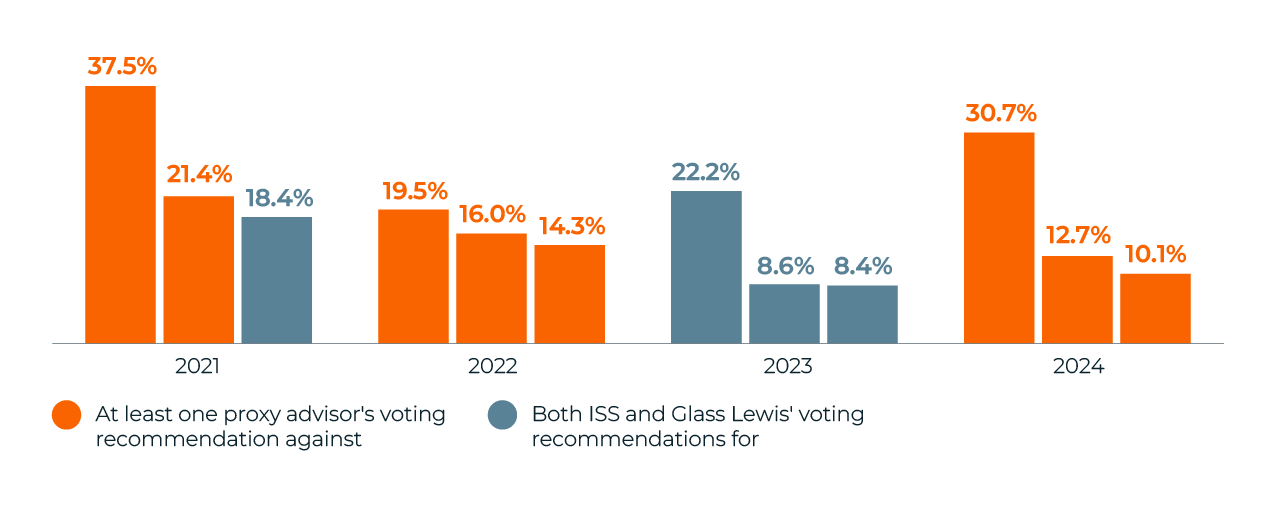

Analysis of vote outcomes

When assessing the joint appointment of all board members in a single slate, while two PSI issuers have proposed under a single bundled vote the election of the entire board for a three-year term, three other PSI issuers also proposed the election of other corporate governing bodies under the same election. Interestingly, while bundled votes may be controversial under international best practices for not allowing the individual election of nominees, global proxy advisors ISS and Glass Lewis did not recommend against this form of election, but rather the insufficient independence levels, the existence of a nominee in the slate that holds a joint Chair and CEO role, the lack of disclosure of the nominees' identities, or the poor composition of the other corporate governing bodies elected under the same vote. Of note is that ISS recommended opposing all five bundled elections of 2024, while Glass Lewis had a more moderate approach - it recommended against two of them.

In the review of the individual election of a replacing nominee for an outgoing director, there were 12 instances. ISS recommended opposing 25% of them, while Glass Lewis did it against just one. The reasons argued were (i) escalation for the poor board composition for which the nominee is held responsible and (ii) insufficient board independence for non-independent nominees.

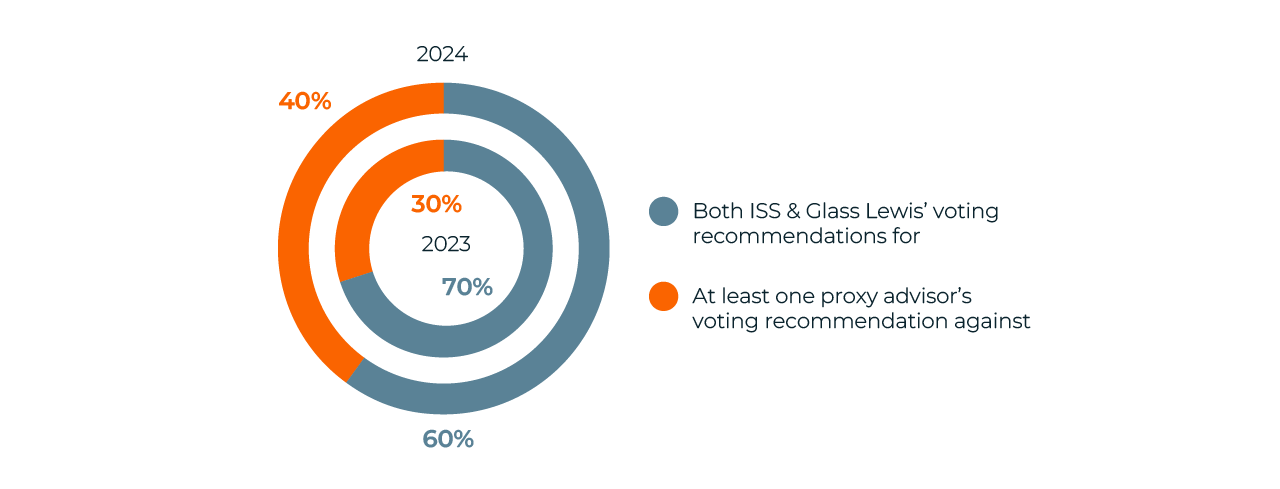

PSI: Proxy advisors' voting recommendations on board elections

This is the overall behavior of proxy advisors ISS and Glass Lewis regarding global board elections. In total, the number of opposed board selections went up from 30% to 40% in 2024.

After the exceptional outcome of 2023, where the three highest opposed board-elections were recommended FOR by ISS and Glass Lewis, in 2024, receiving an against-voting recommendation implied a significant contestation from shareholders at the AGM. This is a sample of the three highest opposed elections amongst PSI members since 2021:

PSI: Highest opposed board elections

In 2024, three PSI issuers did not disclose the voting outcomes. Some of them received against-vote recommendations on their board elections.

Post-AGM Boards

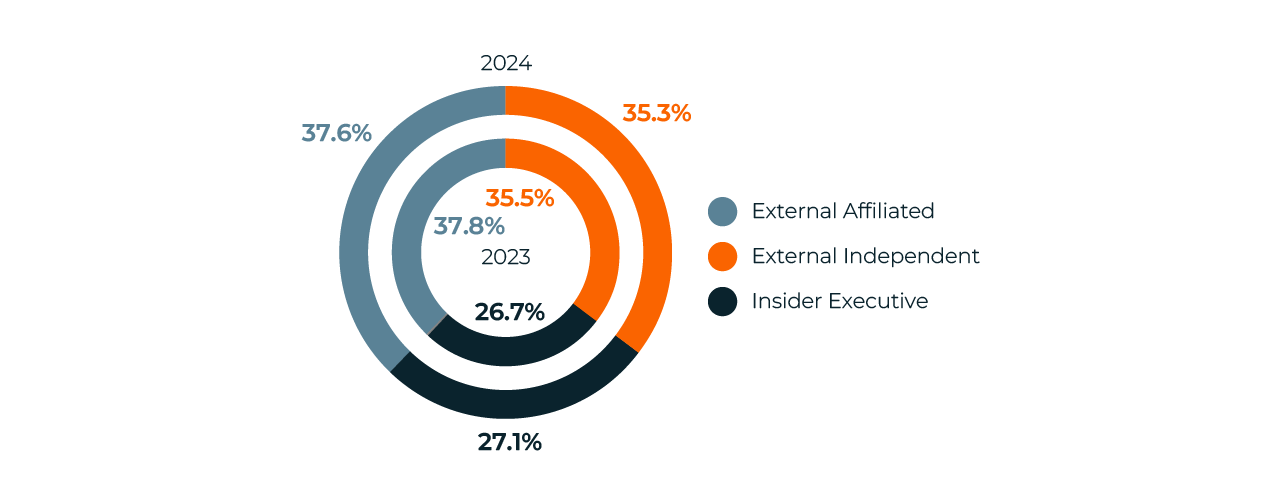

Board Composition

When analyzing the composition of post-AGM PSI boards in the proxy season 2024, this analysis considers three types of directors: insider executive, external independent, and external affiliated (non-independent non-executive) directors. The average board composition in 2024 remains unchanged from the previous season, 2023: External affiliated directors are the largest group (37.6%), followed by independent directors (35.3%) and executive directors (27.1%). Therefore, average PSI post-AGM boards are approximately one-third independent.

PSI: Average Post-AGM Board Composition

The average post-2024-AGM PSI board is similar to 2023's. This composition, where independent directors are not the majority, resembles the average PSI shareholder structure, a minority-free float index.

Taking a closer look at non-controlled PSI issuers who are issuers where a shareholder (or a group of shareholders acting in agreement) manages less than 50% of the existing voting rights.

The average board composition percentages change significantly: external independent directors constitute the largest group (42.2%), while external affiliated and insider executives account for 34.5% and 23.3%, respectively. Interestingly, controlled PSI issuers allocate the largest portion of the boardroom to affiliated board members (38.9%), while external independent and insider executives account for 32.4% and 28.7%, respectively.

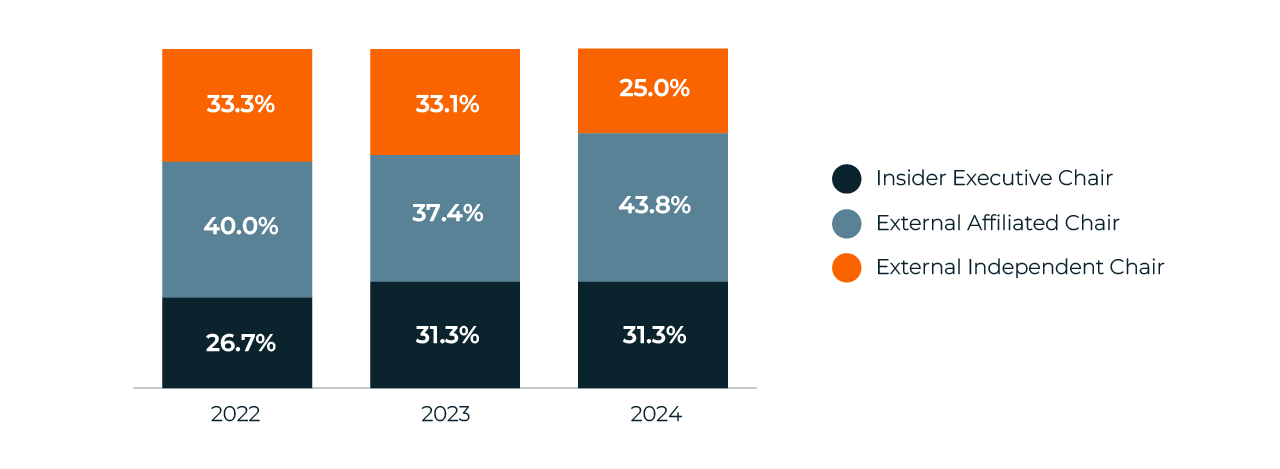

Board Chair

When assessing the director classification of PSI post-AGM board chairpersons in 2024, the distribution somewhat echoes the average board composition. Consistently, external affiliated chairs predominate (43.8% in total), while contrarily, internal affiliated chairs account for 31.3%. Independent chairpersons are a small minority; only 25.0% fall under this director category. This distribution is similar to that of 2023.

PSI: Classification of Board Chairs

In 2024, the proportion of externally affiliated chairs remained the most frequent type, but it grew to the detriment of external independent chairs.

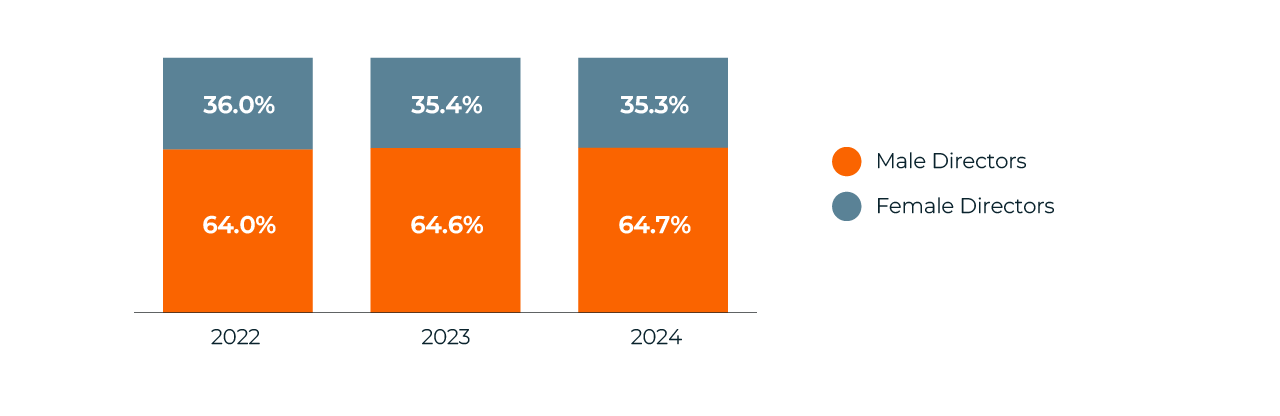

Board Gender Diversity

Assessing gender diversity among PSI boards reflects Portugal's complex regulatory framework. Indeed, the average gender diversity among PSI boards is 35.3% female directors vs. 64.7% male directors, including one PSI issuer that hit a leading 40%- 60% diversity ratio.

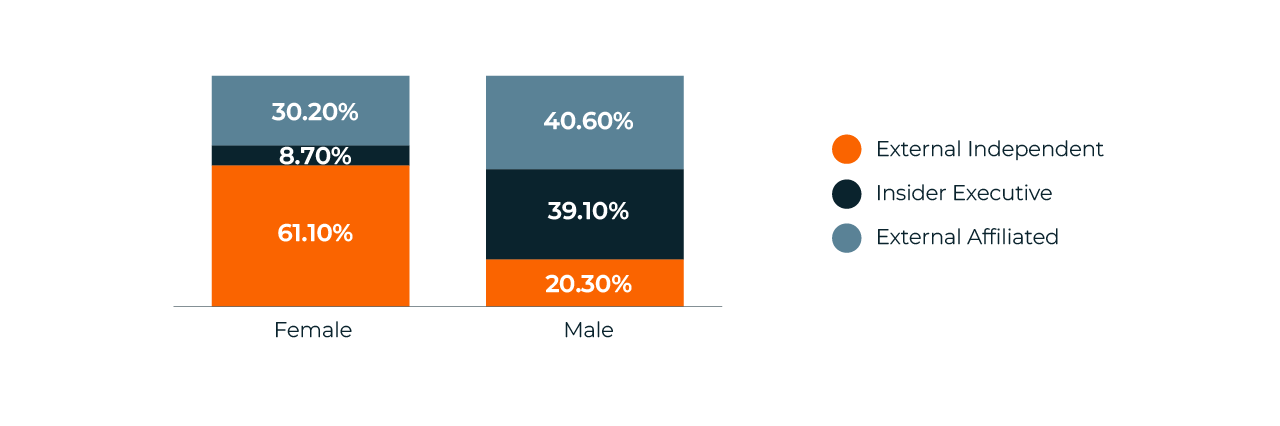

When assessing the director categories under which female nominees are appointed at PSI boards, it is noteworthy that this distribution does not mirror the index's average board composition. 61.1% of the female directors are appointed in an external independent capacity (a category that only represents 35.3% of total directorships). In line with this, the most common director post amongst PSI issuers, external affiliated director (37.6% of all board posts), is held by only 30.2% of total female directors. Finally, and quite revealing, only 8.7% of female board members hold an executive role in PSI boards – a capacity under which a total of 26.8% of directors serve. Board-level management posts seem to remain inaccessible for female directors – indeed, amongst the PSI issuers, there is only one chairwoman (externally affiliated) and one female CEO in 2023.

PSI: Average Board Gender Diversity

On average, PSI boards exceed the mandatory one-third gender diversity threshold.

PSI: 2024 Average Distribution of Genders by Director Category

On average, female directors mainly hold independent directorships in PSI issuers, while executive posts seem far from their reach. Male directors tend to hold externally affiliated and insider executive posts in PSI boards.

Remuneration

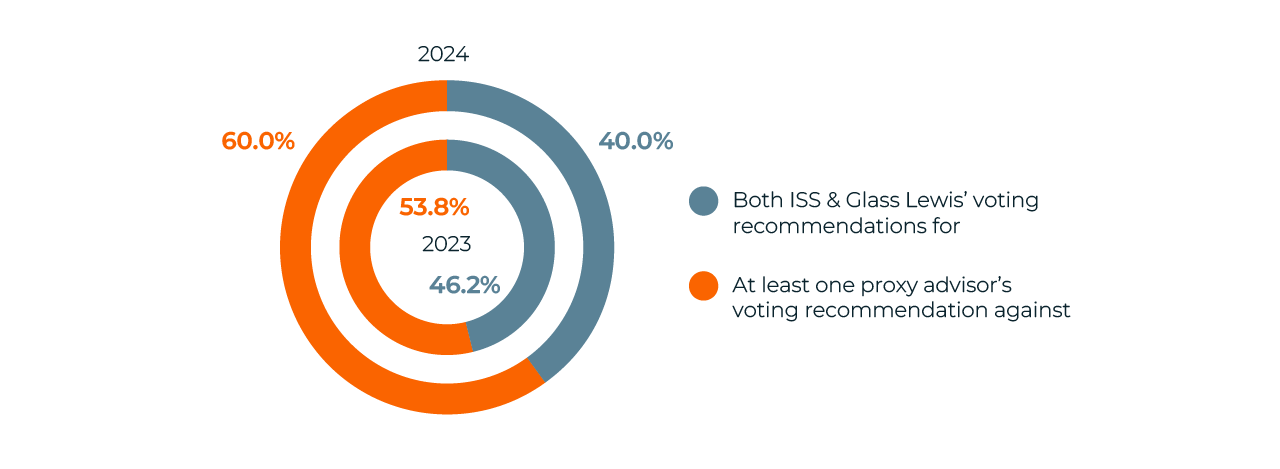

Unlike most European countries, PSI issuers only submit to a shareholder vote the Remuneration Policy, which defines board compensation for up to the following three years.

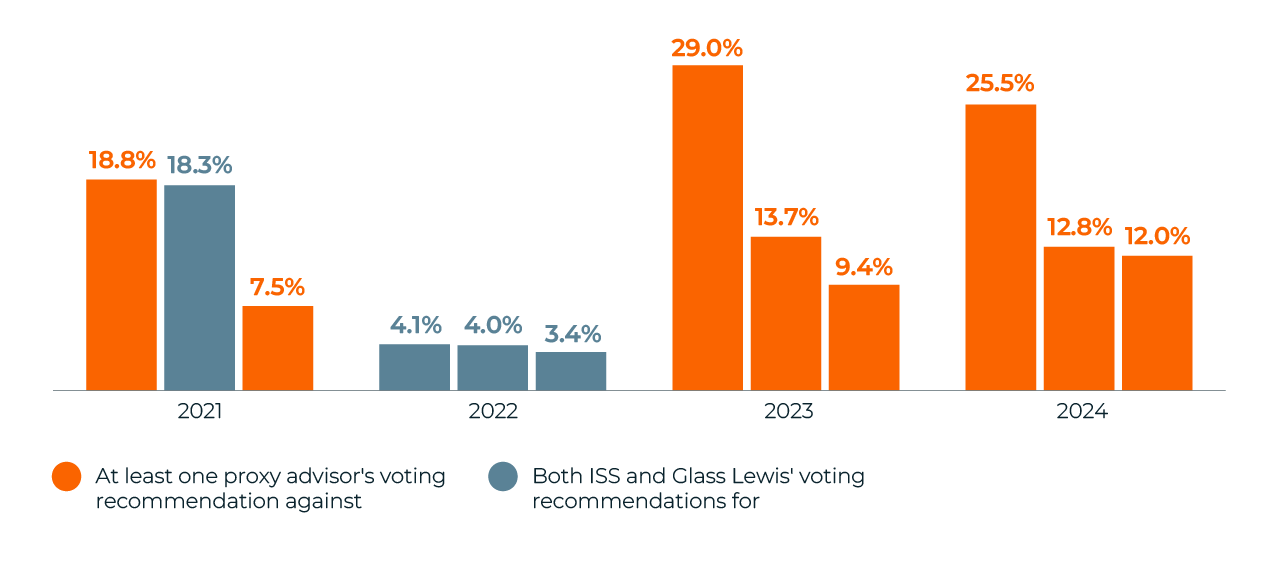

In 2024, up to 10 PSI issuers brought the approval of the Remuneration Policy to their AGMs, which triggered different reactions amongst market stakeholders. Proxy advisors ISS and Glass Lewis have recommended against 40% of these resolutions, while the combination of both accounts for 60% of the Remuneration Policies, which increases the level of 2023 (53.8%). The rationales provided for issuing negative voting recommendations include (i) the payment of retirement contributions to non-executives, (ii) the lack of disclosure of the metrics attached to variable compensation plans, (iii) excessive and unjustified pay increases, (iv) the lack of caps for the settlement of variable pay, (v) poor composition of the remuneration committee – responsible for proposing the remuneration policy, (vi) opaque disclosure on the nature of certain payments, and (vii) lack of deferrals for variable pay.

PSI: Proxy advisors' voting recommendations on remuneration items

For the second consecutive year, most of the remuneration policies submitted by PSI issuers received an AGAINST vote recommendation from ISS and/or Glass Lewis.

While average against-votes impacting the Remuneration Policies were 8.81%, certain instances registered concerning opposition levels (25.49% was the highest). However, while the three most opposed remuneration policies were not as dissented as those of 2023, all were opposed, at least by ISS and/or Glass Lewis.

PSI: Highest opposed remuneration items

**In 2024, three PSI issuers did not report the voting outcomes of their AGMs. Some of them received double against-voting recommendations on their Remuneration Policies.

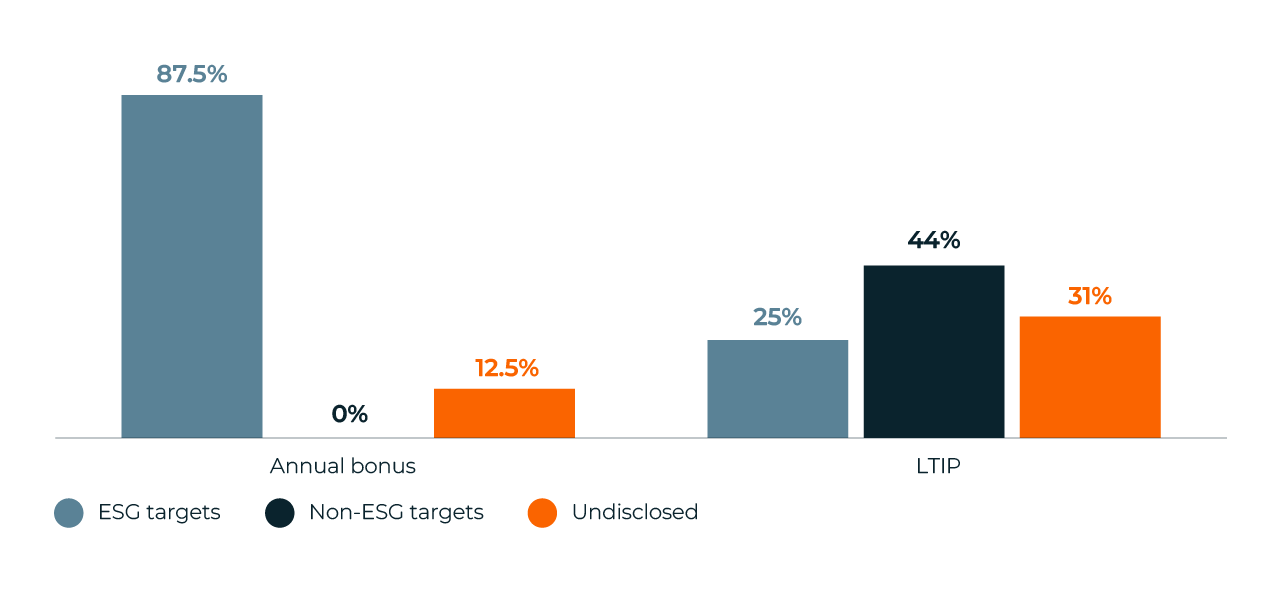

Use of ESG targets in executives’ variable pay

Most PSI issuers require the achievement of ESG targets, amongst other types, to vest their executives' variable pay schemes. In particular, 87.5% of them include ESG targets in short-term annual bonuses, while only 25% of long-term incentive plans include them. Interestingly, LTIPs are not the preferred option to put in pace ESG targets, despite the fact that their forward-looking nature would intuitively flag them as the most suitable schemes for including such targets.

PSI: Use of ESG targets in executie variable pay

The annual bonus is the preferred variable compensation pay element to include ESG targets for Ibex-35 issuers in 2024

Global Proxy Advisors’ behavior

Besides the specific analysis performed in the previous sections regarding the voting recommendations issued by ISS and Glass Lewis on board elections and remuneration-related items, their overall behavior must be considered to understand the type of resolutions in PSI AGMs that these two global proxy advisors have targeted.

The influence of global proxy advisors ISS and Glass Lewis varies significantly due to the differences in their proxy voting policies for Portugal and the manner in which these are applied to PSI proxy season.

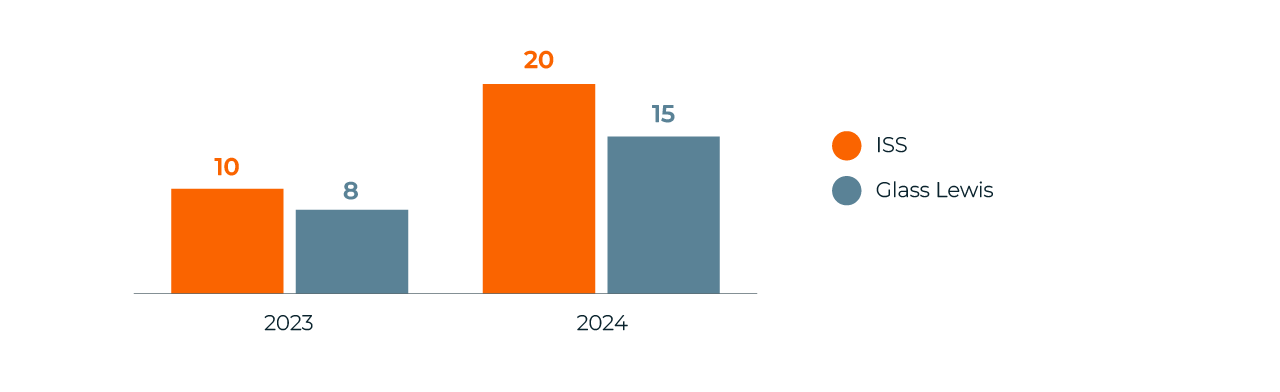

Number of against-voting recommendations

In 2024, both proxy advisors have significantly increased the number of AGAINST vote recommendations regarding 2023. These two stakeholders nearly doubled the issuance of adverse voting recommendations in 2024. This implies a significant detriment in the corporate governance practices of PSI issuers' AGMs.

PSI: AGAINST vote recommendations issued by proxy advisors

In 2024, ISS doubled the number of against-voting recommendations compared with the previous season. Glass Lewis's behavior has been similar, as their adverse vote recommendations increased by 87.5%.

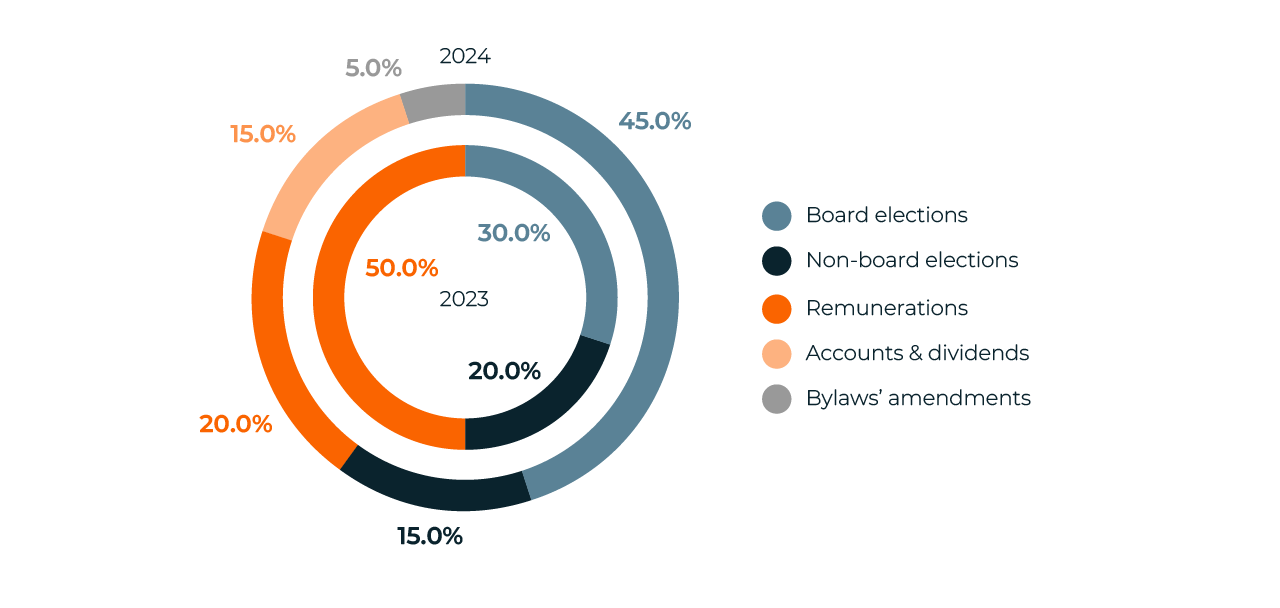

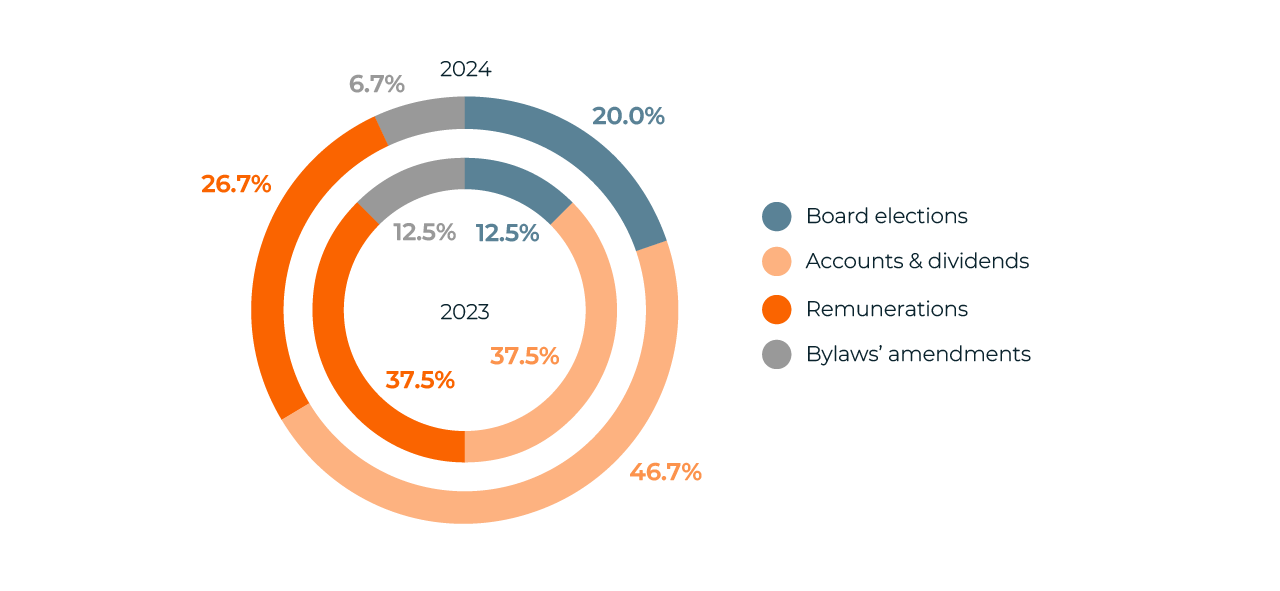

Distribution of AGAINST voting recommendations

Regarding ISS, there was a significant increase in against-voting recommendations that targeted board elections (a yearly increase of 50%), which meant almost half of all adverse recommendations (45%). Remarkably, one-fifth of them targeted resolutions relative to accounts and bylaw amendments for the first time. Positively, the recommendations against remuneration-related items dropped significantly.

ISS: AGAINST vote recommendations in PSI (2024 vs. 2023)

In 2024, ISS shifted the main target of their against-vote recommendations from remuneration-related matters to board elections.

For Glass Lewis, there has been a meaningful increase in the against-vote recommendations targeting the approval of company accounts and board elections, which accounted for nearly two-thirds of all adverse voting recommendations.

Glass Lewis: AGAINST vote recommendations in PSI (2024 vs. 2023)

In 2024, Glass Lewis stopped splitting the focus of the against-vote recommendations amongst accounts and remuneration resolutions to concentrate them in the first instance, which almost accounts for half of all the adverse voting recommendations.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Eduardo Sancho Garcia

Manager – Corporate Governance

Madrid

eduardo.sancho@sodali.com