Subscribe to stay informed, inspired and involved.

The data below shows the evolution of the Ibex-35 2024 proxy season. This time, only 33 issuers were considered as ArcelorMittal and Ferrovial were excluded given their foreign incorporation (which means their AGMs follow other corporate governance regulations and forms that cannot be compared to Spanish practice.)

Attendance formats

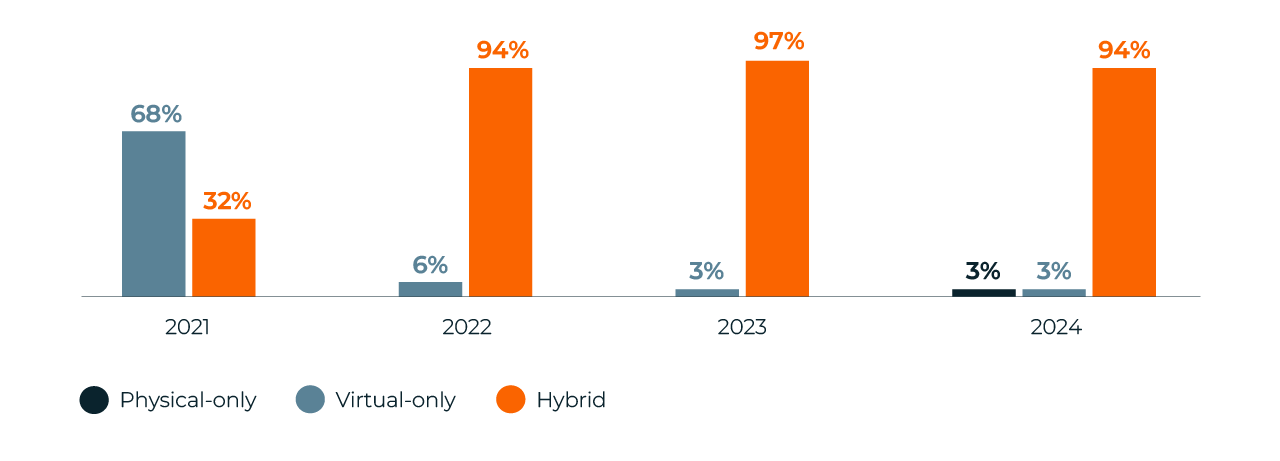

Since the game-changing arrival of virtual attendance at AGMs during the pandemic, Ibex-35 issuers now remain fairly stable regarding the format of their 2024 AGMs.

In fact, in 2024, the vast majority Ibex-35 members opted for hybrid meetings, which account for 94% of the index’s AGMs. Meanwhile, physical-only and virtual-only attendance formats represent the remaining 6% of the meetings (one AGM each).

This confirms a trend that started in 2022, where hybrid AGMs allow shareholders to choose amongst two attendance and voting manners: the traditional physical format (which includes remote voting by post and electronic procedures), or the most recent and technological online live attendance and on-real-time voting.

Ibex-35: Attendance formats

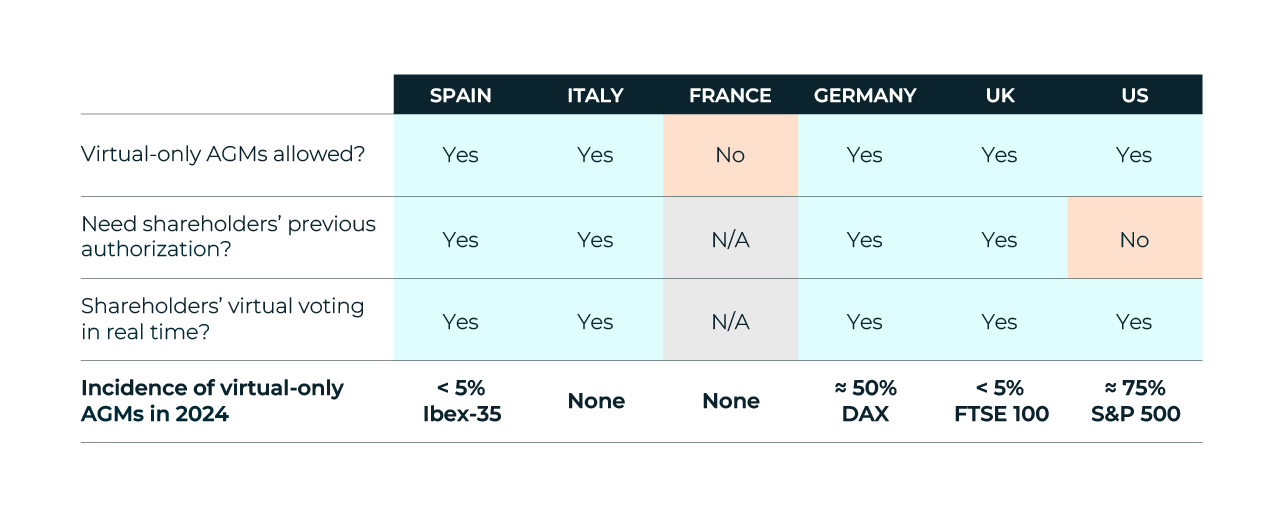

The virtual element of post-pandemic AGMs has had an uneven adoption in the main international markets (see chart below). While some do not allow AGMs to have any virtual component at all (mainly regarding the in-real-time online voting), others allow shareholders’ meetings to be held in a virtual-only format, as long as shareholders had previously authorized it - which is the case of Spain.

Other markets give full powers to the board to convey AGMs under the most convenient format, without asking for shareholders’ permission.

It is worth noting that the authorizations approved by shareholders (in the form of bylaw amendments or specific one-off grants) to enable virtual-only AGMs were passed in the context of the pandemic and under extraordinary circumstances. Some stakeholders have flagged that in 2024 these exceptional circumstances no longer apply and yet some issuers still organized virtual-only AGMs.

Overall, the hybrid format is still perceived as the most inclusive form for shareholders to participate at the AGM, as it allows physical and virtual participation equally.

Participation and Quorum

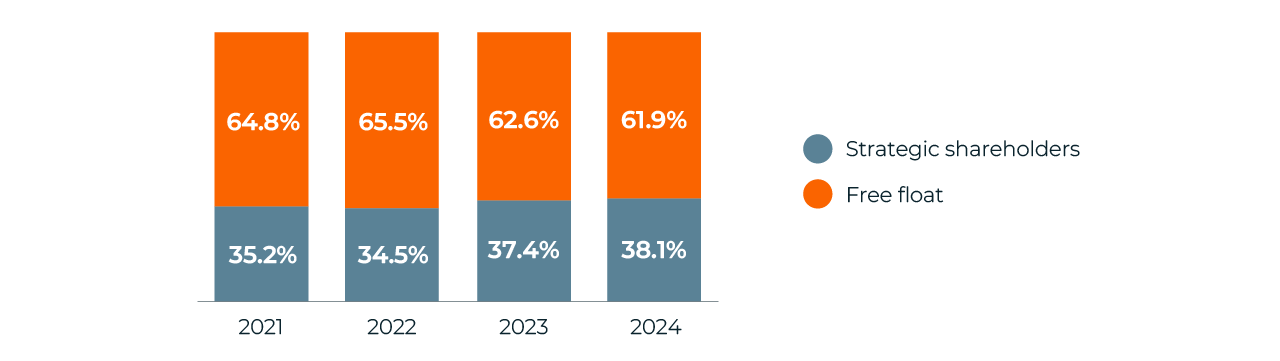

AGM turnout levels are significantly impacted by the issuers’ share capital structure – which is also influenced by the index composition.

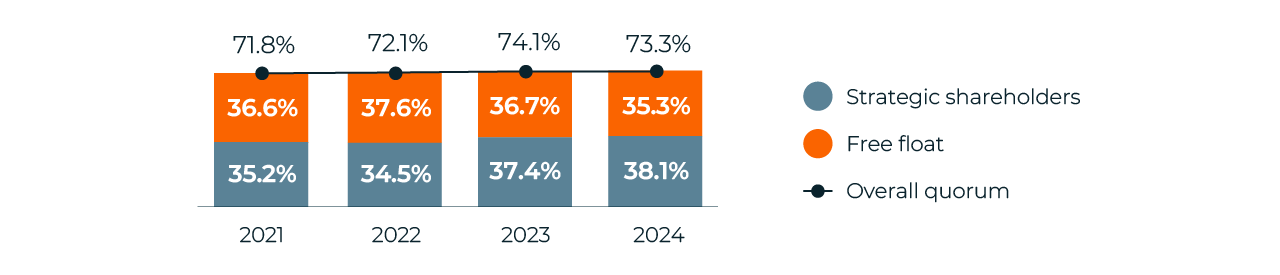

The average quorum remained stable in the Ibex-35 2024 proxy season, although it suffered a slight YoY downturn (73.3% in 2024 vs. 74.1% in 2023). This moderate annual drop seems to correlate with the decrease of the free float participation at the general meetings (in 2024, 48.2% of the average quorum is made up by free float shareholders, which reached 49.5% in 2023). This small drop stems from lower than average presence in the share capital structure of the index (in 2024, 61.9% of the Ibex-35 voting rights are in the hands of the free float, while this level had hit 62.6% in 2023).

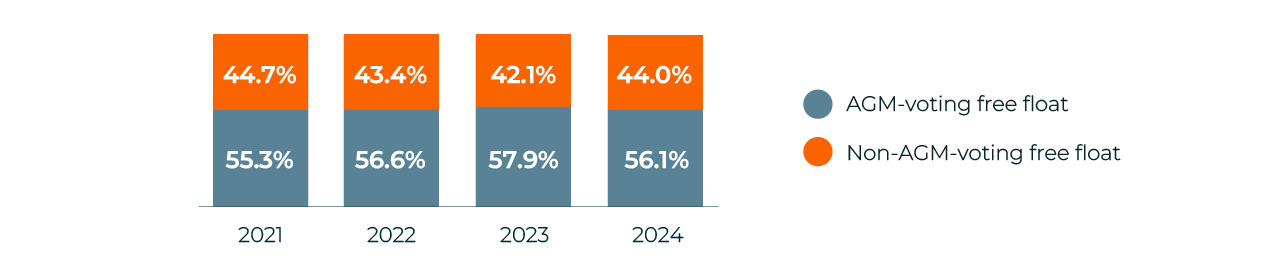

In line with this, free float shareholders seem to be less active than in the past (in 2024, 56.1% of them voted at the AGM, while 57.9% had done so in 2023). Nonetheless, these YoY changes are non-significant as the participation and involvement of free float keeps being crucial for issuers. This is now that proxy advisors and ESG rating agencies are taking a closer look at the free float dissent levels in AGM voting, which is seen as a sign of issuers’ corporate governance health.

Ibex-35: Average share capital breakdown

On average, the Ibex-35 is a free-float index. In 2024, the majority of the voting rights were in the hands of the free float investors -c. 62% on average. Up to four Ibex-35 issuers’ share capital comprise free float investors only, while approximately one-third of them (eight) are fully controlled: at least 50% of the voting rights are managed by a (group of) shareholder(s) acting in concert.

Ibex-35: Average quorum and participation breakdown

The estimated distribution of AGM participation amongst strategic shareholders and free float is close to 50%-50% for the entire data series, although strategic shareholders’ weight is moderately heavier as their stakes in the share capital have also grown in the recent years. On average, 2024 AGM quorum has slightly decreased YoY.

Ibex-35: Free float's average AGM participation

On average, the majority of the free float shareholders participates at Ibex-35 AGMs in the time series - above 55% of them. The index’s lowest free float participation estimation hits 26.6%.

Board Elections

The Spanish market operates one-tiered boards. Insider executives, external independent, and external affiliated directors (primarily proprietary directors representing issuers’ strategic shareholders, but also other external directors who do not fall under any of the remaining categories) co-exist at the board. Nominees are individually elected by shareholders for up to four-year mandates.

Analysis of vote outcomes

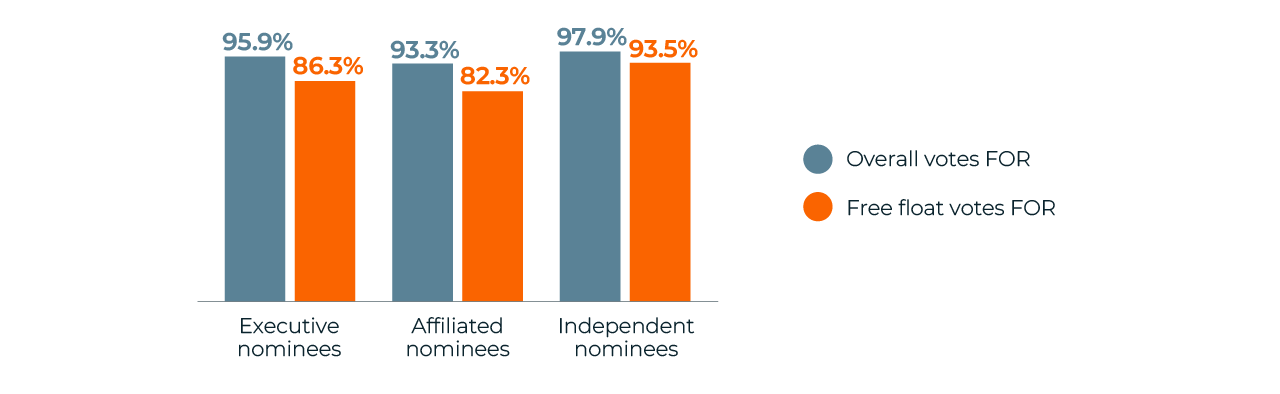

The evaluation of board elections’ approval rates in function of the nominee status has brought diverse results in the 2024 Ibex-35 proxy season. Although in line with those of previous years.

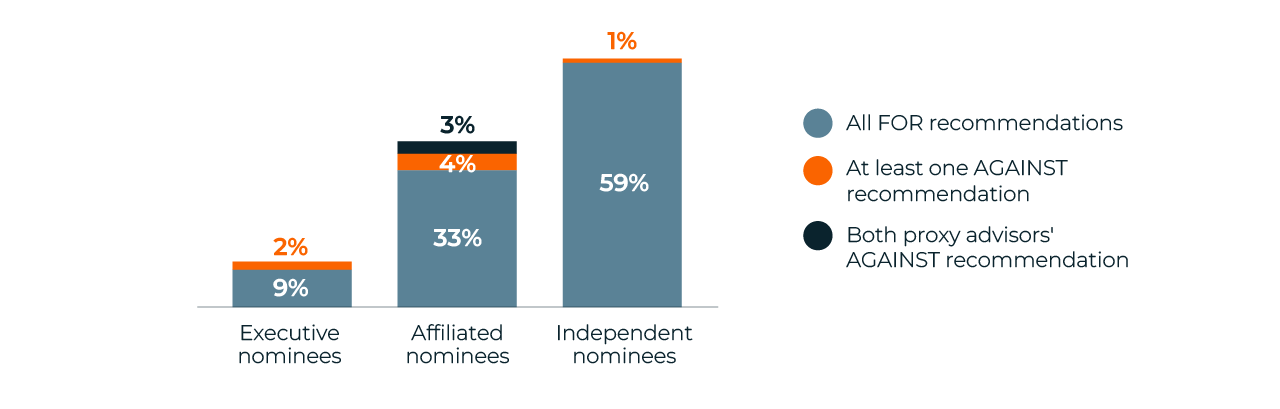

- The election of insider executive directors (11 nominees, 9.9% of total board elections) has been broadly unproblematic. However, in 2024, they received higher adverse voting recommendations than in 2023 (2 vs. 1) and superior dissent levels, too. On average, dissenting votes amounted to 4.02% and an estimation of 13.62% for the free float tranche in 2024 (1.92% and 6.2% respectively in 2023). Looking into individual cases, one of these candidates received the opposition of a significant 21.57% of cast votes, resulting from the allegations of insufficient independence and gender diversity levels at the resulting board. Also, the appointment of another executive nominee under a combined Chair & CEO role was the issue argued by some dissenting shareholders not to support the candidate.

- The election of external affiliated directors (40 nominees, 36% of total board elections) has been the most contentious of all three types, as in past occasions. On average, in 2024 dissenting votes amounted to 6.7% of total cast votes, while the free float tranche estimation hits 17.65%. Nonetheless, both levels are better than in 2023 (7.7% and 20.3% respectively), in line with the lowest incidence of against-voting recommendations (7 vs. 12). Regarding single instances, up to five affiliated nominees received higher dissenting votes than supporting from the estimated free float tranche, which also received overall dissenting levels that exceeded 20%. In these cases, poor board independence and low gender diversity were the rationales for not supporting the candidates.

- Once again, the election of external independent directors (60 nominees, 54.1% of total board elections) was the most well-supported type of election in 2024. This is both in terms of total votes (average votes for reached 97.96%) and the free float tranche (estimated average votes for reached 93.58%). This is an increase compared to 2023 levels (96.9% and 91.1% respectively). This year they received just one opposing voting recommendation by global proxy advisors, while in 2023 they received up to three. The highest dissenting level (14.07% of cast votes) was received by an independent nominee who chaired the Nomination Committee of an Ibex-35 issuer whose board gender diversity had been consistently insufficient for several years (escalation).

Ibex-35: Proxy advisers voting recommendations per nominee type in 2024

In 2024, proxy advisors ISS and Glass Lewis jointly recommended opposing 10 nominees out of a total of 111 candidates on the ballot across the index (8.3%). These levels are less than the 2023 season, when they jointly recommended against 16 nominees out of total 167 candidates (9.6%) - although this season executive nominees were targeted more than in the previous year. Both proxy advisors individually issued fewer adverse recommendations in 2024 than in 2023.

Ibex-35: Support breakdown to board elections in 2024

In 2024, overall the free float tranche approval rates were lower for executive nominees (97.8% and 93.8% respectively in 2023). On the opposite side, both independent and affiliated nominees received higher support levels than in 2023.

Post-AGM Boards

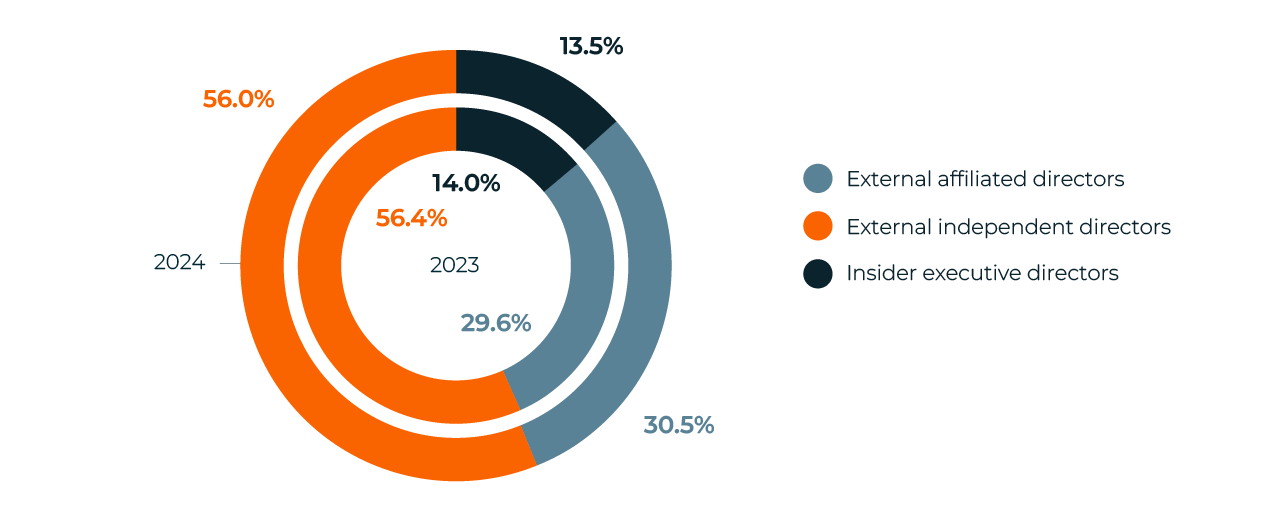

Board Composition

In terms of type of director the average composition of post-AGM Ibex-35 boards in the 2024 proxy season was majority-independent boards (56% of total directors). Affiliated directors accounted for up to 30.5%, while executive directors accounted for the remaining 13.5%.

Ibex-35: Average Post-AGM Board Composition (2024 vs. 2023)

The average post-2024 AGM Ibex-35 board is similar to 2023’s. Both are in line with the average share capital structure of the index, where the free float manages most of the voting rights. In fact, external independent directors implicitly represent minority shareholders.

The average composition does not vary in a meaningful manner when sorted by shareholder basis in 2024. Ibex-35 controlled issuers also tend to form majority-independent boards (50.7% independent), and only three of them have non-majority independent boards.

In the case of all-free float issuers, all of them appoint super-majority independent boards – exceeding two-thirds. The remaining Ibex-35 issuers, also tend to appoint majority-independent boards on average (54.5% independent). The least independent Ibex-35 board only comprises 25% of independent directors, while the most independent reaches 91%.

Board Size

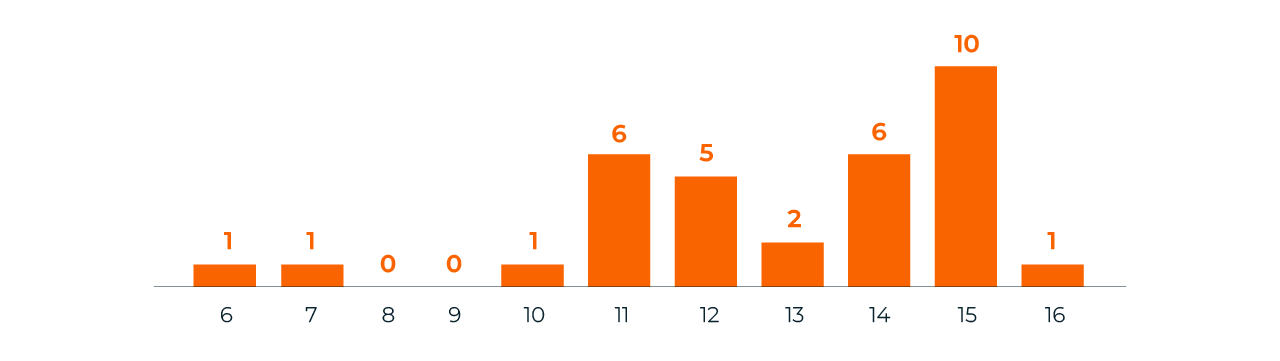

While the local best practice recommends boards include between 5 and 15 directors, the bulk of Ibex-35 boards (91%) include between 10 and 15 directors.

Ibex-35: Board Size

30% of boards include 15 members, which is the fashion for board size in the Ibex-35.

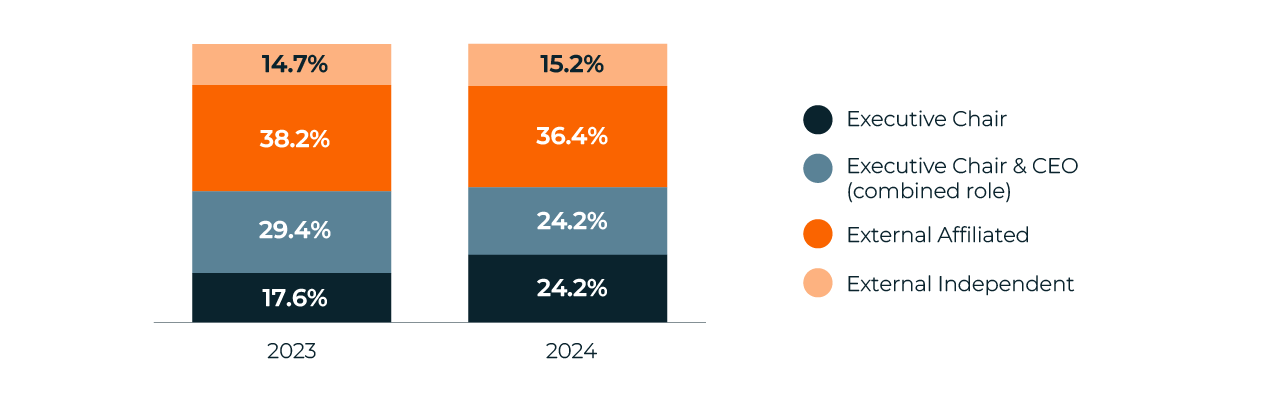

Board Chair

When assessing director classification post-AGM in 2024, the distribution goes against the average board composition. Executive chairpersons predominate (48.4% in total), and external affiliated chairs follow closely (36.4%). Independent chairpersons are a small minority as only 15.2% fall under this director category. This distribution is similar than 2023, and it is worth noting that in 2022, the most common type of chairperson amongst Ibex-35 issuers were affiliated directors (44.1%).

Ibex-35: Classification of Board Chairs

In 2024, the number of executive Chair & CEO joint roles decreased and was equalized by the number of executive chairs (24.2% each).

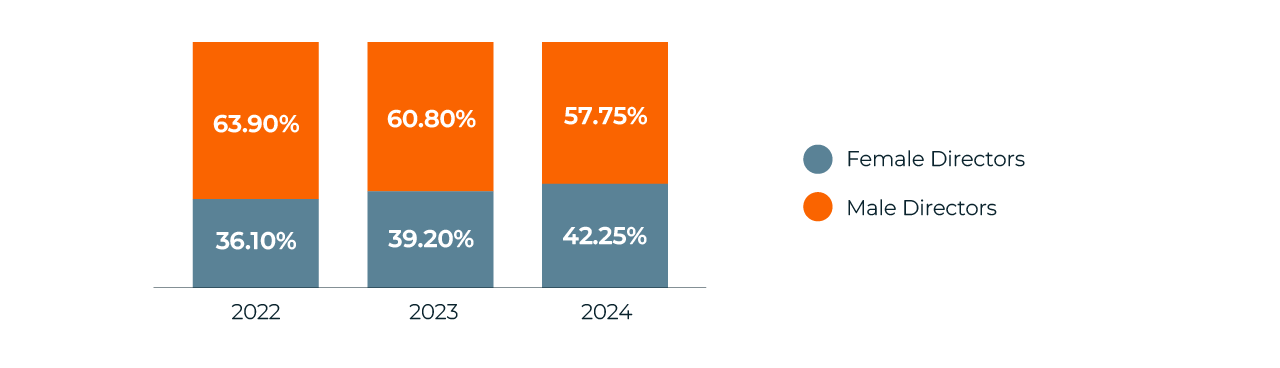

Board Gender Diversity

Under Recommendation 15, the Spanish Corporate Governance Code recommends issuers appoint boards including at least 40% members from the least represented gender by 2022. This soft threshold (which is aligned with the ratios specified in the Directive (EU) 2022/2381 on gender balance amongst directors) has already been transposed into the Spanish regulatory framework as a hard threshold through the Ley Orgánica 2/2024 from August 2.

On average, Ibex-35 issuers did not meet the Code’s recommendation in 2022 or in 2023. But the 40% threshold as an average was finally achieved in the 2024 proxy season. Female directors account for on average 42.25% of Ibex-35 board members, while male directors make up the remaining 57.75%. Up to 75.75% of the Ibex-35 boards meet the 40% threshold, while the rest have yet to reach it. Most fall short of female directors, while only one falls short of male directors.

After the 2024 proxy season, only two Ibex-35 boards have not yet reached the previous 30% threshold for the least represented gender recommended for 2020.

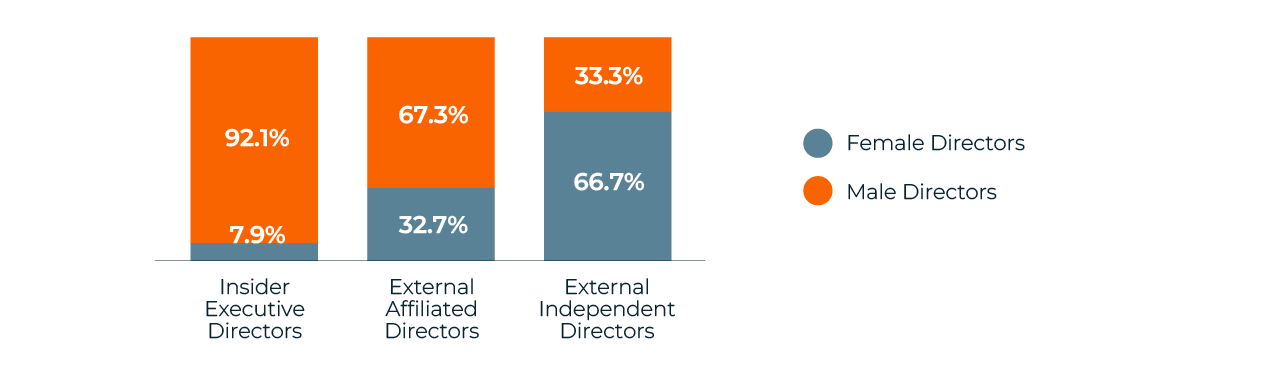

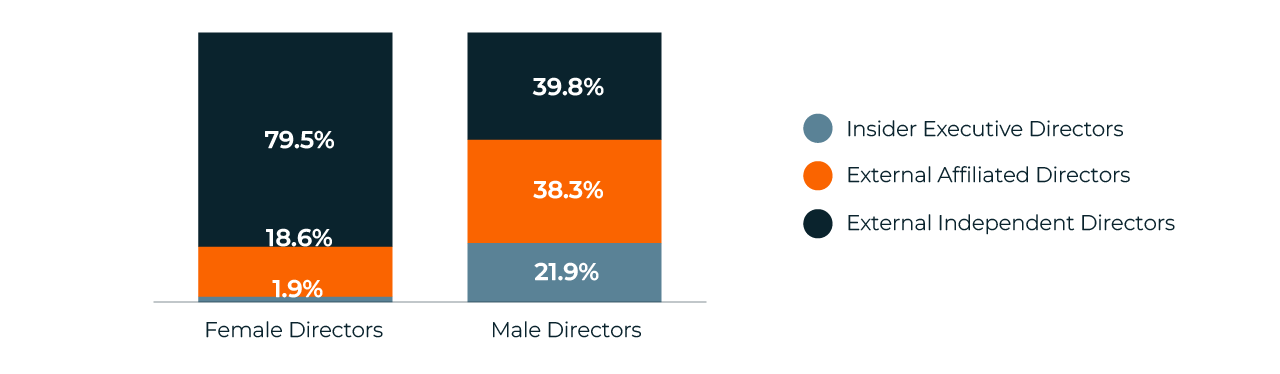

Regarding the director categories under which female candidates are appointed at Ibex-35 boards, it is significant to see that this distribution does not mirror the index’s average board composition.

In fact, 79.5% of the female directors appointed are in an external independent capacity (the majority director category, although it only represents 56.0% of the average board). Of the rest, 18.6% of female directors are appointed as affiliated (the average board would include 30.5% of this director category). In comparison only 1.9% hold executive directorships (which is comprised by the average board by 13.5%).

These levels are similar to those of 2023, proving that board-level executive positions remain out of female directors’ reach. Indeed, amongst the Ibex-35 issuers, only four boards comprise one female executive director. Finally, there are only five Ibex-35 boards chaired by a woman, and only one of them has a female CEO.

Ibex-35: Average Board Gender Diversity

Since 2022, the Ibex-35 has been consistently balanced on board gender diversity. Still, male directors are the majority in the index (57.75%) in 2024.

Ibex-35: Gender Diversity by Director Category

More female directors are serving as external independents than male directors, who tend to hold more directorships as externally affiliated and, specifically, insider executives.

Ibex-35: Distribution of Director Categories by Gender

Executive roles are almost non-existent for female directors (only 1.9% of them hold managerial board posts).

Remuneration

In line with most European markets’ practice, Spanish issuers articulate shareholders’ Say on Pay around two main elements:

- the Remuneration Policy (a forward-looking strategic document that defines the main aspects of board compensation over a three or four-year period); and

- the Annual Remuneration Report (a yearly report that discloses all the details of board payments in the year under review as well as the forecast for the current year).

While the first is sanctioned as binding, the latter is frequently sanctioned in an annual advisory vote – although a few issuers make it binding. Besides these two main compensation resolutions, it is also interesting to review the items that specifically table the approval and amendment of long-term incentive plans for executives, which often are awarded in equity-based prizes.

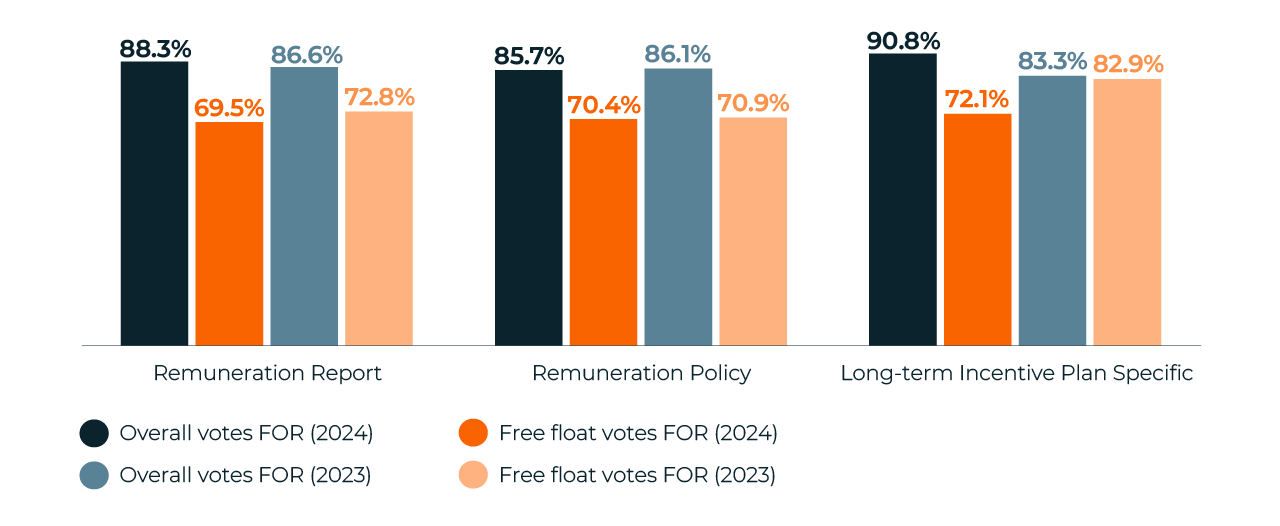

On average, remuneration-related items are the most contested resolutions for Ibex-35 issuers. Once again, proxy season 2024 confirmed this trend.

Analysis of voting outcomes

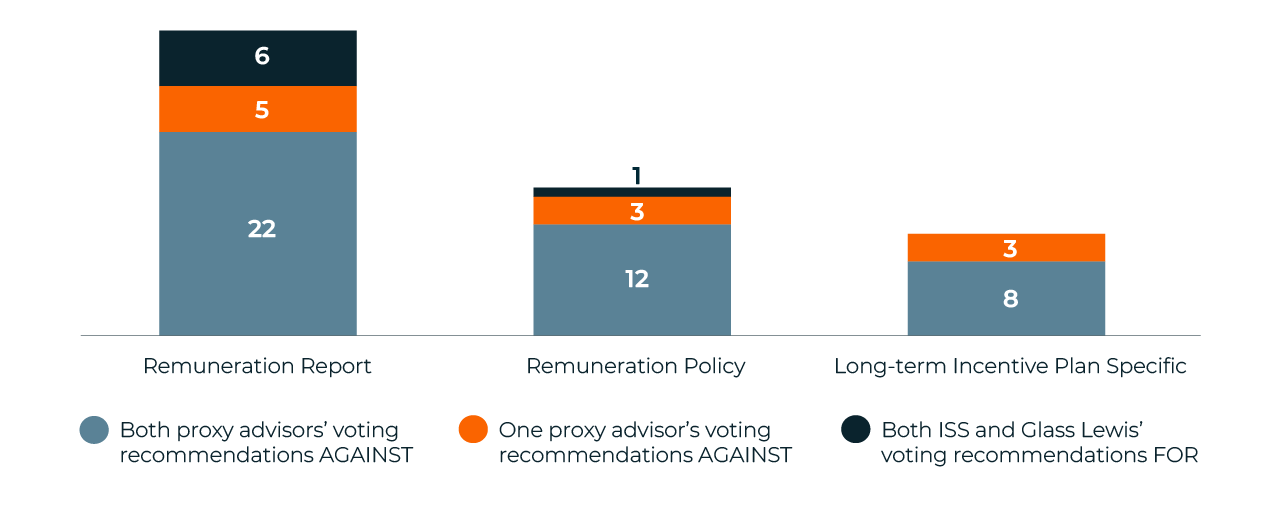

- When assessing the voting outcome of the Annual Remuneration Report (each issuer must submit it to shareholder vote at every AGM), its passing has followed the same controversial line of the previous years. In fact, one-third of these resolutions received an against-voting recommendation from ISS and/or Glass Lewis (versus 20% in 2023), and about one-third of the issuers received above 10% dissent levels of cast votes. Amongst them, two-thirds were dissented by more than 20% of the votes. Looking into individual cases, the most dissented Annual Remuneration Report in 2024 (and third lowest approval ratio amongst all Ibex-35 items) was the advisory approval of an Annual Remuneration Report (59.88% votes for). As usual, stakeholders’ concerns surrounded executive quantum compared to company performance, the disclosure quality of the report, and the use of remuneration schemes that contradict international best practices.

- Remuneration Policy: in 2024, Ibex-35 issuers submitted 16 remuneration policies to shareholder vote. These specific resolutions were the most contested vote in the entire index for the first time. On average, dissenting votes amounted to 14.3% of total cast votes in 2024, while the free float tranche’s estimated average dissent hit 29.6%. Both average levels are worse than those in 2023 (13.7% and 29.1% respectively). This is particularly concerning as it highlights that shareholders seem more demanding than proxy advisers ISS and Glass Lewis - who in 2024 only recommended opposing 25% of the remuneration policies vs. 2023’s 58%. The most dissented Remuneration Policy in 2024 (and the second most opposed resolution of the entire Ibex-35’s proxy season) was a remuneration policy that was passed only for 58.32% of the votes. In this season, 37.5% of the remuneration policies received average dissent levels above 20%.

- In 2024, in the index there were 11 resolutions that tabled the approval of new long-term incentive plans (LTIPs) for executives or the amendment of existing plans. The voting outcome of approval or amendment of LTIPs has been the least controversial type of compensation item on average (90.8% and 72.1% votes for from total votes and from the free float tranche respectively), with unequal outcomes when compared with the 2023 proxy season’s support levels (89.3% and 82.9% respectively). The main complaints from the opposing shareholders are amendments to in-flight LTIPs for the benefit of the beneficiaries, the poor disclosure of performance metrics and targets, and the allotment of shares to beneficiaries that already hold a significant shareholding level of the company equity.

Ibex-35: Proxy advisers voting recommendations per compensation resolution in 2024

Between 37.5% and 25% of these three types of remuneration-related resolutions received adverse voting recommendations from proxy advisors ISS and Glass Lewis.

Ibex-35: Average support breakdown to compensation resolutions

YoY changes vary, although overall, remuneration-related resolutions remain the most contested items in Ibex-35 AGMs in 2024. Remarkably, the voting of the Remuneration Policies became the most opposed type of pay items in terms of average total votes (85.7%) for the first time.

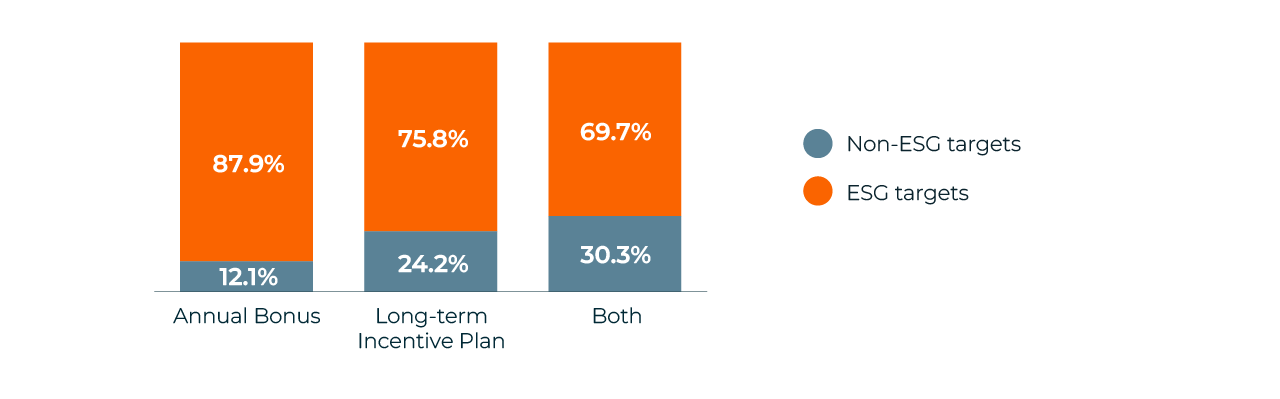

Use of ESG targets in executives’ variable pay

Most Ibex-35 issuers require achievement of ESG targets in order to vest their executives’ variable pay schemes. Sixty-nine percent of them include ESG targets in both short-term and long-term compensation plans, while the annual bonus is the preferred element to include them (87.9%). Interestingly, LTIPs are not the preferred option for ESG targets, despite the fact that their forward-looking nature would intuitively flag them as the most suitable schemes for including such targets. However, almost one-fourth of the issuers do not include them, including issuers that do not operate any LTIP.

Ibex-35: Use of ESG targets in executive variable pay

The annual bonus is the preferred variable compensation pay element to include ESG targets for Ibex-35 issuers in 2024-

Amongst issuers that include ESG metrics in their annual bonus, the average weight of these targets is 15%. In the case of those who use ESG targets in their LTIPs, these metrics are 19% average. It must be noted that some issuers do not disclose a sufficiently precise definition of said metrics, while some others do not clarify their weights.

Proxy Advisors

Beyond the specific analysis performed under Sections 2 and 4 regarding the voting recommendations issued by ISS and Glass Lewis on board elections and remuneration-related items, we have also looked at their overall behavior to understand the type of resolutions targeted by Ibex-35 AGMs.

Number of against-voting recommendations

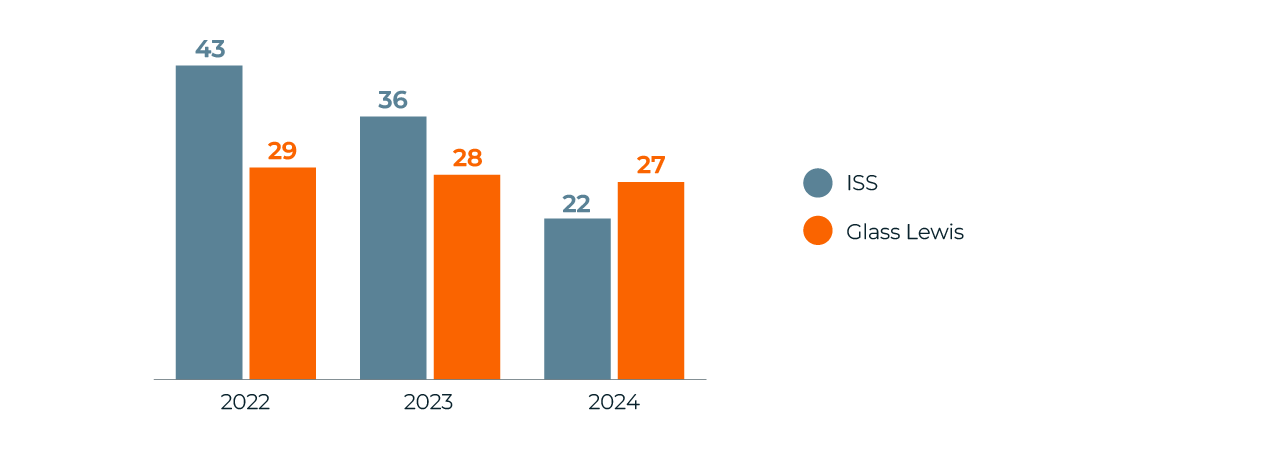

In proxy season 2024, while Glass Lewis’ adverse recommendations remained very stable compared to the previous Ibex-35 proxy seasons, ISS reduced the production of against voting recommendation in a very significant manner (an annual reduction of circa 39%). This is the first time ISS has been more indulgent than Glass Lewis in their voting recommendations (22 vs 27 adverse voting recommendations respectively).

Ibex-35: Number of AGAINST recommendations issued by proxy advisors

ISS has always been stricter than Glass Lewis in the review of Ibex-35 AGMs. In 2024, ISS reduced the number of against voting recommendations significantly, while Glass Lewis remained in line with its approach of the previous years.

Distribution of against-voting recommendations

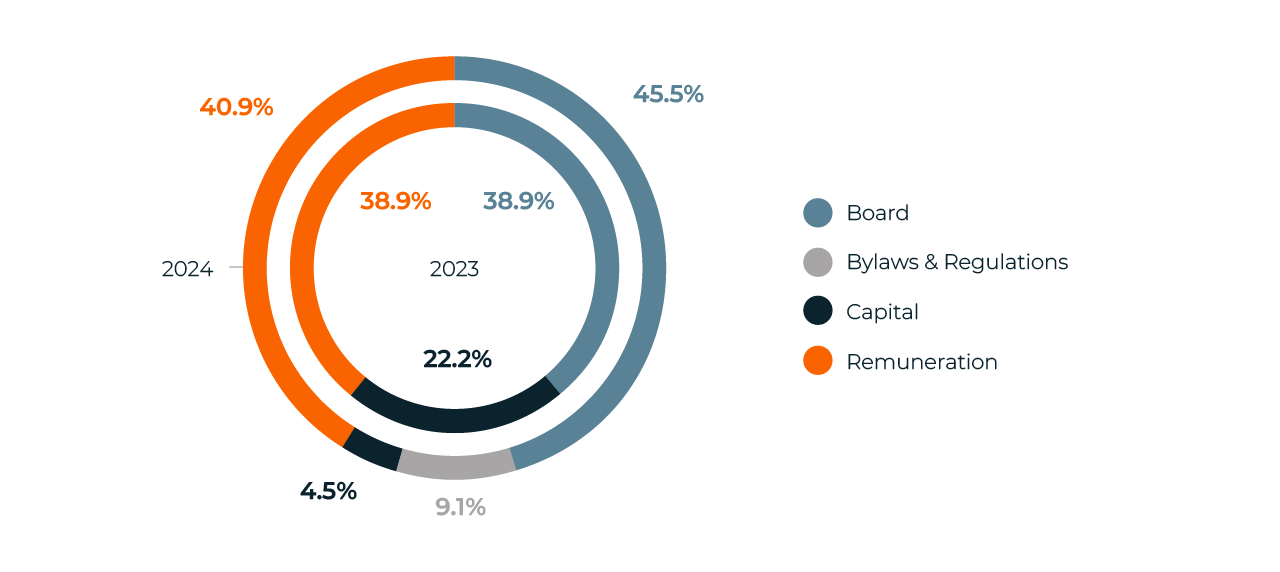

Regarding ISS, while the total number of against-voting recommendations has significantly dropped, their distribution has not changed as significantly. Remarkably, in 2024 ISS has issued fewer adverse recommendations against capital-related resolutions than in 2023.

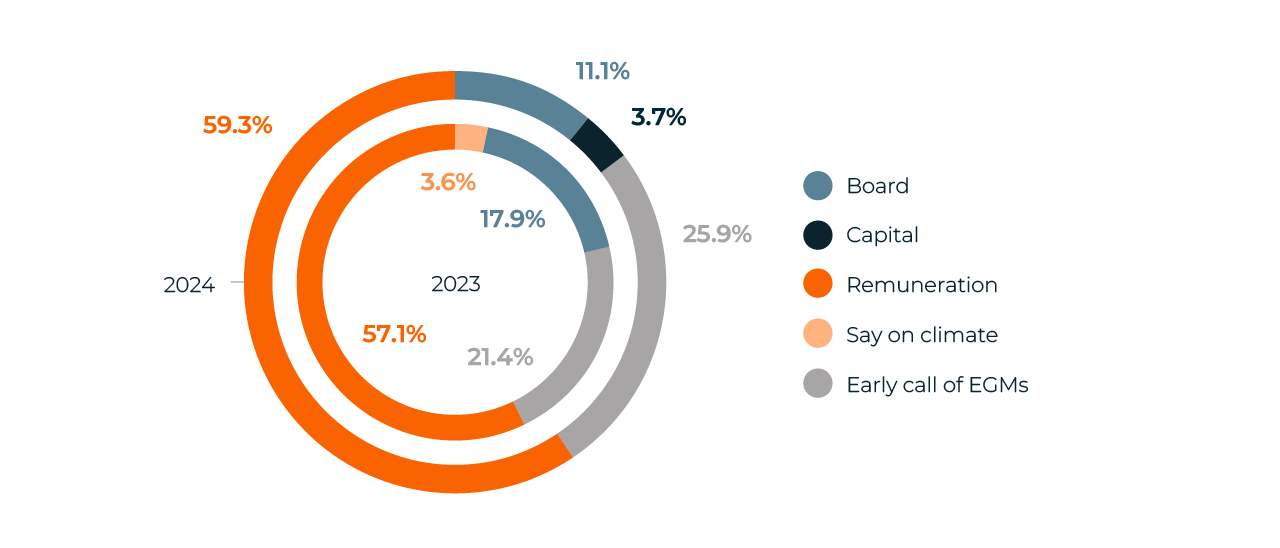

Regarding Glass Lewis, there has not been any meaningful difference in its behavior compared with 2023. Interestingly, Glass Lewis consistently opposes resolutions that seek shareholder approval for the early call of EGMs.

ISS: AGAINST voting recommendations in Ibex-35 (2024 vs. 2023)

ISS keeps concentrating most of its against-voting recommendations on board and remuneration resolutions.

Glass Lewis: AGAINST voting recommendations in Ibex-35 (2024 vs. 2023)

In 2024, Glass Lewis distributed its against-voting recommendation in a similar manner to 2023. The only YoY difference is the opposition to a few capital-related resolutions and the disappearance of its opposition to a few Say on Climate votes.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Eduardo Sancho Garcia

Manager – Corporate Governance

Madrid

eduardo.sancho@sodali.com