Subscribe to stay informed, inspired and involved.

The following analysis covers the published results of the companies included in the SMI 20 (Swiss Market Index) as of September 11, 2024. The main trends for the 2024 SMI annual AGM season were a decrease in AGM participation, shareholder rights (equal voting structures, vote ceilings) remaining a focus of investors, stable support of elections items, remuneration continuing to be the biggest issue, non-financial reporting vote largely uncontroversial, and audit support decreasing on average. Details on each topic are addressed below.

Meeting attendance & quorum

Meeting attendance

Unlike other continental EU markets (e.g., Germanic issuers listed in the DAX), and in line with the 2023 Swiss AGM season, all SMI companies opted to conduct in-person meetings. The topic of virtual meetings is set to remain interesting in European and international markets. However, it is unlikely to be controversial in the Swiss markets. This is because most of the SMI have already asked for such authorization (predominantly for unlimited duration) following the Swiss Code of Obligations reform. This became effective on January 1, 2023, but all have held only physical meetings in the last two years. However, the remaining issuers intending to propose such resolutions would also need to follow the potential development of proxy advisor guidelines closely.

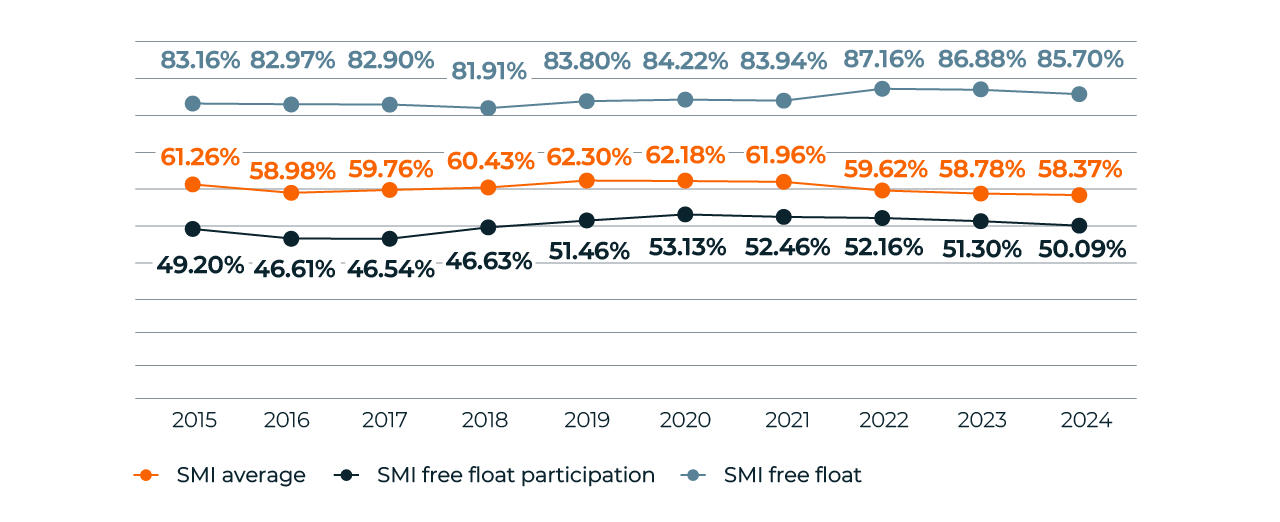

Quorum

Free float participation at SMI issuers’ AGM continued to decline in 2024. In 2023, the reason for the decline was the increase in free float ownership, whereas in 2024, the explanation lay in a temporary share-blocking issue in the custodian chain, which was only solved around mid-April, with the decrease driven by affected free float investors. In addition, the possibility of de-registration of sold shares prior to the AGM and following the registration deadline allowed by some issuers can have a significant and unpredictable impact on participation outcomes. Therefore, consideration of de-registration of shares between registration close and AGM is highly recommended.

2024 marked the first year that an anticipated ISS guideline was applied. This triggered a negative recommendation against directors representing shareholders benefitting from unequal share structures. Where ISS recommended against directors for that reason, the effect on free float support was notable. However, it is less pronounced than other governance issues, such as independence or overboarding. Investors were also more likely to side with proxy advisors against other Swiss market particularities in violation of the one-share-one-vote principles, such as registration or voting rights restrictions.

Lastly, changing articles of association and setting a place of jurisdiction remained a controversial practice for Glass Lewis but were nonetheless largely supported.

Board Elections

Unlike in previous years, there were no controversial discharge proposals in 2024.

For board elections and appointments to chair and committee roles, the average free float support remained stable compared to 2023 (2023: 92.68%; 2024: 93.09%).

So did board-related concerns, which did not register major changes compared to the previous AGM season. Chairs and committee appointments were the items more directly affected by ‘accountability’ votes.

Among individual investors' focus, the most relevant were board and executive diversity, full or majority committee independence, chair independence and lead independent director (LID) role definition, escalation following a vote against remuneration-related proposals, specific expectations on Environmental & Sustainability strategy, oversight and progress, overboarding. In this context, an important consideration is that the concentration of board roles and related accountability can quickly add up to notable vote opposition. However, it should also be mentioned that proxy advisors and investors may support director elections if they have the option to penalize the committee or chair appointment.

Swiss issuers still lag EU countries and the UK regarding gender diversity, where standards are moving towards 40% board gender diversity. Executive diversity, particularly at blue-chip companies, is also a topic of increased investor scrutiny, with board chairs held to account in instances where the nomination and remuneration committees do not overlap. Lack of disclosure of diversity policies, including employees, and related progress has not impacted vote outcomes to date but is captured in Glass Lewis's report. Furthermore, as the relevance of such policies might go beyond voting (e.g., rating), the inclusion of specific targets and timeframe for achievement is recommended, in line with what already happens in other markets (e.g., Germany). Even so, diversity beyond gender remained a marginal concern.

As for board skills, lack of specific competencies had no significant impact, but it is worth noting that proxy advisors (Glass Lewis in particular) and individual investors increasingly scrutinize the definition of expertise of various board members, particularly in the case of lead committee roles (e.g., audit, accounting and financial skills for the audit committee chair). AI and cybersecurity skills (and related board oversight) are also expected to be in focus for investors and Glass Lewis, in particular, between proxy advisors. Companies should, therefore, be prepared to answer questions on skills definition, assignment, and diversity during engagement.

Remuneration

The Swiss structure of remuneration-related votes presents no remuneration policy item and instead consists of binding resolutions on the maximum budgets for boards and executive committees along with an advisory remuneration report proposal. In 2024, all three types of remuneration proposals saw a decrease in free float support, with remuneration report items registering the most significant decline. The reason behind such a decline was mainly market-wide transparency concerns, which had knock-on effects on support of more unconventional pay structures or proposed increases, with one remuneration report proposal failing in 2024. Swiss market practice still has room for improvements compared to international standards, particularly regarding disclosure of performance targets and outcomes, as investors and proxy advisors aim to scrutinize the challenging nature of such criteria and demonstrate pay and performance connection.

Finally, disclosure of average or median employee remuneration remains the exception in Switzerland. Although such issues do not affect proxy advisor recommendations or vote outcomes on a stand-alone basis, a history of disclosure on employee pay development may help support explanations for adjusting executive pay levels.

For executive budgets, breakdowns are expected per remuneration component, particularly in case of increases (or when exceptionally high). The decrease in free float board budget support was primarily driven by one company increasing the director budget without a perceived insufficient rationale. Beyond proxy advisors' guidelines, individual investors closely scrutinized ESG metrics, vesting below the median and LTI vesting in less than five years. All concerns affecting vote outcomes were, to varying degrees, degrees based on the individual company’s shareholder structure.

Sustainability

Auditor elections saw the first ISS against recommendation since 2015 for not disclosing the reasons behind a change in audit company. Notably, that happened despite the lack of any guideline changes. Instead, the explanation could be found in the various auditor controversies occurring at international levels. As for auditor tenure, a mandate above 10 years remained a concern (particularly for individual investors), whereby disclosure of future auditor rotation or details on the tender process can help to improve vote outcomes. Policy surveys recently released in Q3 2024 by ISS and Glass Lewis both queried stakeholders about auditor rotation requirements.

This year's first season with mandatory non-financial report votes saw high levels of free float support (above 90% on average), albeit lower than financial accounts. ISS and Glass Lewis supported all SMI issuers’ resolutions, with ISS’s “flag” for lack of external assurance having no significant impact on vote outcomes (although, given the recent Swiss Council consultation proposing to mandate external assurance for non-financial reports, the issue could no longer exist). Among proxy advisors, Ethos was the most critical in their assessment of inconsistent reporting with website information, target emissions disclosure and verification (scope 3 included), and the presence of credible strategic measures. Ethos also clearly stated a preference for binding votes at the beginning of the AGM season. This did not trigger an against recommendation, but it was nonetheless listed among their concerns for negative recommendations when the advisory nature of the proposal did not represent their only concern. However, a binding feature will become mandatory from next year based on recent Swiss regulations.

We suggest early engagement with proxy advisors and investors to understand how they will assess FY24 climate reports. Also under review will be transition plans following the Ordinance on Climate Disclosure and recent consultation signaling a potential increased alignment with international regulations, namely the EU’s CSRD. So far, only Ethos has outlined a specific preference for the most significant GHG emitters to submit their climate and sustainability reports for approval separately, and only one such company did that in 2024. Note that Say on Climate items are analysed by proxy advisors with different and more detailed approaches compared to non-financial reports. For example, ISS carried out a more technical analysis of the content of the proposal, Glass Lewis focused more on the governance of the vote(including its implications for future engagement), and Ethos investigated the uniformity, transparency, and credibility of each of the various measures included in a company’s climate strategy.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Max Purcell

Director, Corporate Governance