Subscribe to stay informed, inspired and involved.

The following analysis covers the 2024 AGM proxy season across all FTSE 100 issuers, considering the index composition up to September 2024 with an annual meeting date between 1 January and 31 July 2024 (UK 2024 data provided by Diligent).

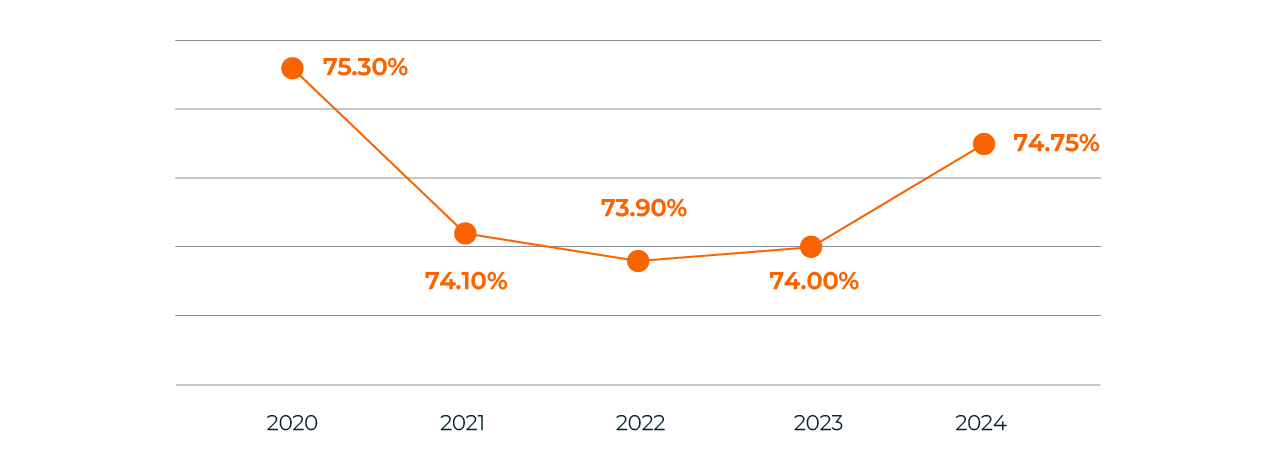

Average Vote Turnout

Although slightly up on 2023, the average 2024 turnout retained its level of approximately 74% for the fourth year.

Physical/Hybrid

As of April 2024, 60% of FTSE 350 companies who issued their AGM notices had opted for an entirely physical meeting without any form of electronic engagement. Hybrid meetings were the next most common form (22%). Entirely virtual meetings were rare, with only one company choosing to adopt this option. White & Case noted “a new trend” for ‘digitally-enabled AGMs’ held under ‘studio conditions’, where meetings are held at a physical place, but shareholders are strongly ‘advised to’ attend remotely.

In early July this year, the Financial Conduct Authority (FCA) announced an overhaul of the process for companies wanting to list on the London Stock Exchange, calling them “the biggest changes to the regime in over three decades.” Listing rules will change from 29 July 2024, aiming to attract more companies amid declining IPOs. Key changes include:

- Simplified listing process

- Single ‘commercial’ category replacing ‘premium’ and ‘standard’ listings

- Reduced shareholder voting requirements

Whilst these reforms align the UK market more closely with our European and US counterparts, aiming to address the 40% decline in UK-listed companies since 2008, in the context of this review, the removal of shareholder votes for significant company transactions is concerning.

The Companies Act 2006 mandates directors to act in the best interests of all members, and voting rights are crucial for this. Without investor input, directors cannot fully understand members’ interests. Voting rights allow investors to hold management accountable and prevent unchecked powers, reducing the risk of corporate scandals.

Average turnout

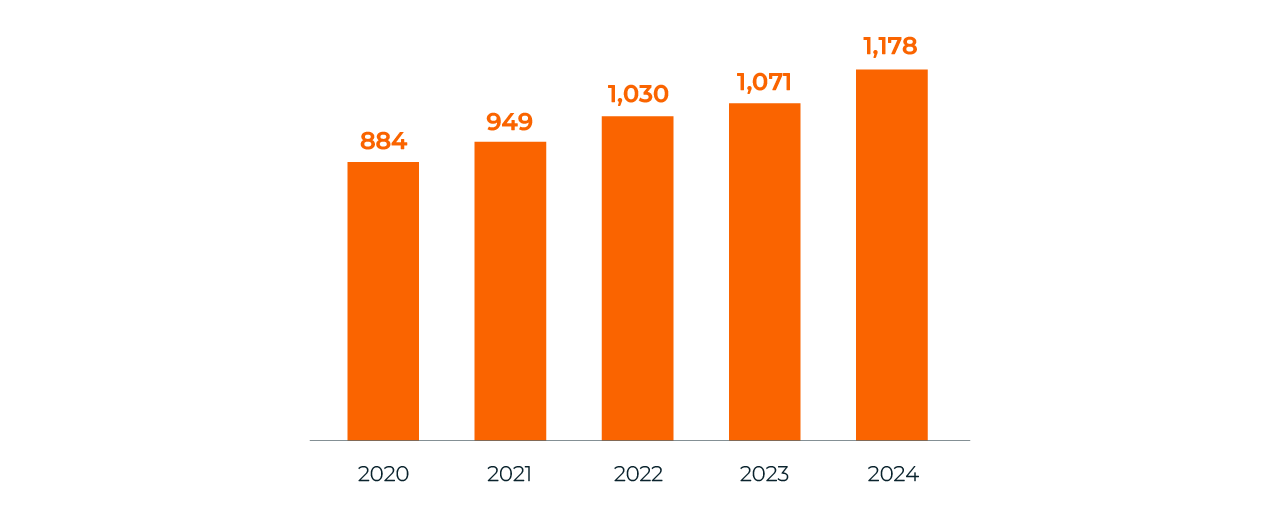

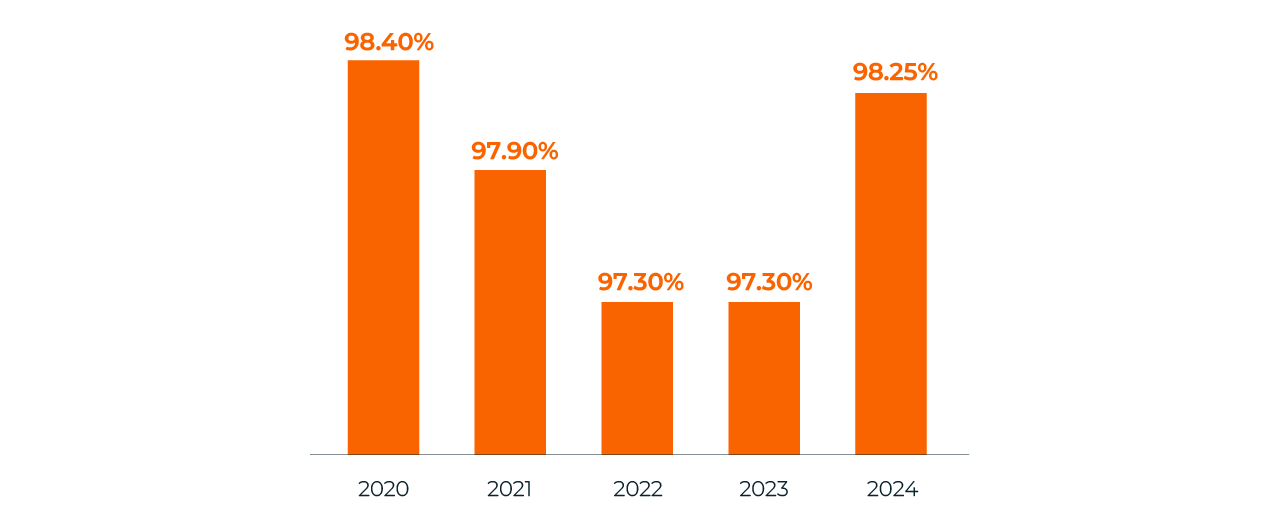

Board Elections

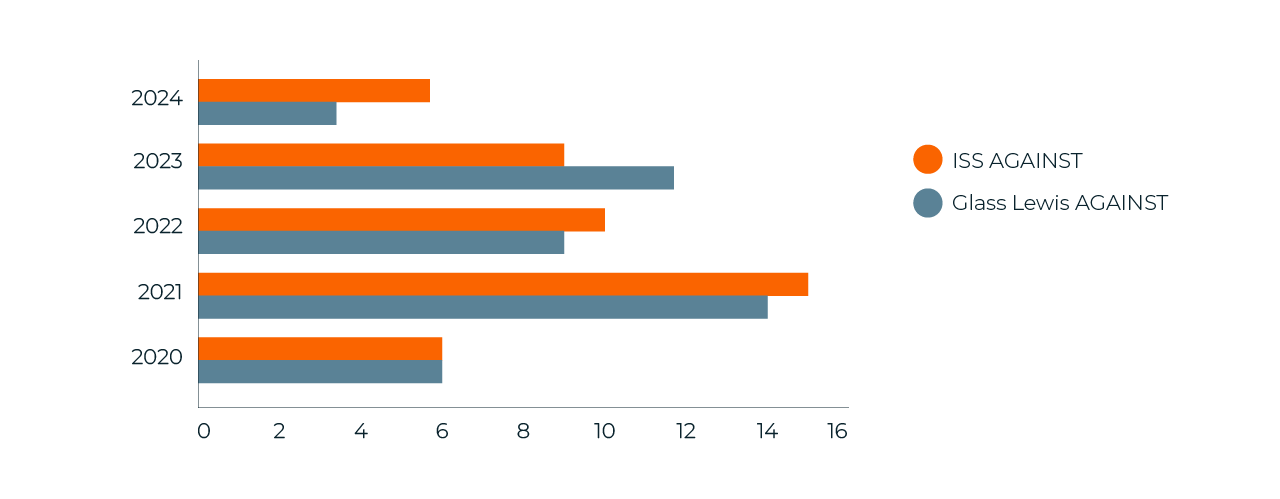

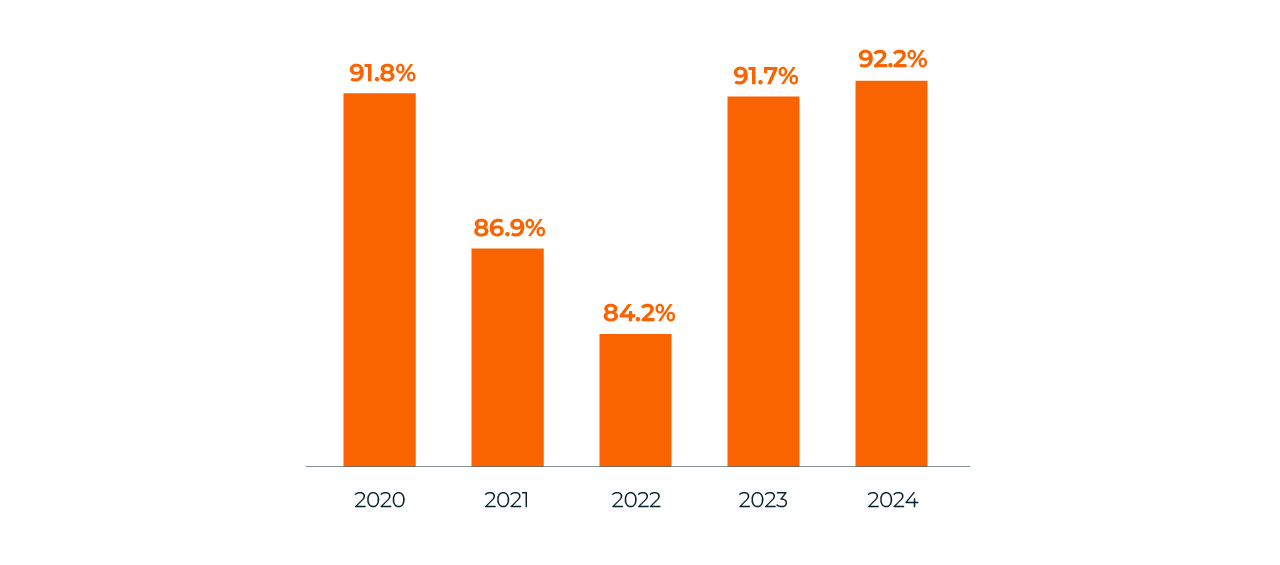

The number of Board election proposals has been steadily increasing, perhaps indicative of enlarging boards adopting broader skillsets to cover increasing oversight requirements. 2024 also saw a higher rate of approval for director elections.

Director Election Resolution Numbers

Director Election Approval Rates

Remuneration Items

In the UK, issuers articulate their remuneration structure and disclosure via two elements that are voted on at the AGM: i) the Remuneration Policy, a forward-looking strategic document that sets the main features of the compensation system of the board for a three-year period (unless updates within a three year period are otherwise sought); and ii) the Remuneration Report, an annual document that discloses all the details surrounding the amounts paid to the board in the year under review. Resolutions proposing Policy are binding, while the Report is subject to an advisory vote. Key trends in 2024 comprise evolving approaches to Environmental, Social, and Governance (ESG) metrics, increases in incentive opportunities, and new long-term incentive (LTI) plan designs.

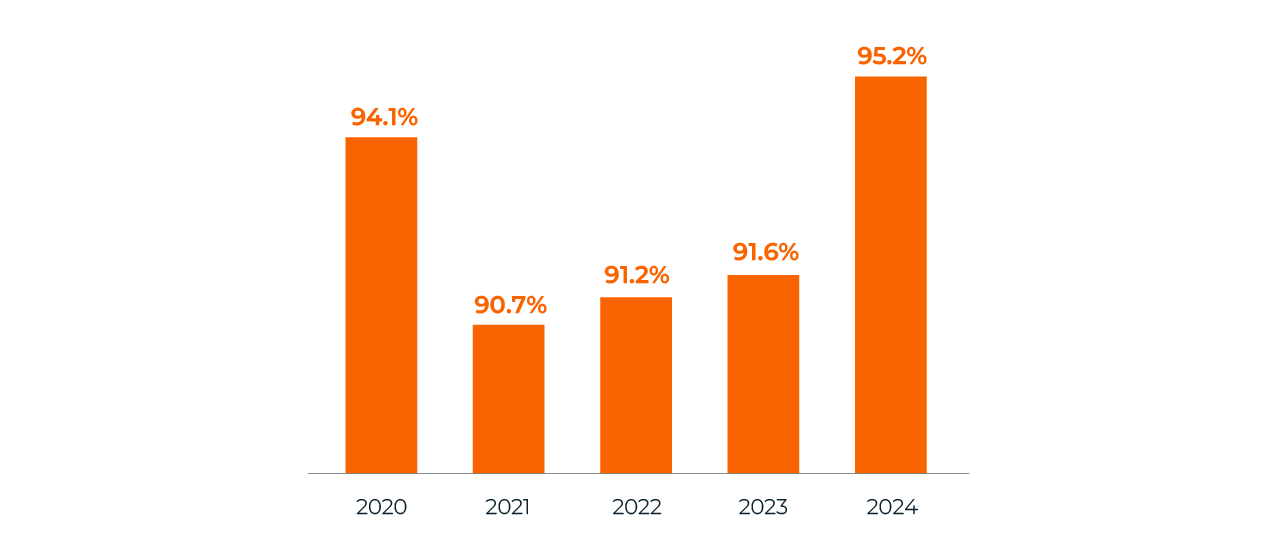

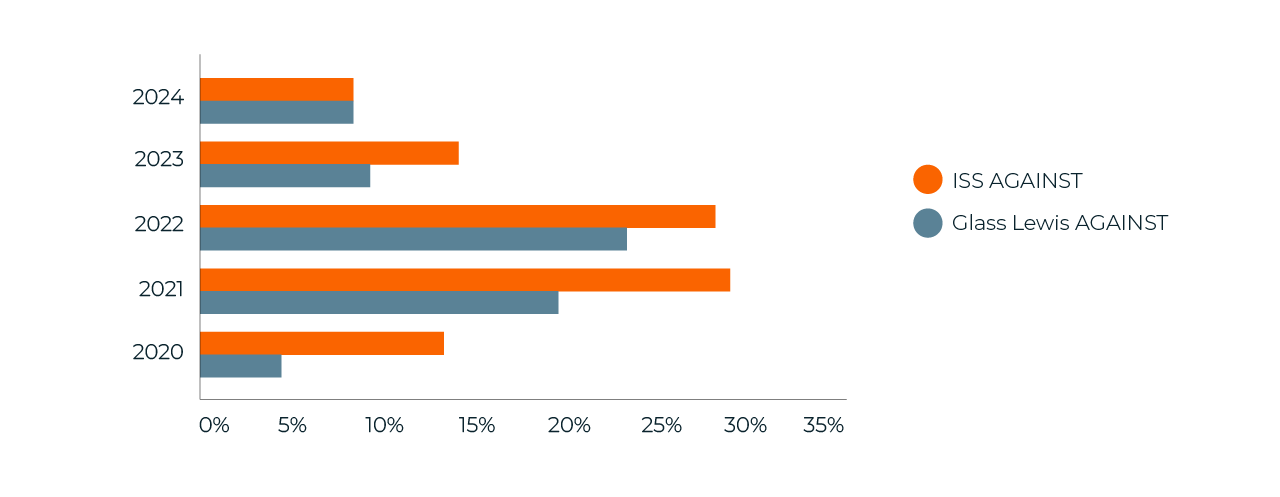

The Remuneration Report

Support levels have seen marginal improvements year on year. This represents a shift in investor perceptions of the application of remuneration policies. Further, it may indicate a willingness to support higher pay for successful performance, aligned with the market competitiveness discourse that has dominated the UK market in recent times. For companies that received material votes against (>10%), ESG metrics in variable remuneration continued to be a key focus for stakeholders, as did pay for performance concerns. The cost of living in the UK continues to be a focus for key stakeholders as well, with stakeholders focused on ensuring workforce pension levels are aligned with market peers whilst also closely monitoring and criticizing excessive CEO-employee pay ratios.

Average Support Level for Rem Report

Proxy Adviser Evolution on Rem Report

The Remuneration Policy

Following 2023, which is considered an ‘on-cycle’ year for remuneration policy updates, there was a drop in the number of remuneration policies up for approval at AGMs in 2024. Given it is an off-cycle year, it is not unusual to see fewer policies up for approval, whilst overall support remained relatively stable from 2023 to 2024. The key themes that arose where significant votes (>10% against) were received against remuneration policies were: pay for performance misalignment, excessive variable remuneration opportunities, unjustified increases to quantum, lack of ESG metrics in variable remuneration, and the introduction of a hybrid structured LTI award where the changes were deemed excessive.

The increase to the existing Performance Share Plan and the introduction of a Restricted Share Plan are not supported. The CEO’s total potential variable remuneration can exceed 150% of base salary for the STI. Buy-out awards are possible, with the Remuneration Committee aiming to structure them similarly to forfeited awards. Awards under the RSP are not subject to performance conditions.

Average Support Level for Rem Report

Proxy Adviser Evolution on Rem Report

Issue of Equity without Pre-emptive Rights

Authorities to issue shares with pre-emptive rights require a simple majority (ordinary resolutions), while those without pre-emptive rights need 75% approval (special resolutions). Institutional investors and proxy advisors often refer to the Pre-emption Group’s Statement of Principles, updated in November 2022, which allows non-pre-emptive issuances up to 20% of share capital, with 10% reserved for acquisitions or capital investments. This additional 10% should be in a separate resolution, leading companies to propose two resolutions at AGMs:

- Authorise Issue of Equity without Pre-emptive Rights

- Authorise Issue of Equity without Pre-emptive Rights for Acquisitions or Capital Investments

Of 160 such proposals reviewed, all passed with an average approval rate of 94.49%.**UK 2024 data provided by ISS

Climate Transition Plans

Two such Management proposals were put to approval in the period under review:

- National Grid Plc – Passed at 99% with no issues

- Glencore Plc – The proposal passed with 90.1% approval despite ISS recommending an abstention. Concerns included:

- Difficulty aligning the company’s coal activities with Paris goals.

- Lack of adherence to any specific net-zero scenarios.

- Discontinuation of the coal production cap from 2021.

- One investor welcomed increased climate transparency but worried that standalone climate strategy votes may reduce board accountability. They prefer targeted engagement and conventional resolutions for high emitters and climate laggards, hence their abstention.

- Another investor acknowledged Glencore’s progress in emissions reduction and disclosure but questioned the impact of coal investments and reduction ambitions. They did not support the current plan and sought further clarity.

Concluding Remarks

For the FTSE 100, the season looks to have been a stabilising one, and free from the notion of any major retail-shareholder spring. Support levels for the critical areas of Director Elections and Remuneration showed an increase.

In 2024, contested share issuance authorities in the UK rose to 16.0%, driven by companies following Pre-Emption Group guidance, allowing share issuances without pre-emptive rights up to 20% of issued share capital. Despite compliance with the Group’s principles, some institutional investors have opposed these authorities in the last couple of seasons.

The FCA review to propose the removal of shareholder votes for significant company transactions is concerning. Any General Meetings should be pivotal touchpoints for companies to effectively engage with their shareholders on significant matters, especially financially impactful transactions. Disenfranchising the vote on such matters looks like a backward step in the world of shareholder rights. The changes to listing rules are very much aimed at satisfying companies rather than shareholders. The reality is that listing will become easier for companies but with diminished shareholder rights.

Download your copy of the 2024 European Proxy Season Review

Summary

Every year our teams of experts across Europe analyze the latest proxy season to identify trends and insights around meeting attendance, board composition, gender diversity, remuneration, climate and ESG matters. You can find other articles from across Europe here.

Author

Jonathan Harker

Senior Director