Subscribe to stay informed, inspired and involved.

Corporate governance is the system of rules and practices that reflects how a company is managed and controlled. Numerous studies show that good corporate governance increases a company’s performance and makes it more attractive to investors.

Good corporate governance is an essential foundation for businesses today as investors have grown to expect deliverables beyond profits when considering which companies to support financially.

The ASX Corporate Governance Council’s (the Council) Corporate Governance Principles and Recommendations (CGPR) state that: “The board performs a pivotal role in the governance framework of a listed entity. It is essential that the board has in place a proper process for regularly reviewing, preferably annually, the performance of the board, its committees and individual directors. Particular attention should be paid to addressing issues that may emerge from that review, such as the currency of a director’s knowledge and skills or if a director’s performance has been impacted by other commitments.”1

Structure the board to be effective and add value

Recommendation 1.6 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations states that: “A listed entity should:

- a) have and disclose a process for periodically evaluating the performance of the board, its committees and individual directors; and

- b) disclose for each reporting period whether a performance evaluation has been undertaken in accordance with that process during or in respect of that period.”2

The Council recommends that “the board should consider periodically using external facilitators to conduct its performance reviews.”3

What makes a board effective?

There are many factors that influence whether a board is effective including:

- its composition and collective skills, experience and perspectives of the board members;

- the performance of and relations between individual members;

- the frequency and format of its meetings and how the agenda is managed; and

- the quality of the information and support it receives to name just a few.

Regular board effectiveness reviews can help the board continuously improve its own performance and, as a consequence, the performance of the organisation. While the board needs to lead the process and take responsibility for addressing any areas where there is room for improvement, engaging an independent reviewer can bring greater objectivity and fresh insights to the process.

It is widely regarded as good practice for companies to undertake externally facilitated board evaluations or reviews on a regular basis, and in many countries, it is now either mandatory or recommended practice for them to do so (for example, in national corporate governance codes). Typically, the recommendation is that this should be done every three years, and this has become the accepted timeframe for the practice in Australia.

In New Zealand, the NZX Corporate Governance Code states that: “The Board should have a procedure to regularly assess director, board and committee performance”.4

In June 2022, the NZ Government set out its expectations for the Reserve Bank of New Zealand for 2022/23 regarding Board evaluations and strengthening the director pipeline. The Government said: “Performance evaluations help boards to improve performance and contribute to the Treasury’s advice to Ministers on board composition. I expect that evaluations will take place annually, once the new board has been in place for a year and should ideally be conducted by an independent evaluator. Along with skills matrices, evaluations contribute to the Treasury’s advice to Ministers on board composition and so should be shared with the Treasury. In addition, we have a general expectation that you will engage a ‘Future Director’ as an observer of the board, where possible, to grow the pipeline of new and diverse director talent.5

The Morrow Sodali team has extensive experience in conducting externally facilitated reviews and supporting boards to conduct their own reviews across many sectors and many countries. Our broad reviews are designed to evaluate the performance of a company’s board of directors, identify areas for improvement, and enhance the overall effectiveness of the board. A comprehensive board effectiveness review can help boards improve their decision-making processes, strengthen board composition, and enhance board dynamics.

We offer both external and self-supported evaluations including an evaluation of the board structure, processes, and performance, to ensure that the board is fulfilling its responsibilities and delivering value to the company. We also assist clients with the development of their own board self-assessment methodologies and the conduct of individual director evaluation exercises.

Morrow Sodali has the skills and experience necessary to facilitate board reviews effectively and has developed a toolkit that can be tailored to meet the specific needs of a company’s board in consultation with the client. This includes BoardMirror®, our secure and user-friendly online survey tool, that can be set up to provide a cost-efficient mechanism for supporting a board’s own self-evaluation exercise.

The scope of a typical board review covers the constitutive elements of an effective Board. The scope can generally be grouped into seven thematic areas:

Role of the Board

- Understanding of its role

- Strategy setting and oversight

- Risk governance

- Audit, controls, and financial reporting

- Strategic HR and remuneration.

Board Composition

- Knowledge, skills, and experience;

- Diversity

- Independence.

Board Functioning and Dynamics

- Board dynamics

- Role of the Chair

Information Flows and Board Materials

- Reporting to the Board

- Board packs and agendas.

Relationship with Management

- Communication

- Trust

- Constructiveness

Board Processes and Support

- Administrative support;

- Board processes

Board Committees

- Board’s view on committee effectiveness;

- Committees’ internal views on their own functioning.

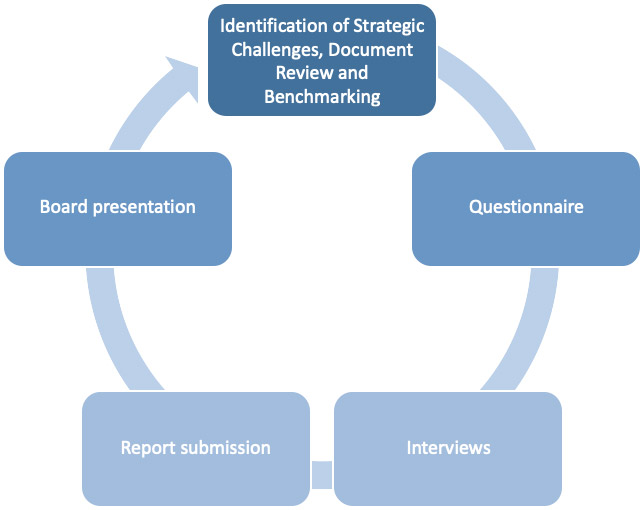

A Morrow Sodali board review follows a structured methodology:

The process starts with the identification of the company’s strategic challenges as part of a briefing with client which establishes context for the review. We then move into reviewing key governance documentation, including the Board and Committee charters and a sample of board packs from previous years. Following the review, we benchmark the client’s Board on select data points against the practices of an agreed set of peers. Insights from the benchmarking are included throughout the final Report and we can include insights from some of the large, global asset managers considered to be leaders in corporate governance best practice.

In the Questionnaire phase, we ask all Board members to complete a comprehensive questionnaire, that is agreed in advance with the client. The questions would potentially consider any pre-existing self-evaluation questionnaire that the client has been using.

The multiple-choice questionnaire provides respondents with the opportunity to submit comments after each question. A final section of the questionnaire includes free text questions in which respondents can share their views on the main areas for Board improvement and make relevant recommendations for addressing these. These comments, together with insights from the interviews, provide the primary basis for recommendations in a Report, supplemented by our understanding of best practice as relevant to the client.

Individual interviews are also undertaken with Directors and, depending on the scope, with representatives of the management team.

The various steps are then brought together in the form of a Report which presents our findings relating to the key strengths, areas of improvement, and recommendations in these areas. With the view of improving Board effectiveness, the Report emphasises the areas of improvement.

Finally, the Report is presented to the Board, providing an opportunity for discussion and questions. This is an important phase as it provides Directors with an opportunity to examine the methodology and for findings to be debated.

Combined, these various elements result in an in-depth analysis of the board’s effectiveness, encompassing board competencies, functioning, structure and support, as well as its behavioural traits, and a discussion of the key findings and recommendations with the board in a workshop setting. We also make ourselves available to help with relevant disclosures and the development of an action plan, as needed.

1. ASX Corporate Governance Council, 2019, Corporate Governance Principles and Recommendations, 4th edition, February, https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-recommendations-fourth-edn.pdf, (accessed 8 May 2019).

2. ASX Corporate Governance Council, 2019, Corporate Governance Principles and Recommendations, 4th edition, February, https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-recommendations-fourth-edn.pdf, (accessed 8 May 2019).

3. ASX Corporate Governance Council, 2019, Corporate Governance Principles and Recommendations, 4th edition, February, https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-recommendations-fourth-edn.pdf, (accessed 8 May 2019).

4. NZX Corporate Governance Code – 1 April 2023

5. Letter from the Hon Grant Robertson, Deputy Prime Minister of New Zaland to Prof Neil Quigley, Chair, Transition Board, Reserve Bank of New Zealand, 29 March 2022.