Subscribe to stay informed, inspired and involved.

Institutional Investors with assets under management of USD 33 trillion continue to want more information from portfolio companies about board composition and business strategy and sustainability related topics, according to Morrow Sodali’s annual Institutional Investor Survey, released today. The survey highlights several areas of concern for investors looking ahead to voting proxies at 2019 annual shareholder meetings:

- Clear articulation of a company’s business strategy and goals;

- Directors’ skills, qualifications, experience and individual contribution to the effectiveness of the board;

- Detailed business rationale for board decisions and their alignment with strategy and financial performance;

- Climate change, the leading sustainability risk factor.

The Morrow Sodali survey, the fourth of its kind, was conducted in December 2018. Forty-six global Institutional Investors, with USD 33 trillion of assets under management, responded to the survey.

Survey respondents also indicated that:

- The quality of governance policies and practices still plays a pivotal role when investors make voting decisions;

- Investors are concerned that quarterly reporting can promote short-term behaviour by companies and investors, and, further, that quarterly reporting can lead to excessive reliance on earnings guidance;

- Investors will increase their focus on board composition and accountability;

- Companies can expect more focus on disclosure and increased dialogue around climate change strategy;

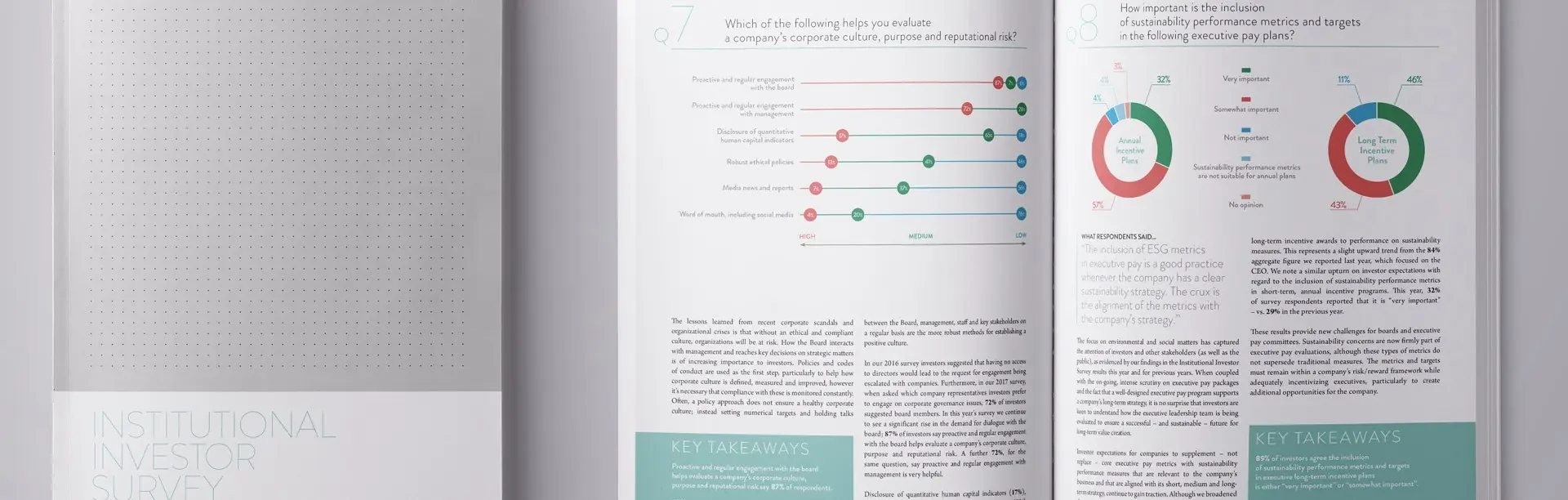

- Executive pay may be the subject of collective engagement efforts by institutions during the Annual General Meeting season;

- Activist campaigns with a credible story focused on long-term strategy are likely to gain investor support when companies have an unclear business strategy.

Kiran Vasantham, Director of Investor Engagement, said: “This survey provides issuers with valuable insights on investor expectations and voting policies. It is a bellwether for all companies as we enter the 2019 Annual Shareholder Meeting season. I am delighted so many investors took part in the survey, as it provides an important overview of asset managers’ priorities on a broad spectrum of ESG issues.”

Summary

Author