Subscribe to stay informed, inspired and involved.

Sign up with your email

chevron_right

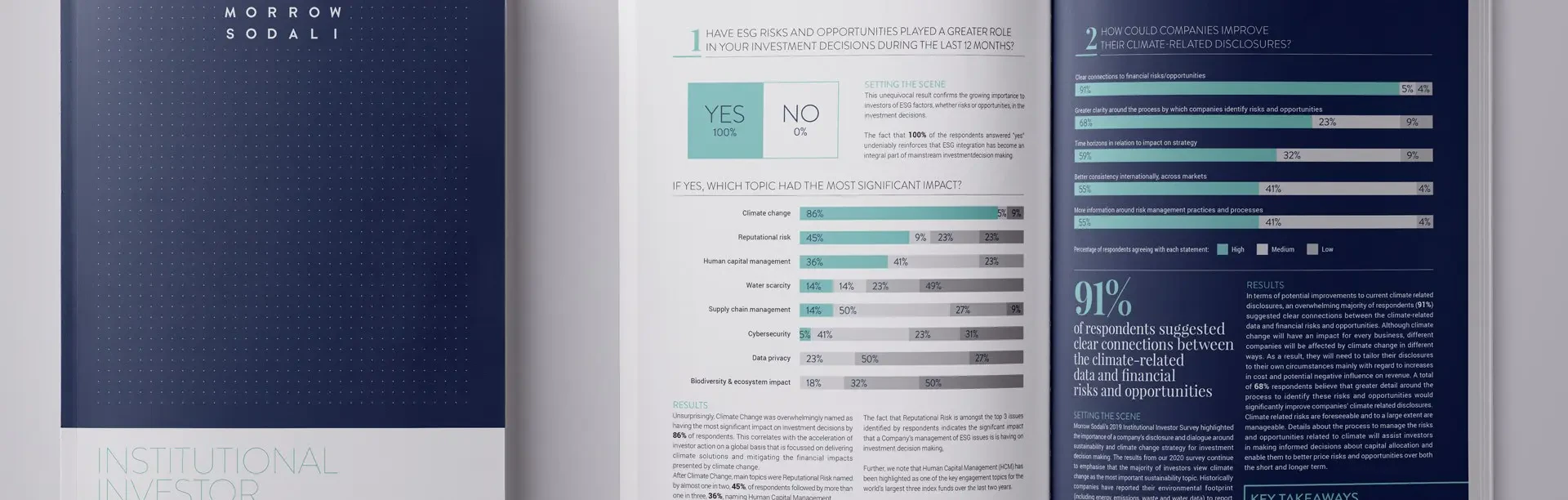

Institutional investors with assets under management of USD 26 trillion unanimously confirm that ESG (Environmental, Social and Governance) risks and opportunities played an increasingly important role in their investment decisions and their evaluation of portfolio companies during the past 12 months, according to Morrow Sodali’s annual Institutional Investor Survey, released today.

The Morrow Sodali survey highlights the main areas of focus for institutional investors in determining how to exercise their voting rights at 2020 annual shareholder meetings. Survey results reveal that the broadly defined concept of ESG will have a direct practical impact on shareholder meetings, proxy voting, engagement and the various means by which investors fulfill their oversight and stewardship responsibilities.

Several findings stood out:

The Morrow Sodali survey, now in its fifth year, was conducted in January 2020. Forty-one global institutional investors, with USD 26 trillion of assets under management in total, responded to the survey.

Access it here.

The Morrow Sodali survey highlights the main areas of focus for institutional investors in determining how to exercise their voting rights at 2020 annual shareholder meetings. Survey results reveal that the broadly defined concept of ESG will have a direct practical impact on shareholder meetings, proxy voting, engagement and the various means by which investors fulfill their oversight and stewardship responsibilities.

Several findings stood out:

- Climate change is at the top of investors’ ESG agenda. All companies, regardless of their sector, should expect increased investor scrutiny on how they approach this issue.

- Investors expect to be privy to the inner workings of the board, underlining the importance of board/shareholder engagement.

- In general pay-for-performance continues to dominate as a key pressure point for investors, but increasingly the emphasis is on how companies and boards respond to shareholder concerns and negative votes.

- Many investors express a need for more explicit non-financial information, which they see as an important indicator of underlying corporate culture, integrity and sustainability. With regards to climate change factors, it is of primary importance to investors that companies clearly show what is the connection to their financial risks and opportunities.

The Morrow Sodali survey, now in its fifth year, was conducted in January 2020. Forty-one global institutional investors, with USD 26 trillion of assets under management in total, responded to the survey.

Access it here.

Summary

Institutional investors highlight the growing importance of ESG in investment and proxy voting decisions in a new Morrow Sodali survey

Author