Subscribe to stay informed, inspired and involved.

Many companies may grapple with the new AASB S2 (Australian Accounting Standards Board – Standard 2) standards as Australia moves toward stricter climate disclosure requirements. A key mandate of AASB S2 is that climate-related disclosures must be reported on the same day as a company’s financials. This shift demands greater integration of sustainability and financial reporting. With reporting gaps still prevalent across the ASX300, how prepared are companies to meet this new standard?

A review of climate reporting by ASX300 companies over a three-year period assesses the timing of these disclosures relative to financial statements. While timeliness has improved, a large proportion of companies still lag in aligning climate and financial disclosures. There remains significant gaps and a pressing need to improve ESG (Environmental, Social, and Governance) data governance processes.

It is widely recognised that data governance for financial reporting has matured, improving the accuracy and reliability of reported financial statements. However, ESG data governance is still in its infancy. An indicator of ESG data governance is the timing of climate-related reporting. Research on the timing of climate-related disclosures highlights progress made in 2024 while identifying potential challenges to compliance with mandatory climate reporting.

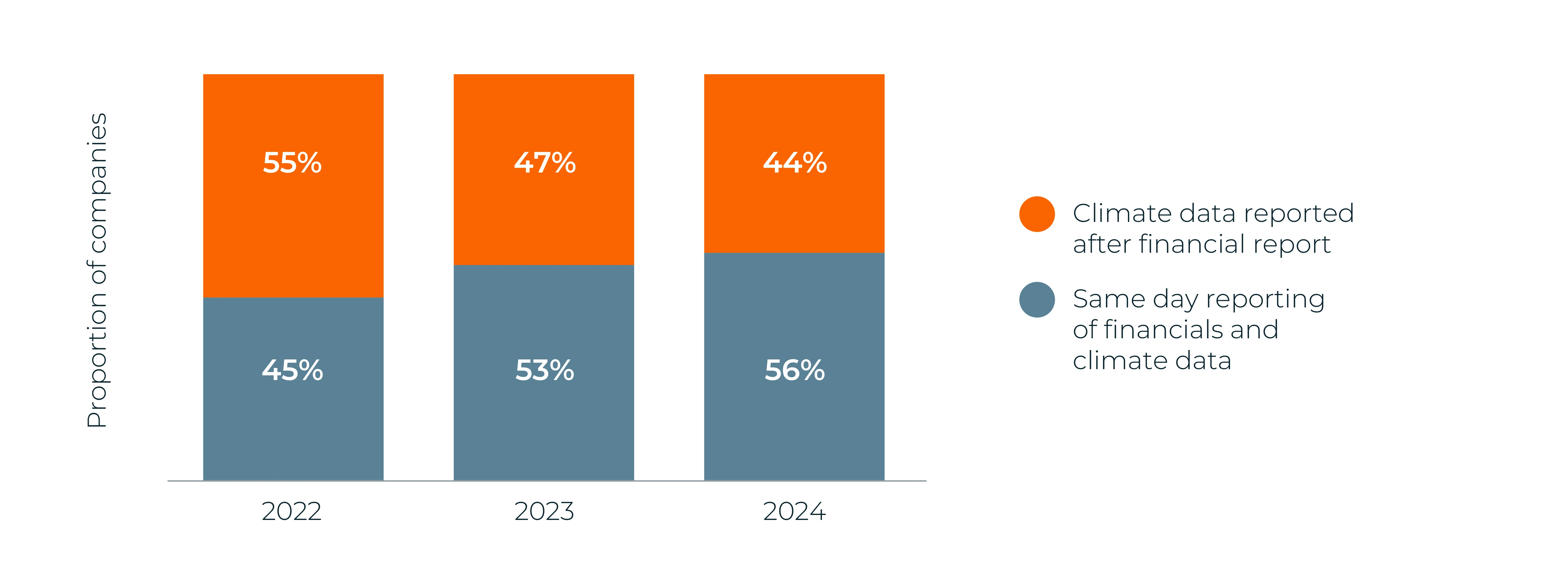

Chart 1: 44% of AXS300 published climate-related reporting after financials in 2024

Key findings from 2024 evaluation of disclosure timing

1. Lack of Climate Reporting:

- In 2024, 23% of ASX300 companies did not provide climate-related disclosures, an improvement from 2022 when 33% of companies did not. However, this number remains high.

- In 2024, 15% of companies in Group 1[1] did not provide climate-related disclosures, while 24% of companies in Group 2 and 38% of companies in Group 3 did not provide climate-related disclosures.

2. Timing Challenges:

- For the companies that provide climate-related disclosures, only 56% disclosed on the same day as their financial statements in 2024, up from 45% in 2022. Although this is an improvement, 44% of disclosing companies have not aligned the timing of their climate-related disclosures with their financial statements (see Chart 1).

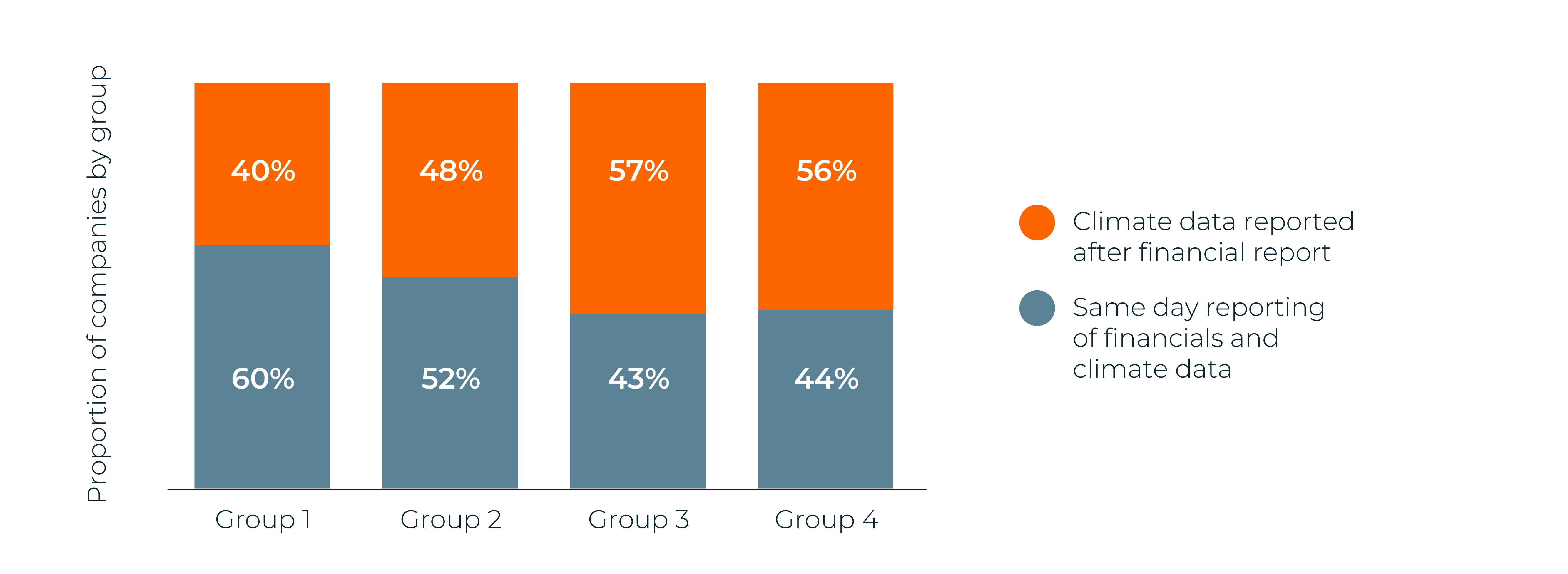

- In 2024, 40% of Group 1 companies provide climate disclosures after their financial statements, while 48% and 57% of Group 2 and 3 companies delay the timing of their climate-related disclosures until after their financial statements (see Chart 2).

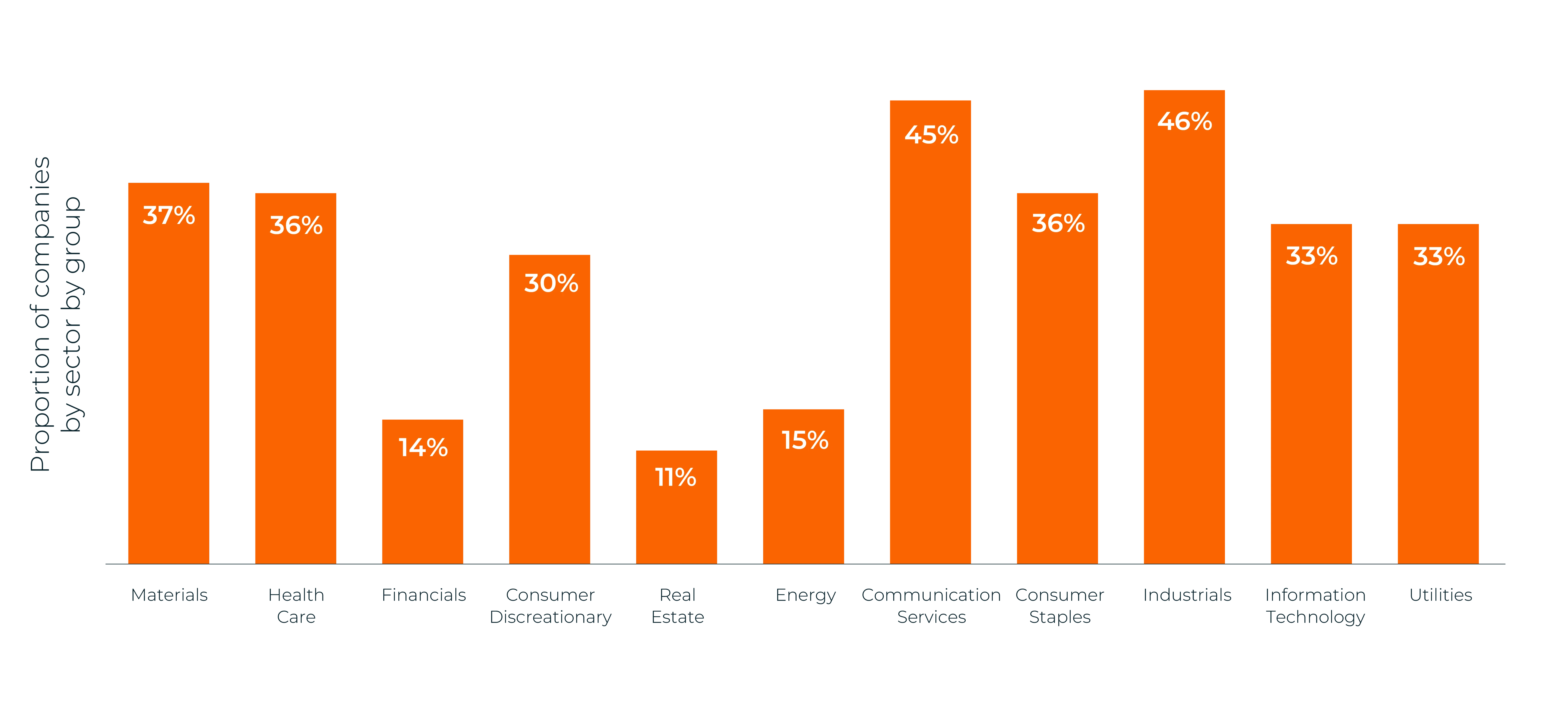

- Analysing Group 1 companies in each industry sector indicates that companies in the Industrials (46%), Consumer Services (45%), Materials (37%), and Health Care (36%) sectors are more likely to delay their climate-related disclosures until after the financial statements in 2024 (Chart 3).

3. Delayed Reporting:

- In 2024, 27% of companies that provided climate-related disclosures did so nine weeks or more after their financial statements. This has marginal improved, with a small proportion reporting in the first week (5%) and a larger group in the fifth week (21%) following financial statements (see Chart 4).

Assessing this gap in disclosure provides one indication of a company’s maturity in ESG data governance systems and processes. Mandatory climate reporting will impose deadlines for companies to report on their climate-related disclosures and any delay could affect the timing of financial reporting, which has significant consequences.

In 2024, the corporate reporting landscape changed, with sustainability reporting becoming increasingly important due to new mandatory climate reporting requirements. A review of company reporting in 2024 reveals a gap in timing and a potential need for companies to enhance ESG data governance practices to improve the timeliness of climate-related disclosures.

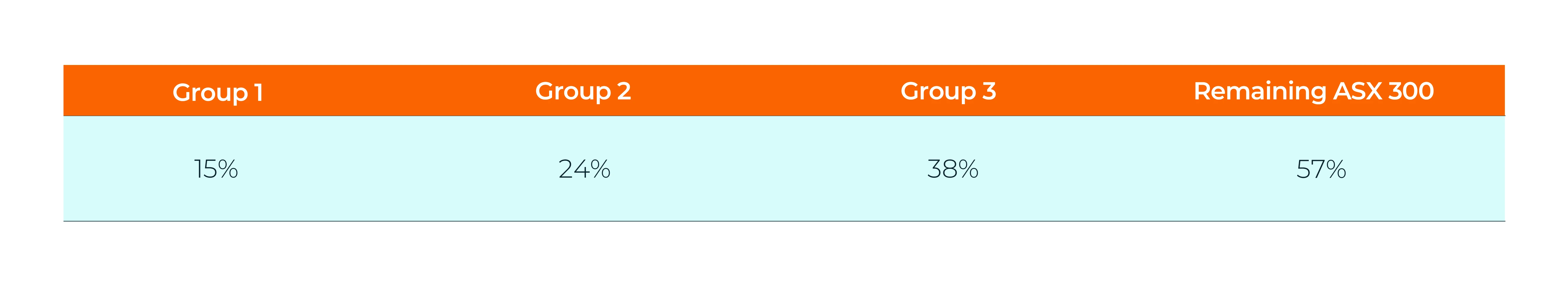

The number of companies with no climate-related disclosures may indicate that companies are yet to measure climate-related metrics. The overall proportion of companies with no climate-related disclosures in 2024 is 23%, while our analysis by reporting group indicates that 15% of Group 1 companies did not report. This increases to 24% of Group 2, 38% of Group 3 and 57% of remaining ASX300 companies, Table 1. These companies may have been measuring climate-related metrics for internal reporting and have established processes to produce a climate-related report.

Table 1: Proportion of companies by reporting group with no climate-related disclosure in 2024

Climate-Related Disclosure Lag

For companies that do provide climate-related disclosures, there is a time lag. Forty percent of companies in Group 1 provide climate-related disclosures after their financial statements (see Chart 2), and this percentage is higher for Groups 2 and 3. Companies in Group 1 will be required to comply with AASB S2 reporting requirements as early as 2026 and will be required to release their climate-related disclosures on the same day as their financial statements.

Chart 2: 40% of companies in Group 1 lagged in climate reporting

Analysing companies that provide climate-related disclosures after their financial statements, by sector reveals several interesting trends. Group 1 companies are delaying their climate-related disclosures more often in the Industrials sector, with 46% of these companies in Group 1 not aligning their climate-related disclosures with financial statements. This is closely followed by Consumer Services (45%), Materials (37%), and Health Care (36%) in 2024, shown in Chart 3. Additionally, an analysis of Group 2 companies indicates that the Real Estate and Health Care sectors have the highest proportion of companies with delayed climate disclosures.

Chart 3: Industrials, Consumer Services, Material, Health Care greatest proportion companies lagging in reporting for 2024

Challenges in data production

A major concern is whether companies can measure and report climate-related disclosures within the required timeframe and with the necessary levels of accuracy. Our findings highlight an urgent need for companies to enhance their ESG data governance processes to expedite the timing of climate-related disclosures. This improvement must prioritise accuracy, reliability, comparability, verification, understandability, and linkage to financial data.

A review of the time lag by working week indicates that the largest proportion of companies (27%) to delay their climate-related disclosures, did so nine weeks or more after the release of their financial statement (see Chart 4). The trend was similar in 2022 and 2023.

Chart 4: Lag in reporting greatest for nine and more weeks across all three years

Issues for ESG Data Governance

Given the evolving nature of ESG data, most companies have not yet had the opportunity to establish robust, strategic approaches for effective ESG data governance. In just a short time, expectations have shifted dramatically, ESG data is now expected to meet the same rigorous governance standards as financial data despite having had far less time to mature within corporate reporting structures. Simultaneously, the volume and complexity of ESG data have surged, with an increasing number of data points sourced from diverse departments across an organization. This challenge is even more pronounced for global companies and conglomerates. Strengthening governance will be critical to establishing efficient, scalable, and repeatable systems and processes that drive consistency and reliability in ESG reporting.

Questions to consider for ESG Data Governance include:

- Where does the data come from?

- Where is the data stored?

- Who is accountable for the data sourcing, calculations, updating, storage, delivery, and usage?

- How is the data verified for accuracy and reliability?

- What are the data privacy and security measures in place?

- How frequently is the data updated and reviewed?

- Are there standardised processes for data collection and reporting across departments?

- How is the data integrated with financial reporting systems?

- What are the potential risks of data discrepancies or inaccuracies?

- How and where is the data used to inform decision-making and strategy?

- What are the compliance requirements for ESG data reporting?

Looking ahead to 2025

In 2025, companies will need to prioritise the development of mature ESG data governance frameworks to meet reporting requirements. Enhanced data accuracy, timeliness, relevance, and reliability will be essential, requiring robust systems, processes, and procedures that are verifiable.

To align climate-related disclosures with financial statements, companies must enhance their data governance practices. This includes incorporating estimates, forward-looking scenario analysis, and ESG metrics across the value chain for a comprehensive representation of the company’s activities. The standard aims to create a clearer link between climate-related risks, opportunities, and their reflection in financial statements. Better data governance will lead to greater efficiencies in assuring the data, as required by the AASB S2 standard.

Establishing robust data governance, along with the necessary climate strategy and analytics for reporting, requires significant time and effort. An ideal roadmap includes a two-year period to prepare, conduct pilot programs, and address any issues.

Companies must continue to evolve their reporting practices to ensure transparency, accountability, and alignment with financial reporting standards.

For more guidance on AASB S2 mandatory reporting read Ready, Set, Report: Guide to Australian Climate-Related Mandatory Reporting

Sodali & Co

Our team of highly experienced professionals brings deep expertise in global standards, local market regulations, and business practices. By integrating extensive capital markets data with top-tier talent, we offer a unique combination of shareholder services, governance and sustainability, and strategic communications—unlocking opportunities and fostering trust.

The Asia Pacific Sustainability team has developed a future-proof framework designed to meet the evolving demands of sustainability. This integrated approach focuses on three priority themes: Transition (encompassing climate and nature), Impact (including CSRD and Double Materiality), and ESG Data Governance. Represented as a Venn diagram, these three themes underscore their interconnected nature and the holistic approach required to address future challenges.

[1] Groups as defined by Section 292A of the Corporations Act.

Summary

44% of ASX300 companies are still lagging in aligning climate and financial reporting—are they ready for AASB S2 compliance?

Author

Rowan Clarke

Manager, Sustainability

Sydney

rowan.clarke@sodali.com

Jana Jevcakova

Senior Advisor, Corporate Governance & Sustainability

Sydney

jana.jevcakova@sodali.com