Subscribe to stay informed, inspired and involved.

In recent years, the urgency of measuring and managing climate risks has intensified, driven by growing environmental challenges1 and increasing regulatory disclosure requirements. Governments, investors, and stakeholders demand greater transparency in how businesses plan to manage the risks and opportunities brought by climate change.

Beyond compliance, companies regularly monitoring and assessing climate risks and opportunities are better equipped to adapt, drive innovation, and stay ahead of emerging climate challenges.

Understanding Climate Risk and Scenario Analysis

All companies face the threat of business impacts due to climate change, which can be categorized into physical and transition risks. Physical risks stem from the direct impacts of climate change, such as more frequent and severe weather events, rising sea levels, and changes in global temperature. These phenomena threaten infrastructure, disrupt supply chains, and escalate business costs across industries. Transition risks, on the other hand, stem from changes in policies, technologies, market dynamics, and reputational factors as the global economy shifts towards a low-carbon future. Companies that fail to adapt risk losing their competitive advantage and facing financial penalties.

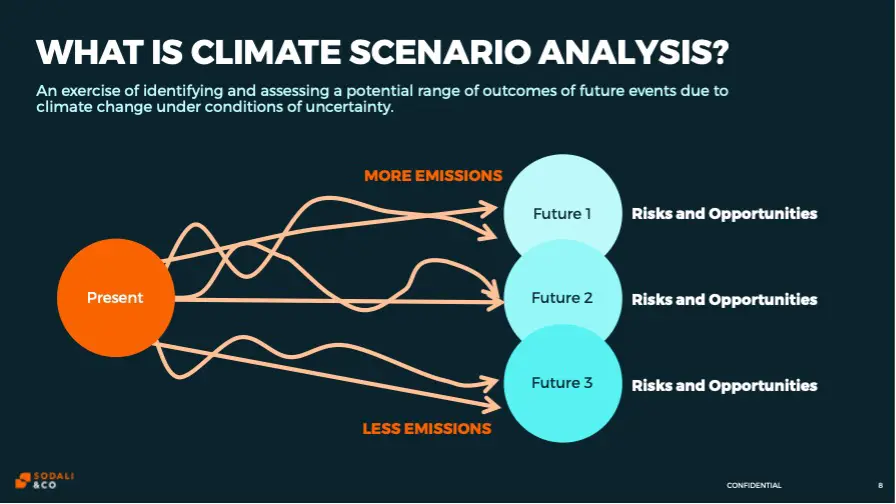

Reporting frameworks for climate disclosures emphasize the use of climate scenarios2. Using climate scenarios allows organizations to explore the potential risks and opportunities of different climate trajectories on their business. By evaluating multiple future states—such as scenarios where global temperatures rise by 1.5°C, 2°C, or higher—companies can better understand their vulnerabilities and take informed actions to mitigate risks. This proactive approach helps businesses stay resilient in uncertainty and enables climate considerations into their strategic decision-making.

Climate Risk Reporting Requirements

In an era of increasing accountability, regulators, investors, and stakeholders demand transparency around how companies manage climate risks and opportunities. Climate-related disclosures, such as those recommended by the TCFD, have become a cornerstone of corporate reporting. Scenario analysis is at the heart of these disclosures, enabling organizations to present structured, forward-looking assessments of climate impacts on their operations and financial performance.

By incorporating scenario analysis, companies demonstrate their commitment to understanding and addressing climate risks, strengthening stakeholder relationships, and indicating to investors an effort to enhance resiliency.

Aligning with Regulatory Standards

Governments around the world are implementing stringent reporting requirements of companies’ climate-related financial disclosures, including their climate-related impacts, risks, and opportunities. Below, we summarize the regulations to date as they relate to climate scenario analysis.

Comparison of Regulations with Respect to Climate Scenario Analysis

| Regulation | Framework Alignment | Time Horizons | Risks and Opportunities | Impacts | Resilience | Minimum Scope | Required Scenarios |

| California SB-261 Greenhouse Gases: Climate Related Financial Risk | TCFD | Short, medium, long | Description of risks and opportunities | The effects on businesses, strategy, and financial planning. Include impact on financial performance and financial position. | Description of climate resilience of strategy | Not specified | 2 deg C or lower scenario; scenarios with increased physical risk where relevant to organization. |

| IFRS S2 | Short, medium, long | Description of risks and opportunities | The current and anticipated financial effects on business model, and value chain. Include impacts on financial position, financial performance, and cash flows. | Description of climate resilience. Include implications, areas of uncertainty, and capacity to adjust or adapt. | Business model and value chain | Not specified | |

| European Union Corporate Sustainability Reporting Directive | ESRS E1 | Short, medium, long | Process to identify and assess risks and opportunities | The anticipated financial effects on financial position, financial performance, and cash flows. | Description of climate resilience of strategy and business model | Operations and value chain | High emissions scenario; 1.5 deg C with no or limited overshoot scenario |

| Australian Sustainability Reporting Standard AASB S2 | IFRS S2 | Short, medium, long | Description of risks and opportunities | The current and anticipated effects on business model, and value chain. Include impacts on financial position, financial performance, and cash flows. | Description of climate resilience. Include implications, areas of uncertainty, and capacity to adjust or adapt. | Business model and value chain | Not specified |

| United Kingdom Climate-Related Financial Disclosures ((SI 2022/31 and SI 2022/46) | TCFD | Short, medium, long | Description of risks and opportunities | The actual and potential impacts on businesses model and strategy. | Description of climate resilience of business model and strategy | Business model and strategy | Not specified |

Disclaimer: This table provides a simplified summary of requirements for reference purposes across different regulations and does not capture all requirements. For complete details, please refer to the official regulations.

Failure to comply with climate reporting regulations may result in reputational damage, financial penalties, and reduced investor confidence.

Facilitating Stakeholder Communication

Beyond regulatory compliance, scenario analysis enriches the quality of dialogue with stakeholders. It offers a tangible way to communicate the company’s risks to climate and how they may be managed. This clarity fosters engagement with investors, customers, and employees, who increasingly value businesses that are proactive in addressing environmental challenges.

Assessign Climate Risks

The following outlines a process that companies should consider to assess for physical and transition risks.

Step 1. Define the Parameters

Objectives: Start by clearly identifying the purpose of the analysis. Are you aiming to comply with reporting requirements, assess specific vulnerabilities, or guide strategic decision-making? The objectives will shape the scope and depth of the analysis.

Scenarios: Identify the scenarios you’ll evaluate. Typical scenarios include global temperature rise of 1.5°C, 2°C, or higher. Refer to frameworks like the TCFD’s recommended scenarios or regional climate projections. Tailor the scenarios to your company’s specific risks and opportunities.

Time Horizons: Include both short-term, medium-term, and long-term perspectives. The company’s time horizons should align with its financial planning and be consistent with the lifespan of the investment or activity.

Step 2. Develop the baseline and scenarios

Baseline: The baseline serves as the foundation for understanding how the company’s operations might be impacted under different climate scenarios. It provides the starting point for measuring deviations or impacts from those scenarios. It allows you to map your company’s current climate footprint and risk exposure. Baseline information may include the historical performance of extreme weather events that have already impacted your company’s operations or current greenhouse gas (GHG) mitigation efforts.

Scenarios: Scenario data will include projections associated with scenarios based on different levels of global temperature rise (e.g., 1.5°C, 2°C, 3°C). This data can be obtained from sources such as the Intergovernmental Panel on Climate Change (IPCC), regional climate models, or subject matter experts.

Step 3. Evaluate Business Impacts, Risks, and Opportunities

Translate climate risks and opportunities into financial terms to understand their potential impact on financial position, financial performance, and cash flows. Assess the resilience of the strategy and business model and identify any uncertainties. Risks and opportunities should be assessed in qualitative terms and quantitative terms to the extent practical.

Step 4. Identify Potential Responses

By analyzing business impacts, risks, and opportunities, companies can identify and implement actions or adjust strategies to mitigate risks or capitalize on emerging opportunities effectively.

Mitigation and adaptation to address climate change may involve upgrading infrastructure or improving resource efficiency. For example, companies operating in areas prone to hurricane events might enhance resilience by relocating key facilities or investing in stormproofing to minimize losses and disruptions.

Another vital response is preparing for shifts in the global landscape, including changes in policies, market dynamics, and consumer behaviors. Organizations can stay ahead by embracing the low-carbon economy, including the adoption of low-carbon technologies and reducing their carbon footprint.

Ultimately, effective responses to climate risks require foresight, flexibility, and collaboration. Leveraging climate risk assessment allows companies to anticipate future challenges and tailor their strategies accordingly.

Conclusion

Climate risk and scenario analysis have emerged as indispensable tools in the modern business landscape. They enable companies to anticipate and adapt to the multifaceted challenges posed by climate change. By examining various climate trajectories, businesses can align their strategies with both regulatory requirements and stakeholder expectations, ensuring transparency and accountability.

Sodali & Co has a team of climate experts who help companies assess and understand their climate-related risks while ensuring compliance with regulatory requirements. By analyzing various climate scenarios, identifying risks and opportunities, and crafting investor-focused disclosure narratives, we provide strategic support to help companies navigate climate-related reporting with confidence.

- Intergovernmental Panel on Climate Change (IPCC). (2023). Climate change 2023: Synthesis report. Summary for policymakers (Section: Observed Changes and Impacts, pp 5-7). IPCC. https://www.ipcc.ch/report/ar6/syr/downloads/report/IPCC_AR6_SYR_SPM.pdf

- Key reporting frameworks include the Task Force on Climate-Related Financial Disclosures (TCFD), the International Financial Reporting Standards Climate-Related Disclosures (IFRS S2), and the European Sustainability Reporting Standards’ topic E1 (ESRS E1). These frameworks form the base for many climate disclosure regulations seen to date.

Summary

In recent years, the urgency of measuring and managing climate risks has intensified, driven by growing environmental challenges and increasing regulatory disclosure requirements. Governments, investors, and stakeholders demand greater transparency in how businesses plan to manage the risks and opportunities brought by climate change.

Author

Benjamin Robinson

Senior Director, Sustainability & Climate

ben.robinson@sodali.com

Norman Wong

Director, Sustainability & Climate

norman.wong@sodali.com

Iryna Bilohorka

Associate, Sustainability & Climate