Subscribe to stay informed, inspired and involved.

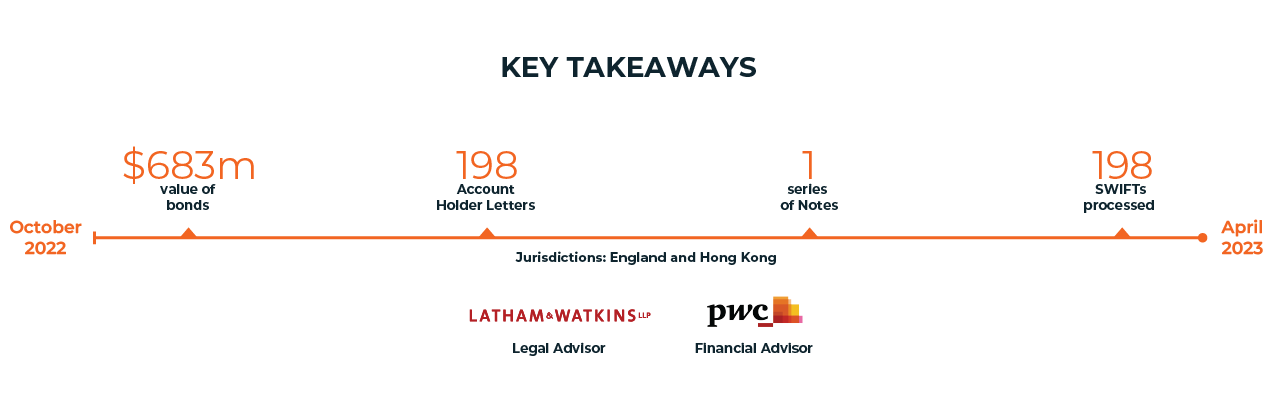

In 2022, Hong Kong Airlines proposed concurrently a Restructuring Plan under Part 26A of the UK Companies Act 2006 and a Scheme of Arrangement pursuant to Sections 670, 673 and 674 of the Hong Kong Companies Ordinance.

The Plan envisaged that the creditors would release their claims, and corresponding liabilities of the Company, the Related Debtors and the Related Guarantors (as applicable), in return for consideration in the form of new notes and cash.

They required support from an Information Agent in respect of the Perpetual Notes.

Our role included:

- Reviewing the operational aspects of the plan documents.

- Announcing the event to the market, acting as a crucial conduit between the Issuer and its Creditors.

- Collecting and tabulating the custody instructions and Account Holder Letters, which contained voting instructions.

- Reporting and assessing if certain conditions had been met (e.g., Required Quorum/Consent, Perpetual Notes Alternative Consideration Election).

We were able to maximize bondholder participation across regions by addressing all bondholders' queries promptly, via our operational teams in Europe, US and APAC.

Our real-time reporting platform Bondwatch meant we were able to provide constant feedback to the Company and Advisors.

And our Portal platform enabled creditors to quickly and in an orderly way submit Account Holder Letters (AHLs).

We also proactively targeted key creditors to ensure timely submission of custody instructions and AHLs prior to the relevant deadlines.

Find out more about our Global Debt & Bondholder Services.

Summary

Our team supported Hong Kong Airlines' debt restructuring by managing creditor communications, voting processes, and entitlement submissions through our platforms, ensuring smooth execution and maximizing bondholder participation.

Author