Subscribe to stay informed, inspired and involved.

As 2025 begins, President-elect Trump takes office alongside a Republican-controlled Congress, signaling potential shifts in U.S. policies, including changes to climate-related regulations that could affect corporate sustainability programs.

While regulatory and policy change is anticipated and the potential negative repercussions for climate action are significant, opportunities for progress will remain. The transitory nature of presidential administrations indicates that these policies will continue to shift, at times strengthening climate ambitions and environmental protections and at other times scaling them back. In either case, however, local and international governments are not waiting on U.S. federal legislation. State and global regulations proactively advance climate and environmental policies, such as California’s Senate Bill 253 and 261 and the European Union’s Corporate Sustainability Reporting Directive (CSRD), respectively.

Anticipated Changes Under the New Administration

As the new administration assumes office, companies doing business in the U.S. should expect changes to existing climate and environmental regulations at the federal level, from the SEC’s Climate Disclosure Rule to the Inflation Reduction Act. Furthermore, there is a predicted retraction of both U.S. and international climate targets.

Expected Rollback of Federal Rules and Regulations

SEC Rule Scrutiny

Trump’s nominee for SEC Chair, Paul Atkins, is likely to take steps to either block or reconsider the SEC Climate-Related Disclosure Rule.1 Regardless of the outcome of the SEC ruling, companies should still plan to track and disclose climate-related risks and greenhouse gas emissions to align with expectations from institutional investors and customers, adhere to global frameworks, and comply with international and state-level regulations.

For private companies regulated by the SEC, the 2023 adjustments to the SEC Name Rule aim to prevent misleading or deceptive investment fund names by requiring an 80% investment threshold for any thematic naming, including ESG-focused funds. Private companies could face increased scrutiny if the new SEC maintains these adjustments, potentially escalating greenhushing investigations.3 This is particularly relevant for funds that may consider marketing themselves with an ESG-tilt in Europe but pulling back on messaging when fundraising in the U.S. It will be crucial for these companies to ensure consistent strategy messaging to accurately reflect their investment focus and avoid greenwashing risks.

Expected EPA Rollbacks

Following the 2024 Supreme Court ruling on Loper Bright Enterprises v. Raimondo that up-ended the forty-year-old “Chevron deference” precedent (which required courts to defer to government agencies' interpretations of ambiguous statutes), the EPA’s authority has been significantly curtailed.4 Additionally, lessons from the first Trump presidency have prepared EPA officials to advance a conservative agenda more effectively. Significant budget cuts and Biden-era regulations, such as the tailpipe vehicle emissions rule, are likely targets. The Heritage Foundation’s Project 2025 suggests prioritizing the downsizing of the EPA and reviewing greenhouse gas standards for cars.5

Uncertainty Over the Inflation Reduction Act (IRA)

Trump has promised to “rescind all unspent funds” of the IRA—one of Biden’s hallmark federal laws passed in 2022, which includes updates to tax laws related to energy and climate. However, House Speaker Johnson (R) said in September 2024 that he would “use a scalpel, not a sledgehammer” in any changes made to the IRA legislation.6 Many House and Senate Republicans may oppose a full repeal of the IRA or a repeal of certain aspects of the IRA due to how it has positively affected their electoral districts.

Bloomberg has reported that, as of June 20, 2024, at least $206 billion in investments in clean technology manufacturing have been announced during Biden’s presidency, with 80% of these investments directed toward electric vehicle and battery projects.7 Approximately $42 billion is slated for Democratic House districts, with nearly four times that much—$161 billion—directed towards Republican districts (about $3 billion is still unallocated). 64% of investments in Republican districts have come after the passage of the IRA.

Out of the top 25 districts in the country for announced cleantech manufacturing investments, 21 are represented by Republicans in the House. These 21 districts alone account for $119 billion in investments and over 80,000 jobs. Repealing these investments would mean turning down significant job opportunities and financial gains, leading to opposition from various Republican representatives regarding appeals related to energy credits.8 The IRA has found other unlikely allies in the oil and gas industry. Certain corporations are requesting that Trump retain parts of the IRA focused on renewable fuels, carbon capture, and hydrogen.9

Should a more precise trimming approach be taken to the IRA, funding for electric vehicle credits and wind subsidies—which have faced significant criticism from the incoming administration—is likely to be revoked. However, tax credits for domestic clean energy manufacturing are likely to persist, as they align with Trump's anti-China and pro-U.S. manufacturing stance.10

A Retreat from International Climate Action

Despite the incoming administration’s expected rollbacks on climate initiatives, in December 2024, the Biden administration released a new goal to reduce U.S. greenhouse gas emissions by 61% to 66% by 2035 from a 2005 baseline and is submitting it as part of the U.S. Paris Agreement (the international treaty adopted at COP21 in 2015 to limit the increase in global average temperature to well below 2°C above pre-industrial levels).11, 12 The Biden administration believes that investments and actions taken at the state, local, and private levels will lead to the U.S.’ achievement of the new target, even without federal involvement over the next four years.

In 2017, the first Trump Administration withdrew the U.S. from the Paris Agreement and the Biden Administration re-entered the agreement as soon as President Biden took office in 2020. While Trump's presidency is expected to take a similar approach to its prior term, it is worth noting that the U.S.' absence during Trump's first term, though seen by many as a setback, did not deter other parties from remaining committed to the Paris Agreement and bolstering their climate efforts. If the U.S. were to withdraw again, a global movement of retractions is not predicted.

In September 2024, President-elect Trump promised to approve measures promoting fossil fuel production in the U.S. by reducing restrictions on leasing and oil and gas extraction on federal lands. Increased production and supply would likely reduce fuel prices and boost consumption, leading to higher emissions. It is unclear how significantly progress towards climate targets might be affected.

Despite Federal Headwinds, City, State, and Global Corporate Sustainability Regulations Will Persist

Despite the anticipated changes at the federal level under the new administration, corporate sustainability regulations are expected to continue progressing, driven by state and local governments and international standards. Several U.S. cities and states have already implemented robust environmental and climate-related regulations that will remain unaffected by the predicted federal policy shifts.

Statewide Climate Regulations for Corporations Move Forward

In 2023, California signed two landmark climate disclosure requirements into law, Senate Bill 253 (SB 253) and Senate Bill 261 (SB 261).13,14 New York and Illinois followed suit shortly thereafter with S879A and HB4268, respectively (note: as of December 2024, these bills are still awaiting passage).15,16 These requirements all mandate the disclosure of GHG emissions and increased reporting around assessing and managing various climate-related risks and are indicative of states’ assuming responsibility for climate-related disclosures given the difficulty federal climate legislation is facing.

European Compliance Will Continue to Impact U.S. Companies

Corporate sustainability regulations are also gaining momentum internationally and are expected to remain firmly in place. The European Union's Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), and Sustainable Finance Disclosure Regulation (SFDR) are key frameworks that will continue to shape corporate sustainability practices globally.17,18,19 These regulations emphasize transparency, accountability, and the integration of sustainability into business operations, ensuring that companies remain committed to environmental and social responsibilities.

Federal, State and International Climate Law Alignment

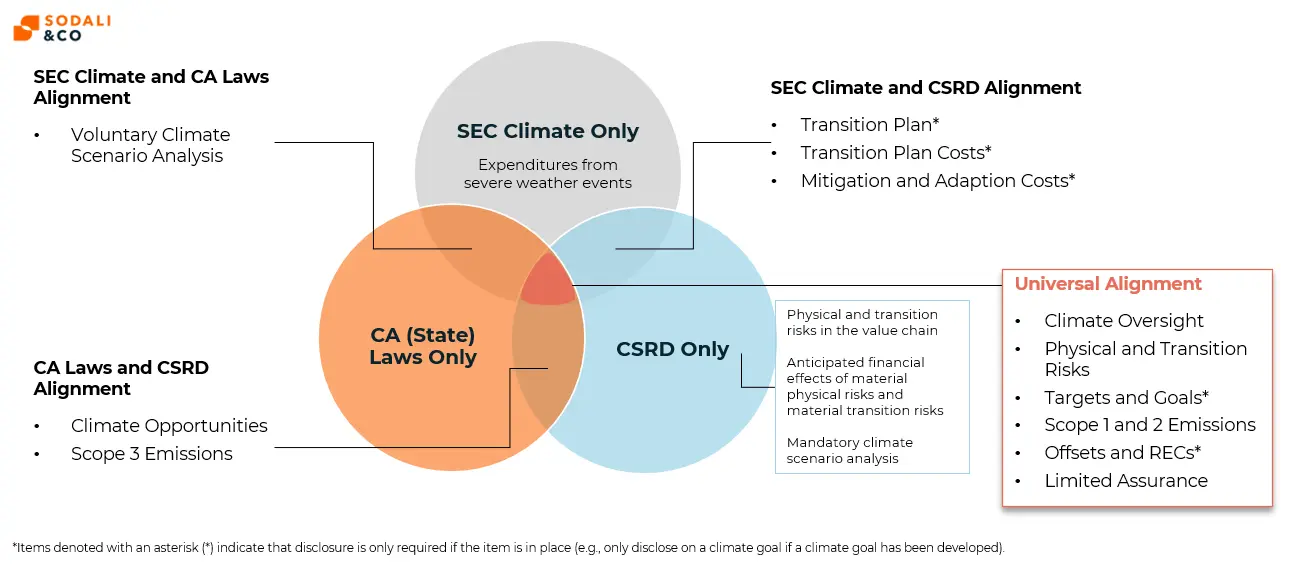

The graphic above highlights the interconnectivity of local, federal, and international climate-related regulations. In the absence of the SEC Climate-Related Disclosure Rule, similar (and in many cases, more far-reaching) legislation will persist at both local and international levels.

What Does This Mean for My Company?

Until the Trump Administration is officially in office and implementing changes, companies will have to prepare without a clear picture of the federal climate policy landscape.

While federal policies may fluctuate, the commitment to corporate sustainability at the state, local, and international levels will continue to demand sustainability action and disclosure. For many companies, it is likely that solely adhering to U.S. federal regulations will not be sufficient. Those subject to local state-level climate regulations and global international standards will need to stay informed and adapt to these evolving regulations to ensure compliance.

Notably, for companies that have been utilizing or planning on utilizing the incentives provided by the Inflation Reduction Act, particularly around electric vehicles and wind power, we recommend more conservative financial calculations (in case those incentives were to change or be removed). Additionally, we recommend preparing for state-aligned disclosures for companies with operations in progressive cities and states that have drafted or passed climate regulations (California, New York, Illinois).

If you have additional questions on how your company specifically should prepare for these upcoming changes, our team at Sodali & Co is available to support.

Summary

As President-elect Trump takes office, significant shifts in U.S. climate policies are expected, including potential rollbacks on environmental regulations. Corporate sustainability programs may be impacted, particularly with changes to climate disclosure rules, such as the SEC’s Climate-Related Disclosure Rule, and the Inflation Reduction Act. However, state and international regulations like California’s Senate Bill 253 and the European Union’s Corporate Sustainability Reporting Directive will continue to drive progress in corporate sustainability and climate action. Despite federal setbacks, companies must adapt to local and global regulatory frameworks to maintain compliance. Firms relying on federal incentives for clean energy projects should prepare for potential reductions and stay informed about evolving climate legislation.

Author

Julia Sullivan

Director, Sustainability

julia.sullivan@sodali.com

Nicole Nishizawa

Senior Associate

nicole.nishizawa@sodali.com