Subscribe to stay informed, inspired and involved.

Public offerings peaked in 2021 and fell over the past couple of years due partly to economic downturns and high interest rates. However, in 2024, we are seeing a resurgence in the number of companies going public1. In the first quarter of 2024 alone, there were already 62 IPOs in the US stock market2. Yet, companies pursuing IPOs are entering a market with more regulatory scrutiny and continuous investor focus on mitigating risk, necessitating rigorous financial disclosures, and providing a high degree of transparency.

Over the past few years, ESG factors have emerged as critical considerations. These factors, encompassing a company’s environmental impact, social practices, and governance structure, significantly shape business and investment decisions.

Overlooking ESG considerations during an IPO can expose a company to a multitude of risks. These include potential devaluation, reputational damage, legal repercussions, and obstacles to the business's long-term viability. Therefore, companies must integrate ESG considerations into their strategic vision to successfully navigate the public market landscape.

All companies are under increased ESG scrutiny

ESG factors are high-priority considerations for many stakeholders, spanning investors, customers, and regulators. Despite anti-ESG sentiment in the US, recent research on IPO trends continues to find that investors globally, including many in the US, still consider ESG components in their assessment of IPOs, especially as more countries are raising the bar on ESG-related disclosures and performance to achieve goals such as net-zero emissions3. Beyond standard financial metrics, investors continue to demand a holistic understanding of a company’s operations—one that encompasses not only profit margins but also its environmental footprint, human capital management, and robust governance practices, among others.

Similarly, we are seeing a rise in customers and suppliers seeking companies with strong environmental and social responsibility, such as those who promote diversity and inclusion, have strong human rights policies, and source materials sustainably4. They want to partner with companies with similar commitments and can support them in achieving their sustainability goals.

Regulatory bodies are also closely monitoring ESG priorities and performance, emphasizing the need for compliance and transparency. Many companies are subject to the reporting requirements of some of the newer regulations, such as the CSRD (Corporate Sustainability Reporting Directive), California Climate Corporate Data Accountability Act, and SEC climate rules, which have varying levels of penalties if companies fail to comply.

ESG negligence is an IPO risk

Undoubtedly, significant risks are associated with ESG negligence. Missteps in ESG practices can profoundly impact a company’s brand and investor relations. Negative publicity arising from environmental or social issues can quickly erode trust and lead to lasting reputational damage. Lack of transparency on ESG issues may be perceived by stakeholders as something being hidden, such as poor labor practices or environmental pollution.

In the run-up to an IPO, companies must navigate a complex landscape beyond traditional financial metrics. With investors increasingly factoring in ESG considerations when evaluating investment opportunities, ignoring ESG concerns can lead to consequences, including reputational damage, regulatory scrutiny, and backlash from investors. Thoughtful consideration of these risks can lead to higher IPO valuation, increase competitiveness, and attract investors56.

There are several high-profile instances of companies that failed to adequately consider ESG in their IPOs and received backlash from their stakeholders.

- Rivian, the electric vehicle manufacturer, had a highly anticipated IPO in 2021 and was initially valued over $66 billion7. However, concerns were raised by a pension fund advisor on the environmental and human rights impacts in the EV battery supply chain, exposing Rivian to significant regulatory, litigation and reputational risks8. The company was called on to commit to a human rights assessment of its value chain before the S-1 registration statement was finalized.

- Another high-profile IPO was of the UK-based food delivery company Deliveroo9. Dubbed by the media as the “worst IPO in history”, Deliveroo received scrutiny from UK fund managers who refused to invest in the IPO mainly due to concerns over poor labor practices, considering that the Deliveroo riders were not classed as employees, which opened the company up to regulatory risks around the status of the rider, their safety and welfare, and their entitlement to a living wage.

These instances underscore the importance of ESG considerations for companies considering an IPO. Aside from being mere optional extras, ESG factors are integral to a company’s value proposition to investors and the public. Failure to address ESG risks will continue jeopardizing IPOs in 2024 and beyond.

Preparing for an ESG-powered IPO

Investors now demand a holistic view beyond profit margins, emphasizing transparency and long-term sustainability. Private companies planning an IPO are expected to expand their focus beyond financial metrics to include robust ESG planning that also satisfy regulatory requirements. Companies that proactively incorporate ESG considerations into their IPO strategy stand a better chance of success and build long-term trust with their stakeholders.

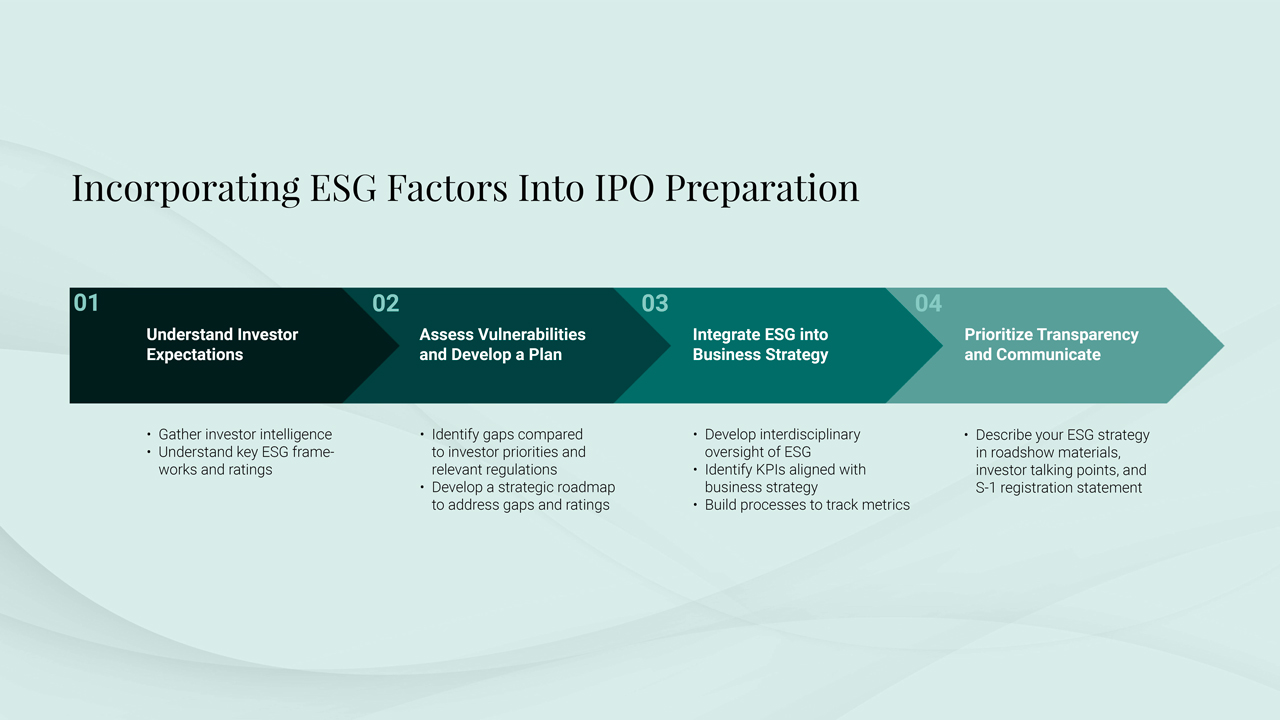

Here are five key steps for your company’s IPO journey:

- Understand investor expectations: When preparing for pre-IPO roadshows, it is crucial to understand investor’s ESG priorities. Whether by reviewing investors’ stewardship documents, conducting competitive analysis, or leveraging Sodali & Co’s Capital Markets Intelligence services, gaining insights into ESG frameworks and ratings prioritized by potential investors and their key focus areas will better tailor your company’s engagement with investors.

- Assess vulnerabilities: Just as you would evaluate governance and other business risks to prepare for your company’s IPO, evaluating ESG risks and establishing plans to mitigate risk or capture opportunities is essential. Consider feedback from your investors, relevant regulatory requirements, and how your current ESG initiatives, programs, governance structures, and data controls align with these expectations. Identifying gaps and developing a strategic roadmap can better position your company for long-term success in an ever-changing investment landscape.

- Integrate ESG into business strategy: ESG concerns are ethical and strategic, crucial in risk management and sustainability. To remain competitive, your company should integrate ESG considerations into its long-term strategy rather than be in its silo. This requires developing oversight of key ESG topics across interdisciplinary teams, identifying key performance measures that align with your business strategy, and building processes to track these metrics as you would financial data.

- Prioritize transparency: ESG strategies take time to implement. Stakeholders recognize this. However, transparency on your company’s progress and plans is essential to building trust and alignment. Pre-IPO, consider describing your ESG strategy, including how your company is on track to comply with relevant ESG-related regulation, in your roadshow materials, investor engagement talking points, and S-1 registration statement. Post-IPO, expect to continue regularly communicating with to stakeholders on your ESG progress.

Are you ready to get started?

Sodali & Co can help your company or portfolio company understand your investors’ and regulators’ ESG expectations, identify gaps in your ESG program, disclosures, and governance practices, and develop a plan to best prepare you for IPO or exit.

Summary

Author

Emily Wei

Co-Lead, Global Sustainability

emily.wei@sodali.com

Sharnvir Dhillon

Director