Subscribe to stay informed, inspired and involved.

Increasing stakeholder attention on environmental, social and governance (ESG) matters has made it critical for companies to improve the quality of their disclosures, but boards and management seeking to understand how this impacts their organisations must master a constantly evolving array of acronyms, advisors and associations, agencies, standards and frameworks.

Deciphering how these influences affect the behaviours of key investors, and the company's share register as a whole, adds an additional layer of complexity that is beyond the capacity of any in-house investor relations team to unravel, says Justin Grogan, Morrow Sodali’s Senior Managing Director, Corporate Governance & Sustainability APAC.

“It’s information that directors and management need, whether to understand the drivers of investor decision-making, to reach good decisions on resource allocation or to determine what their organisations should be disclosing. But it’s information that very few of them have ready access to, which leaves them guessing about the intent of their investors,’’ says Grogan. “And that’s the role of our Voting Power and ESG Influence Analysis, to provide evidence-based analysis.’’

Building upon a standard Beneficial Ownership Analysis, Morrow Sodali can leverage its proprietary global database of institutional investor information to generate unique insights into the most important influences on a company’s shareholder base, and then provide regular updates on how these influences are changing over time.

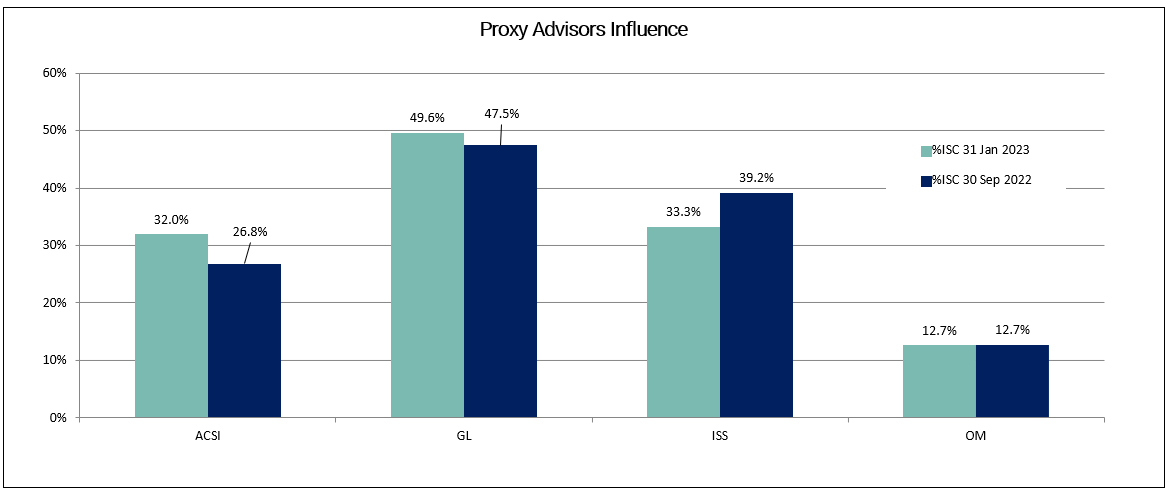

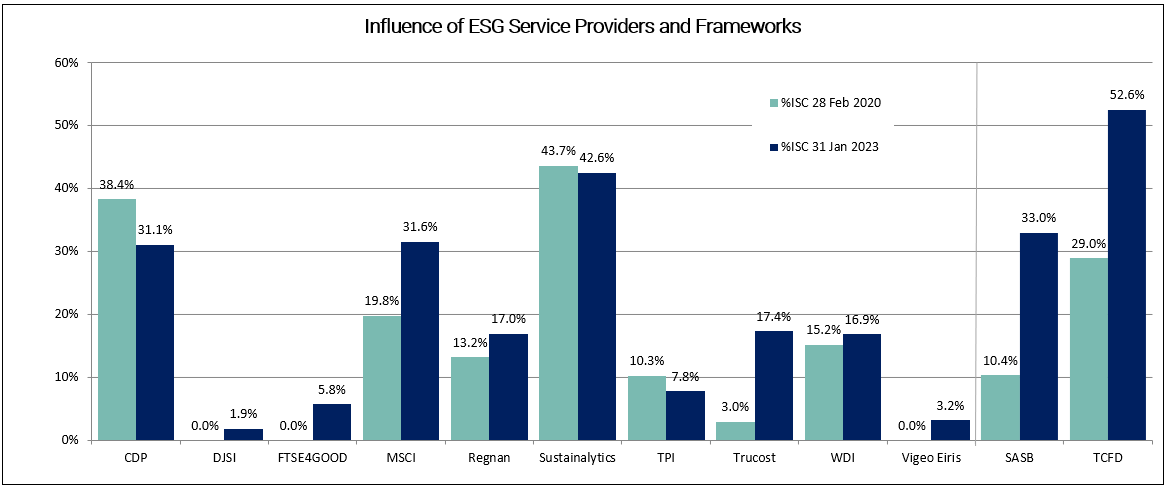

This provides quantitative and qualitative data on the forces shaping investor behaviours, including which proxy advisors’ research is most relied upon; which ESG associations have the greatest influence (i.e. Climate Action 100+, ICGN, RIAA, UN PRI, etc); which ESG surveys are most widely used (i.e. MSCI, Sustainalytics, CDP, DJSI, etc); and, which ESG frameworks (i.e. SASB, TCFD, GRESB, etc), are the most important.

Example of an extract from a Voting Power and ESG Influence Analysis report

“Summarised in a presentation for the board and management, a Voting Power and ESG Influence Analysis provides up-to-date insights into the consequences of any movements within the register, and the increasing or decreasing influence of various third parties on a company’s actual owners.

The result is quantifiable, actionable evidence of which ESG associations, service providers and frameworks are currently driving investor decisions, says Grogan.

Example of an extract from a Voting Power and ESG Influence Analysis report

“The purpose of a Voting Power and ESG Influence Analysis is to educate boards and management about what is swaying their investors and how various influences are evolving over time. It enables them to better understand the motivations and drivers of investor behaviours, to decide how to most effectively respond to ESG rating surveys, and how to frame the structure of disclosures such as sustainability reports.’’

By combining its global shareholder engagement expertise with specialist advisory capabilities, Morrow Sodali can provide detailed information about a company’s institutional and beneficial shareholders and their policies relating to key governance, remuneration and sustainability matters.

This analysis outlines which shareholders subscribe to proxy advisors whose recommendations may significantly impact voting outcomes at AGMs or EGMs. Additional analysis of the ESG ratings agencies, associations and disclosure frameworks can uncover the ESG sensitivities within a company’s register.

This information can be used to:

- Ensure that the investors who actually control the voting mandate are identified and appropriately engaged with throughout the year.

- Enable a targeted approach for the board chair and non-executive directors to engage with proxy advisors in the lead-up to an AGM and during the 'off' season.

- Decide where to allocate time and effort when responding to ESG rating surveys.

- Better understand the motivations and drivers of investor behaviour.

- Educate board and management about what is influencing investors and how their influence is evolving over time.

- Align the structure of the sustainability report with investors’ requirements and to help determine what information should be disclosed.

A Voting Power and ESG Influence Analysis can also benefit companies seeking to improve their ratings by ESG data providers such as MSCI and Sustainalytics, says Grogan.

“As part of the service, we help organisations identify where they are under-performing and then make recommendations on how to improve their ratings.

For example, by disclosing more information on their health and safety policies and performance, or on their strategy to transition from carbon – anything that can be identified as a weakness but is deemed important because it is a factor in the rating process and, ultimately, investors are focused on it as a material issue.’’

Increasingly, stakeholders and proxy advisors are not only focused on disclosure around sustainability and ESG, but they also want to understand issues such as remuneration structures, how a company incentivises management and what sort of governance structures are in place.

“And that, in turn, links into what information a company provides in their broader set of disclosures, such as their corporate governance statement or remuneration report, and how it provides this information,’’ says Grogan.

“Investors and other stakeholders are increasingly demanding more detailed information across a range of issues that they can use to make informed decisions. A Morrow Sodali Voting Power and ESG Influence Analysis will advise companies about who they should listen to, who is important and where they should focus.

Failing to understand these influences is akin to setting sail without a map – when a GPS is available.”

Should you wish to discuss matters pertaining to Voting Power and ESG Influence Analysis with our team, kindly complete the form provided below.

Download the full report

Summary

Author