Subscribe to stay informed, inspired and involved.

Introduction

With the recent establishment of the California Climate Accountability Package, companies that may be in the scope of the regulation should act now to ensure that they are adequately prepared to comply. U.S. companies satisfying the outlined monetary thresholds and “doing business” in California should err on the side of caution and expect to be subject to the requirements of this regulation. While the exact definition of “doing business” in California has yet to be released, companies with any presence or operations in the state should take steps towards alignment.

With reporting requirements around the corner, companies reasonably expected to adhere to the California Climate rules should prepare to audit their data management processes, set inventory boundaries, conduct inventory calculations in alignment with the Greenhouse Gas Protocol (GHG Protocol), map physical operations and value chains, consider conducting climate risk assessments, and seek third-party assurance. By proactively preparing for these impending requirements, businesses will be better positioned to address climate accountability head-on and enhance their overall resilience and reputation in an evolving regulatory landscape.

Background

The California Climate Accountability Package1 is a suite of California state laws designed to increase transparency and accountability from companies doing business in the state of California. The bill suite comprises of two bills: SB-253, the Climate Corporate Data Accountability Act2 and SB-261, the Climate-Related Financial Risk Act3.

- SB-253: Requires the disclosure of Scope 1, 2, and 3 emissions, starting in 2025.

- SB-261: Requires the submission of biannual climate-related financial risk reports starting in 2025.

These bills were passed in the state legislature on September 12, 2023, and were signed by Governor Gavin Newsom on October 7, 2023, with proposed amendments4. On October 1, 2024, an amended version (SB-219) of the Climate Accountability Package was signed into law.

Requirements

Eligibility

Any U.S.-based corporation, partnership, limited liability company or other business entity doing business in the state of California and meets the below criteria must comply with the legislation:

| SB-253 | SB-261 | |

| Revenue Threshold | > $1 Billion Annually | > $500 Million Annually |

| Exclusions | None | Insurance Companies |

The exact specification of what “doing business in California” encompasses has yet to be explicitly defined by the California Air Resource Board (CARB), the regulatory body in charge of rulemaking for this bill suite. The definition is expected to be clarified by July 1, 2025, when the bill suite requires CARB to develop the logistical components of compliance and adopt the regulations. Generally, the definition is expected to cover businesses:

- Engaging in financial transactions within California.

- Being organized or commercially domiciled in California.

- Exceeding certain thresholds for sales, property, or payroll within the state5.

This criterion is expected to apply to a wide range of companies across multiple sectors. We recommend companies presume the regulation will be applicable to their entity, based on the projected reporting timeline (shown below), to ensure compliance if necessary.

Data & Disclosure Requirements

Covered entities will be subject to the below requirements for each bill:

| SB-253 | SB-261 | |

| Data Required | Scope 1, 2, and 3 GHG Emissions | Climate-related financial risks and measures adopted to reduce and adapt to such risks |

| Framework | Greenhouse Gas Protocol | Task Force on Climate-Related Financial Disclosures (TCFD)6 |

| Disclosure Platform | Digital reporting platform7 | Company website |

| Disclosure Frequency | Annual | Biennial |

| Penalty for Non-Compliance | Up to $500,000 per year | Up to $50,000 per year |

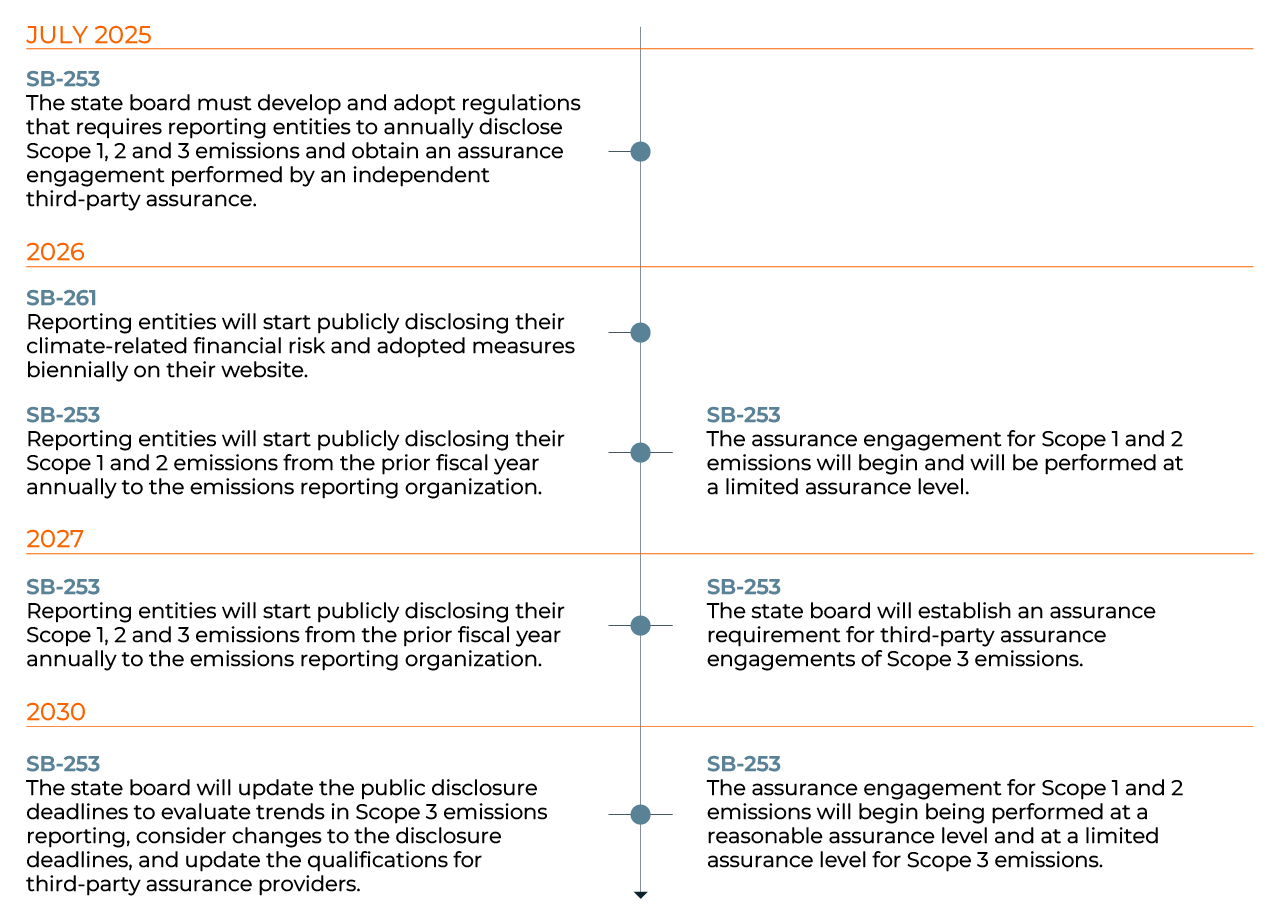

Timeline

Pathway to Compliance

How to Prepare – SB 253

SB-253 requires the disclosure of Scope 1, 2, and 3 GHG emissions,8 with Scope 1 and 2 beginning in 2026. Given this nearing timeline, companies are encouraged to quantify Scope 1 and 2 emissions8, starting with identifying emissions sources within their business operations.

- Choosing an Organizational Boundary

SB-253 requires emissions inventories to align with the GHG Protocol. Following the Protocol’s recommendations, companies will first need to define what organizational boundary approach will best suit their inventory, keeping in mind that whichever organizational boundary they choose can affect which Scope 3 categories will be necessary to report on. Factors such as the company structure, the number of leased vs owned assets, and the existence of franchises and joint ventures can influence which organizational boundary is best suited. - Data Management

Companies must track monthly utility and fuel usage across their operations and vehicle fleet to quantify emissions. Developing structured data management processes to ensure information is gathered, stored, and reported accurately is critical to the overall inventory process. For companies just getting started with a GHG inventory, implementing a clear data management process with identified data owners is an essential first step. Data owners may vary depending on the company’s structure and internal processes. Utility bill data can usually be acquired by accounting departments, facility managers, or building landlords. Companies relying on this kind of manual data management will have to engage with different departments to obtain the necessary information to begin the inventory process.

Alternatively, companies utilizing data management platforms that automatically upload data from the respective owners or directly from utility meters will need to focus on analysis to ensure accuracy. Inventory calculations can begin once all necessary inputs have been collected and assessed. - Inventory Calculations

GHG inventory calculations can be conducted independently or by utilizing a carbon accounting software. If using a software for calculations, companies should ensure that the platform is aligned with GHG protocol and can be leveraged for assurance purposes. If calculating independently, companies will need to source emissions factors from the EPA to quantify emissions from operations within the U.S. and potentially engage with global sources, such as the EIA, for emissions from operations outside of the country.

Upon calculation, companies should report their emissions in terms of carbon dioxide equivalents (CO2e), as established by the GHG Protocol, to ensure a normalized quantification of emissions across various greenhouse gases. CO2e is calculated based on the global warming potential (GWP) for each gas, which can be sourced from the EPA. SB-253 requires submission of completed emissions inventories to a digital reporting platform to be created by the California Air Resources Board (CARB)9. - Assurance Readiness

Assurance of emissions inventories will also be required by SB-253 beginning in 2026, at the limited assurance level10. While assurance is conducted by a third-party, companies can aide in the verification process by creating detailed Inventory Management Plans outlining key assumptions, estimations, and calculation processes.

How to Prepare – SB 261

SB-261 requires the disclosure of a climate-related financial risk report beginning in 2026. As such, companies should conduct a TCFD-aligned climate-risk assessment. This process can begin by mapping physical operations and value chains to prepare for assessing the physical climate risks posed to each under future climate scenarios. Evaluating transition risks will involve an examination of potential market, regulatory, technology, and reputational changes in future scenarios, as well as opportunities. Companies should also consider evaluating their current risk management practices to identify where climate risk may currently be considered, and where gaps exist.

Through a climate risk assessment, companies can identify the areas of their business that are most susceptible to climate change effects and implement measures to mitigate and adapt to these risks. Beyond meeting regulatory requirements, climate risk assessments can enhance transparency, help address investor expectations, and inform both financial reporting and sustainability disclosures by quantifying the material and monetary impacts of climate change. In doing so, companies can also better prepare for transition-related risks and fortify their long-term resilience.

Conclusion

With the reporting timeline for this legislation rapidly approaching, it is crucial that companies take the necessary actions to prepare for compliance. Building a strong foundation for emissions inventory development and conducting climate risk assessments now will aid companies in navigating the evolving legislative landscape, as it is expected that more states are likely to implement climate legislation of their own, as evidenced by Illinois11 and New York12.

Sodali & Co’s team of climate experts can help companies align the requirements of the California Climate Accountability Package by conducting climate risk assessments and supporting all stages of the GHG emissions journey from data preparedness and calculations to assurance. By providing support and serving as advisors to our clients, Sodali & Co can ease the transition stress from this legislation and ensure compliance.

- State of California, 2024. Bill Text - SB-219 Greenhouse gases: climate corporate accountability: climate-related financial risk.

- State of California, 2023. Bill Text - SB-253 Climate Corporate Data Accountability Act.

- State of California, 2023. Bill Text - SB-261 Greenhouse gases: climate-related financial risk.

- State of California Office of the Governor, 2023. Statement on Climate Accountability Package | gov.ca.gov.

- State of California Franchise Tax Board, 2024. Doing business in California | FTB.ca.gov.

- With the disbandment of TCFD, any successor to the framework should be used in its place.

- As part of CARB's obligations under SB 253, CARB will be required to engage with an emissions reporting organization to develop a reporting program to make the required disclosures publicly available on a digital platform.

- Scope 1 and Scope 2 Inventory Guidance | US EPA

- State of California, 2024. Bill Text - SB-219 Greenhouse gases: climate corporate accountability: climate-related financial risk.

- The Importance of Auditable Emissions Data: Preparing for Verification.

- State of Illinois, 2024. HB4268: Corporate Climate Accountability Act.

- State of New York, 2023. S897A: Climate Corporate Data Accountability Act.

Summary

Learn more about the California Climate Accountability Package, including SB-253 and SB-261. Companies that may be in the scope of the regulation ought to take steps to prepare for these regulations. We break down the rules including timeline, eligibility and disclosure requirements.

Author

Alyssa Sweigard

Director, Sustainability and ESG

alyssa.sweigard@sodali.com

Hallie Elrod

Analyst, Sustainability & Climate