Confidence, Coverage, Conversion: Driving PHP’s success in a contested UK M&A battle

12 February 2026

Subscribe to stay informed, inspired and involved.

Primary Health Properties (PHP), a long-established UK-listed REIT with nearly three decades of uninterrupted dividend growth, faced formidable competition in its bid to acquire Assura plc. The rival offer - an all-cash proposal backed by private equity giants KKR and Stonepeak - had initially secured the recommendation of Assura’s Board. PHP’s challenge was not only financial but reputational: to demonstrate that Assura’s future would be stronger within the UK public markets.

CHALLENGE

The core challenge was to shift stakeholder sentiment and demonstrate that Assura’s long-term future was more secure and valuable within the UK public market.

We combined strategic communications, proxy advisory, and capital markets intelligence into a single, coordinated campaign – a unique integrated approach that aligned investor sentiment, media advocacy, and shareholder mobilization.

This gave PHP the tools to build confidence, engage shareholders, and ultimately change and rally decisive support in a fiercely contested takeover.

SOLUTION

To counter the private equity bid, PHP deployed a coordinated, multi-disciplinary campaign that integrated strategic communications, proxy advisory, and capital markets intelligence. This unique approach aligned investor sentiment, media advocacy, and shareholder mobilization to build momentum and trust in PHP’s offer.

Working closely with the leadership team and other advisors, our work focused on:

- Media strategy

We positioned PHP as an antidote to London’s de-equitization trend, highlighting its long-term value creation and dividend track record. Through targeted media placements, we amplified supportive investor voices, framed the societal benefits of public ownership, and built strong relationships with influential journalists. This narrative not only undermined the rival bid but also drove exceptional retail investor engagement.

- Investor engagement

Our team engaged directly with index managers at BlackRock, Vanguard, and LGIM. We issued panel-approved communications to retail investors, educated hedge funds on hedging risks, and encouraged price differentiation at critical junctures—ensuring momentum in tender acceptances.

- Market intelligence and execution

We delivered weekly ownership and sentiment tracking and scaled proxy agent activity to maximize shareholder awareness and participation ahead of the deadline.

RESULTS

The integrated campaign delivered a decisive victory for PHP:

- The Assura Board reversed its recommendation, backing PHP under pressure from active institutions amplified through media channels.

- Media momentum successfully debunked rival claims and reinforced support for the UK public market.

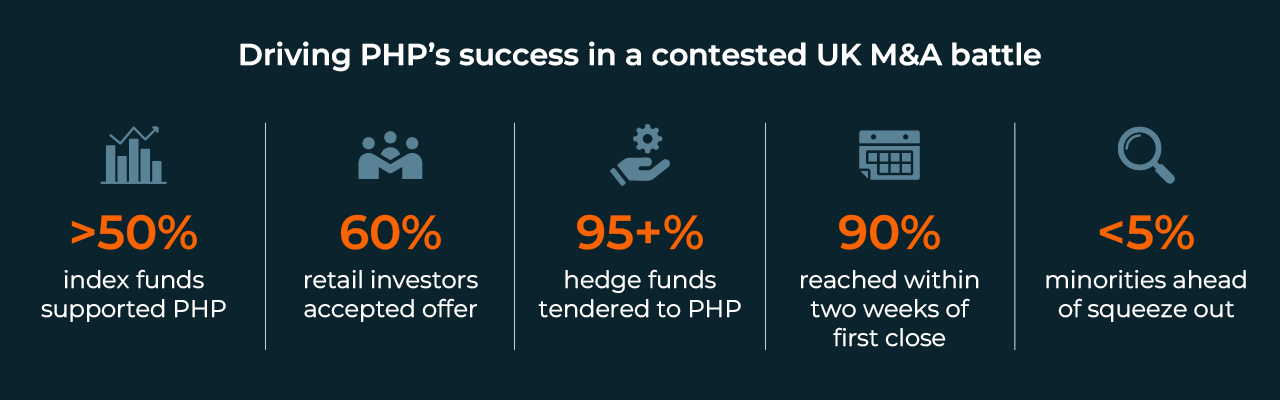

- Over 50% of index funds supported PHP’s offer, and 60% of retail investors accepted it.

- More than 95% of hedge funds tendered to PHP.

- PHP reached 90% ownership within two weeks of first close, with Assura delisted and fewer than 5% minority shareholders remaining ahead of the squeeze-out.

This outcome marked the ultimate success of the takeover, showcasing the power of a strategically integrated communications and investor engagement campaign in overcoming private equity competition.

Summary

We helped PHP overcome competing private‑equity bids through an integrated campaign combining strategic communications, investor engagement, and market intelligence. By shifting stakeholder sentiment toward the strength of UK public markets, PHP secured investor support, reversed Assura’s Board's recommendation, and achieved decisive acceptance levels, delivering a successful takeover.

Author